Amidst easing trade concerns and better-than-expected earnings reports, global markets have shown positive momentum, with technology stocks in particular experiencing notable gains. As the Asian tech market continues to evolve within this optimistic climate, identifying high-growth opportunities involves looking for companies that demonstrate resilience and adaptability in navigating economic uncertainties.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.00% | 28.07% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.40% | 29.29% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| PharmaEssentia | 32.31% | 59.75% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., listed on KOSDAQ under the ticker A196170, is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩18.99 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, which contributes ₩102.85 billion.

ALTEOGEN has demonstrated robust growth dynamics, with revenue and earnings forecasted to expand by 54.9% and 71.2% annually. This performance notably outpaces the broader Korean market's growth rates of 7.4% for revenue and 21.2% for earnings, positioning ALTEOGEN favorably within the high-growth tech sector in Asia. The company's commitment to innovation is evident from its R&D spending trends, which are crucial for sustaining its rapid growth trajectory in a competitive biotech landscape. Recent strategic moves, including significant presentations at investor conferences and closing private placements, underscore ALTEOGEN’s proactive approach in capitalizing on emerging opportunities within the biotechnology field.

- Delve into the full analysis health report here for a deeper understanding of ALTEOGEN.

Evaluate ALTEOGEN's historical performance by accessing our past performance report.

OFILM Group (SZSE:002456)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OFILM Group Co., Ltd. is engaged in the manufacturing and sale of optic and optoelectronic products both domestically in China and internationally, with a market cap of approximately CN¥39.35 billion.

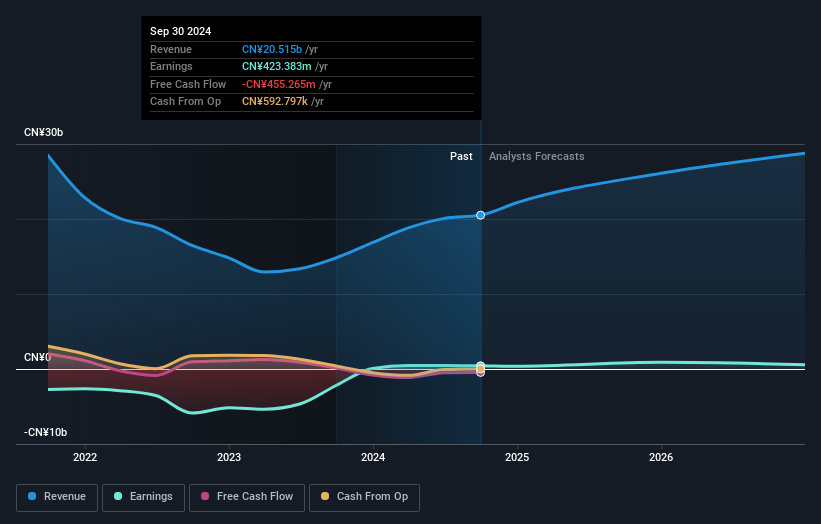

Operations: The company's primary revenue stream is from the manufacturing of optics and optoelectronic components, generating approximately CN¥20.67 billion.

Despite a challenging quarter with a net loss of CNY 58.95 million, OFILM Group's annual revenue growth of 16.4% outpaces the broader Chinese market's 12.6%. This trajectory, coupled with an expected shift to profitability within three years, underscores its resilience in the tech sector. The company's substantial R&D investment is pivotal, fostering innovation that keeps it competitive amid rapid technological advancements. Looking ahead, these strategic focuses may well position OFILM for recovery and growth as market conditions evolve.

- Click to explore a detailed breakdown of our findings in OFILM Group's health report.

Gain insights into OFILM Group's historical performance by reviewing our past performance report.

Empyrean Technology (SZSE:301269)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Empyrean Technology Co., Ltd. specializes in the development, sale, and servicing of electronic design automation (EDA) software, with a market capitalization of CN¥65.97 billion.

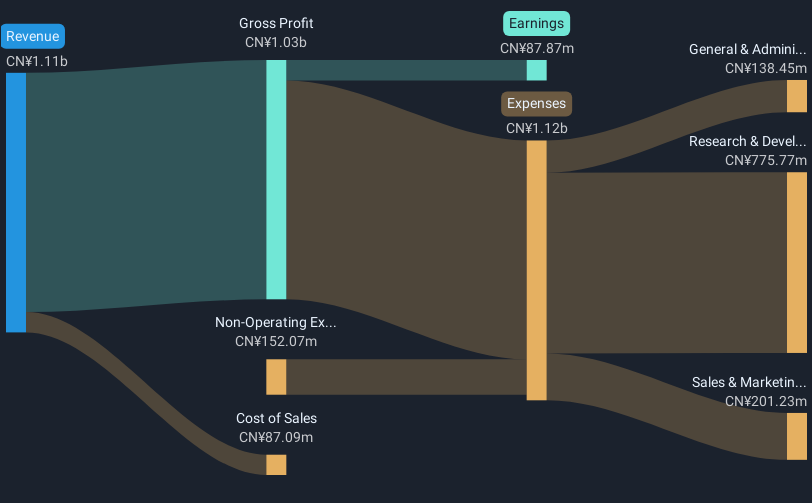

Operations: The company focuses on electronic design automation (EDA) software development, sales, and services.

Empyrean Technology, amid a dynamic market, reported a robust annual revenue growth of 29.1%, significantly outpacing the industry average. This surge is supported by its aggressive R&D spending which has been strategically channeled into emerging tech sectors, reflecting in its latest quarterly revenue jump from CNY 213.46 million to CNY 234.32 million. The firm’s ability to grow earnings at an impressive rate of 48.8% annually further underscores its potential in leveraging technological innovations for financial performance, despite a competitive backdrop where many peers struggle with slower growth rates or declining profitability.

- Unlock comprehensive insights into our analysis of Empyrean Technology stock in this health report.

Understand Empyrean Technology's track record by examining our Past report.

Where To Now?

- Embark on your investment journey to our 489 Asian High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empyrean Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301269

Empyrean Technology

Develops, sells, and services electronic design automation (EDA) software.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives