- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

High Growth Tech Stocks in Asia with Promising Potential

Reviewed by Simply Wall St

As Asia's tech sector continues to evolve amidst fluctuating global trade policies and economic indicators, investors are closely monitoring the region's potential for high growth. In this dynamic environment, identifying promising tech stocks often involves evaluating their ability to adapt to market changes and capitalize on technological advancements.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.68% | 30.37% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Auras Technology | 21.79% | 25.47% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of ₩20.36 trillion.

Operations: The company derives its revenue primarily from the biotechnology segment, totaling ₩151.65 million.

ALTEOGEN has demonstrated a remarkable financial trajectory with its earnings surging by 387.3% over the past year, significantly outpacing the biotech industry's growth of 47.8%. This performance is underpinned by robust revenue growth projections at 54.4% annually, eclipsing the broader Korean market's forecast of 7.1%. Despite a highly volatile share price in recent months, ALTEOGEN's strategic emphasis on R&D has positioned it well for sustained innovation and market competitiveness. The company’s commitment to reinvesting in technological advancements is evident from its substantial R&D expenditures, which are pivotal in maintaining its edge in a rapidly evolving sector. Looking ahead, ALTEOGEN is poised to maintain an upward trajectory with earnings expected to grow by approximately 69.84% annually over the next three years, leveraging high-quality earnings and strategic market positioning.

- Click here to discover the nuances of ALTEOGEN with our detailed analytical health report.

Review our historical performance report to gain insights into ALTEOGEN's's past performance.

Empyrean Technology (SZSE:301269)

Simply Wall St Growth Rating: ★★★★★☆

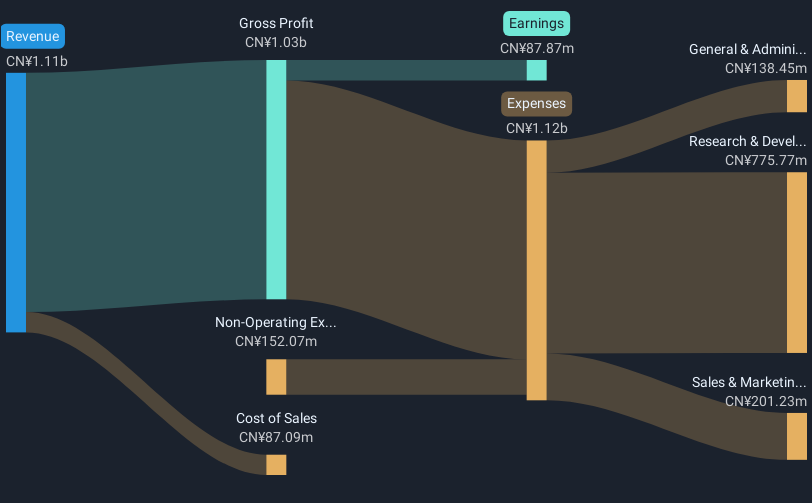

Overview: Empyrean Technology Co., Ltd. specializes in the development, sale, and servicing of electronic design automation (EDA) software with a market capitalization of CN¥67.92 billion.

Operations: Empyrean Technology focuses on electronic design automation (EDA) software, generating revenue primarily through software development, sales, and servicing. The company operates with a market capitalization of CN¥67.92 billion.

Empyrean Technology has shown robust financial performance, with a notable annual revenue growth of 29.4%, outpacing the broader Chinese market's average of 12.4%. This surge is complemented by an impressive earnings growth forecast of 51.8% per year, significantly higher than the market's 23.4%. The company's strategic focus on R&D is evident from its substantial investment in this area, which not only fuels innovation but also solidifies its competitive stance in the high-growth tech sector. Recent corporate activities including a dividend affirmation and a private placement suggest proactive shareholder engagement and potential for capital expansion, respectively. These elements collectively underscore Empyrean’s strong positioning for future growth within Asia’s tech landscape.

Giga-Byte Technology (TWSE:2376)

Simply Wall St Growth Rating: ★★★★☆☆

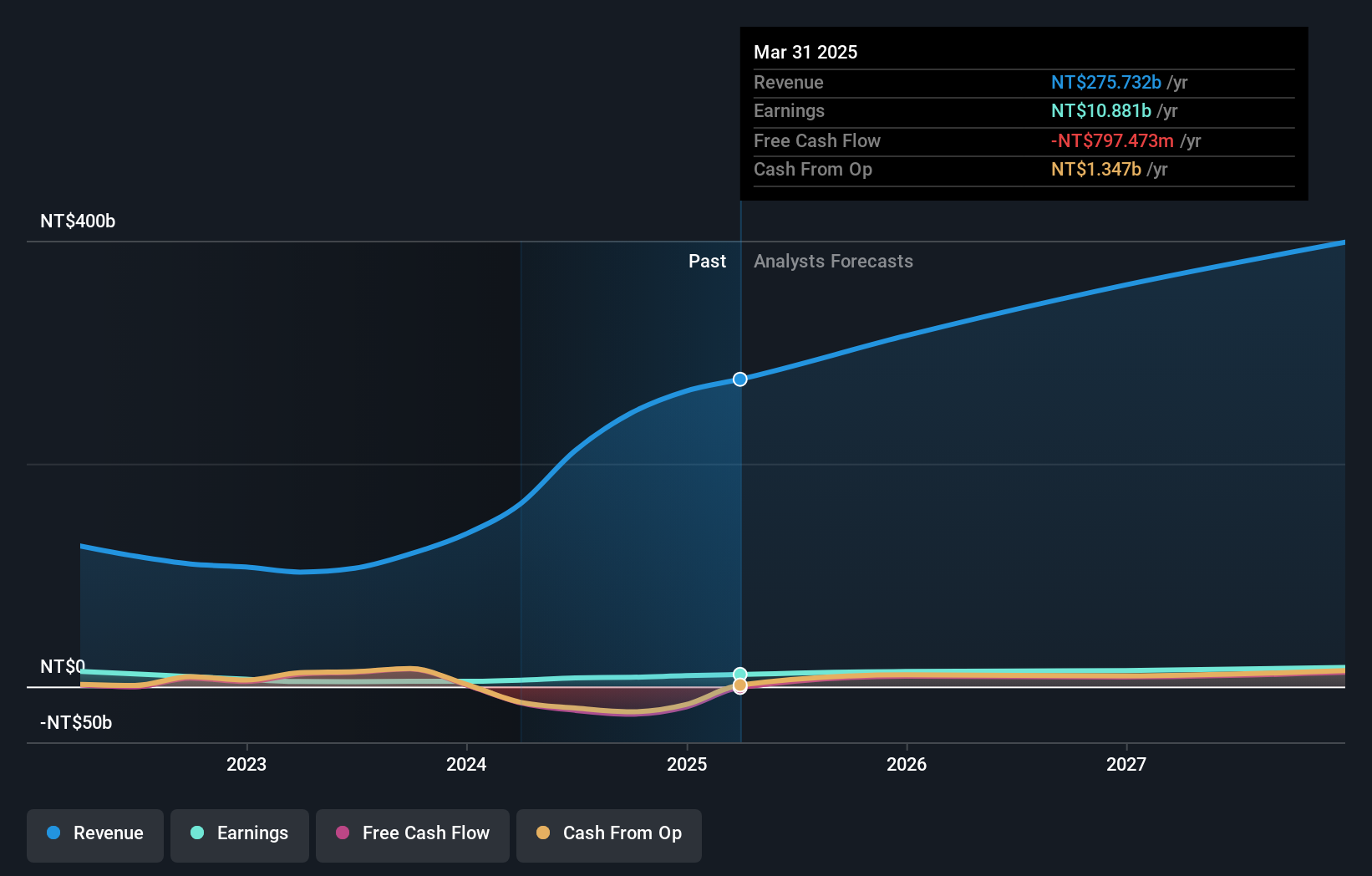

Overview: Giga-Byte Technology Co., Ltd. and its subsidiaries are involved in the manufacturing, processing, and trading of computer peripherals and component parts across Taiwan, Europe, the United States, Canada, China, and other international markets with a market cap of NT$192.26 billion.

Operations: The company primarily generates revenue from its Brand Business Division, which accounts for NT$274.76 billion, significantly overshadowing the Other Business Group's contribution of NT$971.26 million.

Giga-Byte Technology is making significant strides in the AI and high-performance computing sectors, as evidenced by its recent showcase at COMPUTEX 2025. The company reported a robust increase in quarterly sales to TWD 65.75 billion, up from TWD 55.16 billion year-over-year, with net income rising to TWD 3.12 billion from TWD 2.02 billion. These financial metrics underscore Giga-Byte's effective strategy in expanding its AI infrastructure capabilities through innovations like GIGAPOD and collaborations on next-gen storage technologies for AI clusters, positioning it well for sustained growth in the dynamic tech landscape of Asia.

- Navigate through the intricacies of Giga-Byte Technology with our comprehensive health report here.

Gain insights into Giga-Byte Technology's past trends and performance with our Past report.

Summing It All Up

- Delve into our full catalog of 488 Asian High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives