- China

- /

- Electronic Equipment and Components

- /

- SZSE:301556

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with U.S. consumer confidence declining and major stock indexes experiencing moderate gains, the technology sector remains a focal point for investors due to its potential for high growth. In this environment, identifying tech stocks with strong fundamentals and innovative capabilities can be crucial for those looking to capitalize on emerging opportunities in January 2025.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Jade Bird Fire (SZSE:002960)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jade Bird Fire Co., Ltd. develops, manufactures, and sells professional fire safety electronic products and systems both in China and internationally, with a market cap of CN¥8.26 billion.

Operations: Specializing in fire safety electronic products and systems, the company operates within China and globally. Its business model focuses on developing and manufacturing these products, which are then sold domestically and internationally.

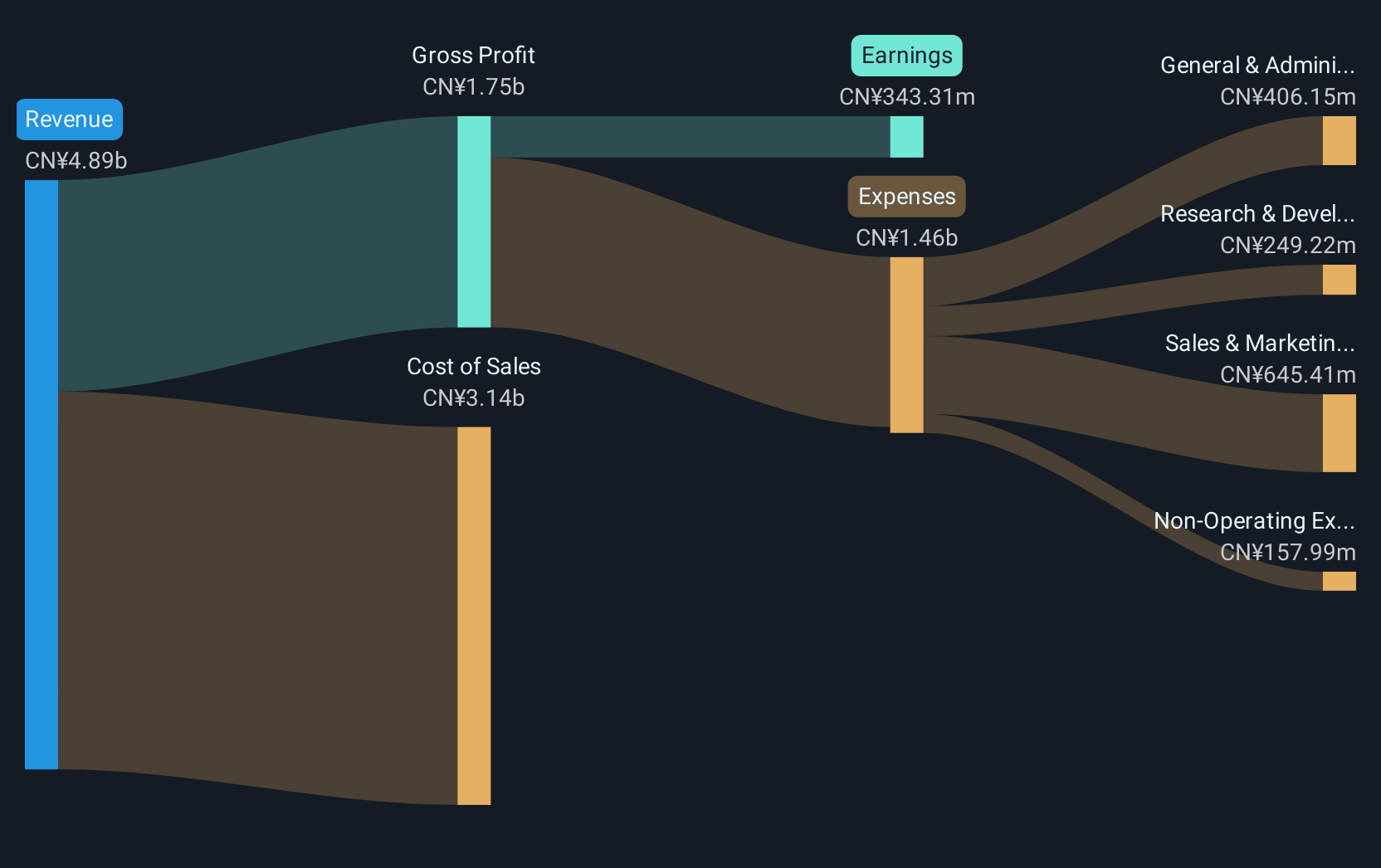

Jade Bird Fire's strategic maneuvers, including a robust share repurchase program where 1.28% of shares were bought back for CNY 100 million, underscore its commitment to shareholder value amidst challenging market conditions. Despite a slight revenue dip to CNY 3.52 billion from CNY 3.64 billion year-over-year and a net income decrease to CNY 335.33 million, the company's aggressive R&D investment and forecasted earnings growth of 30.8% annually signal strong future prospects in the electronic sector. This focus on innovation is critical as it navigates below-industry-average returns with an expected Return on Equity of just 11.1% in three years, contrasting with its significant market outperformance in revenue growth predictions against the Chinese market average (19.1% vs 13.6%).

- Click here and access our complete health analysis report to understand the dynamics of Jade Bird Fire.

Explore historical data to track Jade Bird Fire's performance over time in our Past section.

Beijing CTJ Information Technology (SZSE:301153)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing CTJ Information Technology Co., Ltd. operates within the software and information technology service industry, with a market capitalization of CN¥9.10 billion.

Operations: The company generates revenue primarily from the software and information technology service sector, totaling CN¥920.11 million.

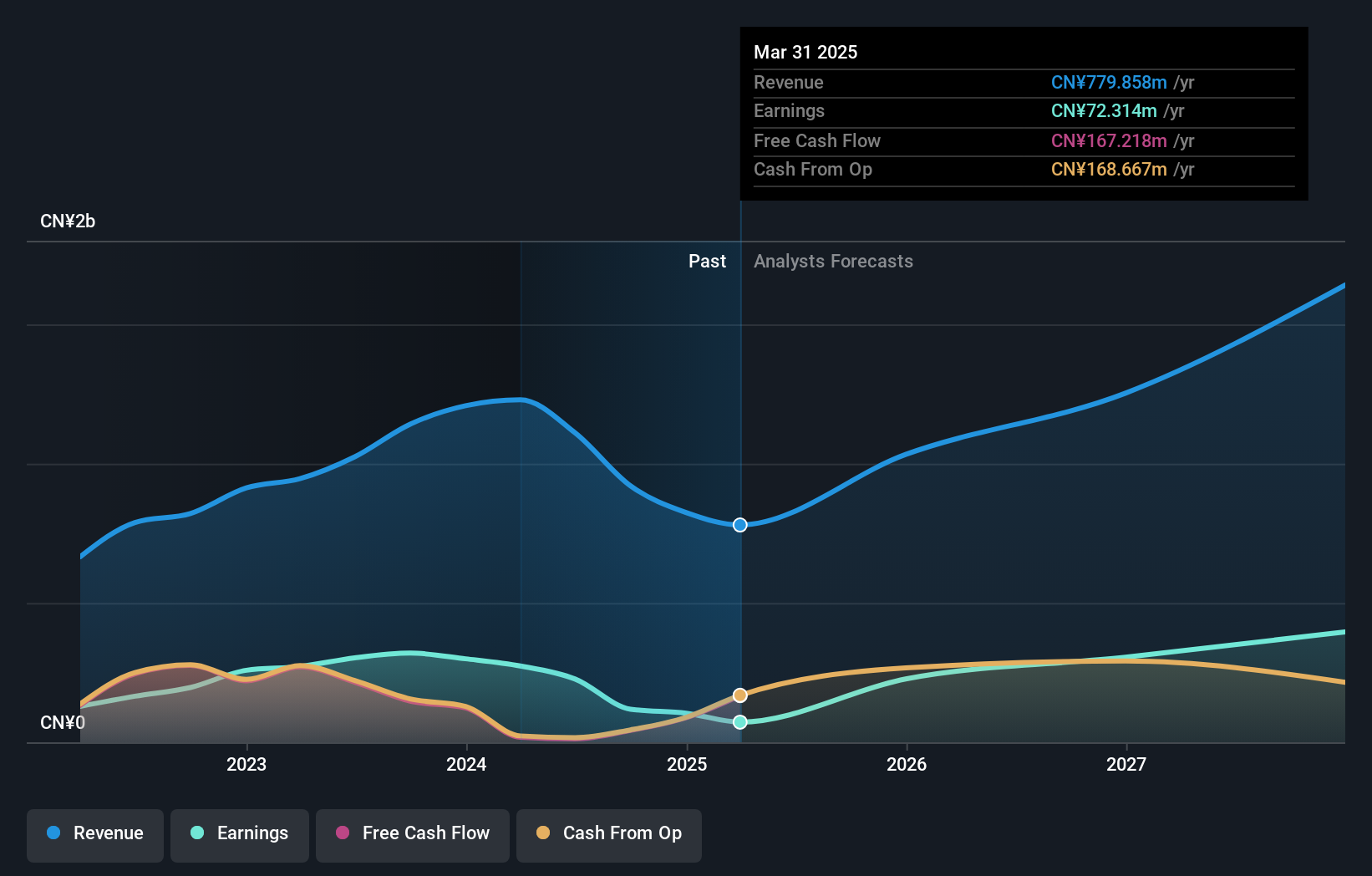

Beijing CTJ Information Technology's recent financial performance reflects a challenging phase, with revenue dropping to CNY 493.5 million from CNY 781.21 million year-over-year and net income plummeting to CNY 6.78 million from CNY 187.82 million. Despite these setbacks, the company is poised for recovery, underpinned by an aggressive R&D strategy that promises robust future capabilities in the tech sector. This focus on innovation is crucial as it aims to outpace the average market growth forecast of 13.6% with its own target of a 24% annual increase in revenue and a significant earnings jump of 52.2% per year, positioning it well within a competitive landscape marked by rapid technological advancements and shifting market demands.

- Take a closer look at Beijing CTJ Information Technology's potential here in our health report.

Understand Beijing CTJ Information Technology's track record by examining our Past report.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. engages in the development and provision of agricultural technology solutions, with a market capitalization of CN¥7.18 billion.

Operations: Zhejiang Top Cloud-agri Technology Co., Ltd. focuses on creating and delivering agricultural technology solutions. The company operates in various segments, contributing to its overall revenue generation strategy.

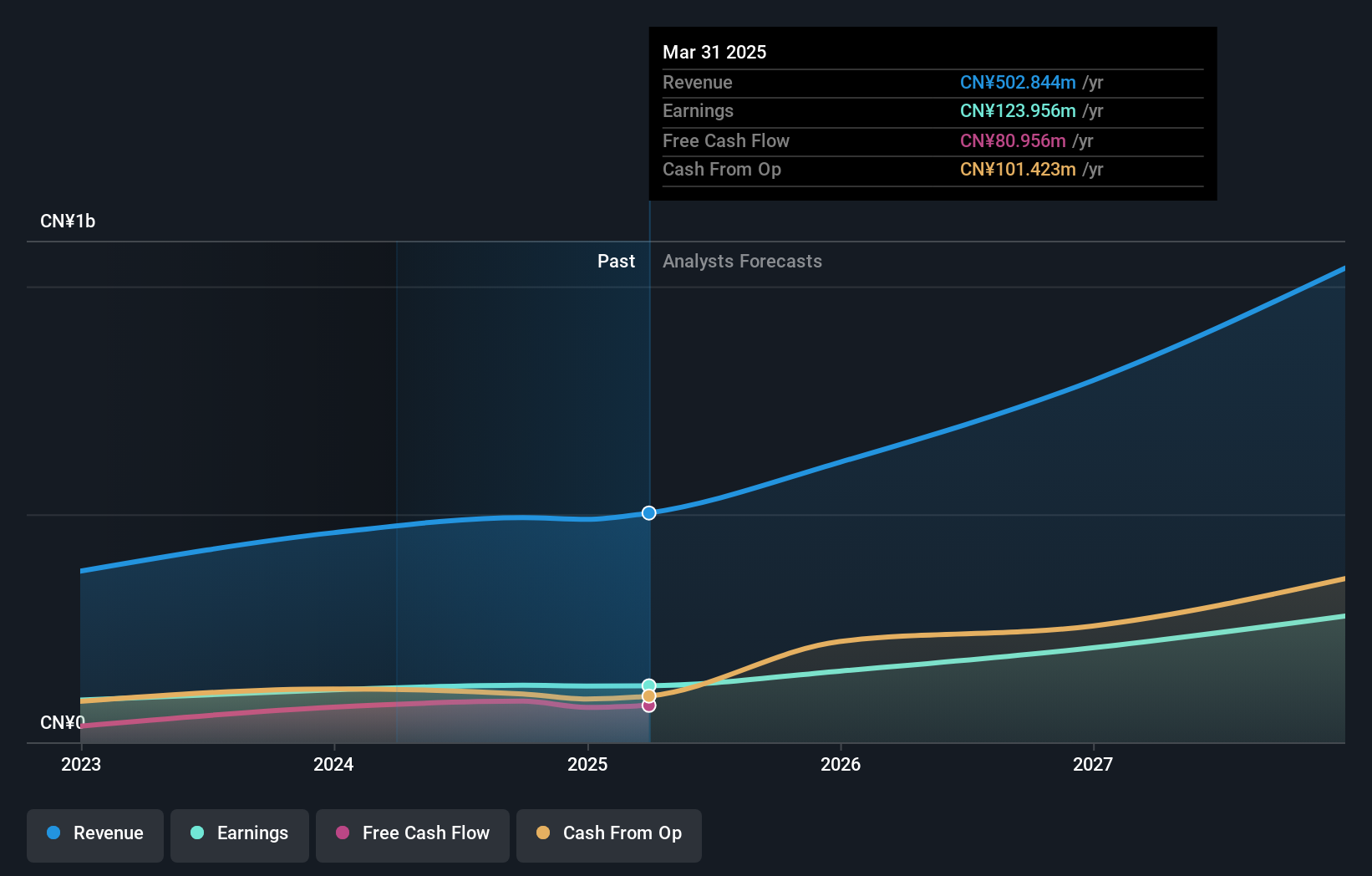

Zhejiang Top Cloud-agri Technology Co., Ltd. has demonstrated robust financial growth, with a notable 30.6% increase in annual revenue and earnings expanding by 31.1% per year, outpacing the broader Chinese market's average. The company's recent IPO raised CNY 309.14 million, bolstering its capital structure and enabling further investment in innovative agricultural technologies—a sector ripe for disruption through advanced data analytics and AI integration. This strategic focus is supported by a solid R&D commitment that not only fuels ongoing product enhancement but also positions the firm advantageously for sustained competitive edge in the tech-driven agri-sector.

Key Takeaways

- Discover the full array of 1263 High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Top Cloud-agri TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301556

Zhejiang Top Cloud-agri TechnologyLtd

Zhejiang Top Cloud-agri Technology Co.,Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives