High Growth Tech Stocks To Watch For Potential Portfolio Gains

Reviewed by Simply Wall St

As global markets experience fluctuations, with U.S. consumer confidence dipping and major indices showing mixed results, the technology sector remains a focal point for investors seeking potential growth opportunities. In such an environment, identifying high-growth tech stocks that align with current economic indicators and market sentiment can be key to enhancing portfolio performance.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Fenghua Advanced Technology (Holding) Co., Ltd. is a company engaged in the production and sale of electronic components and parts, with a market cap of CN¥15.87 billion.

Operations: Fenghua Advanced Technology focuses on producing and selling electronic components and parts, generating revenue of CN¥4.55 billion from this segment.

Guangdong Fenghua Advanced Technology has demonstrated robust growth with a 160.1% increase in earnings over the past year, significantly outpacing the electronic industry's average. This surge is supported by an aggressive R&D investment strategy, where expenses are consistently aligned with emerging technological trends, ensuring their offerings remain at the forefront of innovation. Recent leadership changes and strategic meetings suggest a focus on refining internal controls and governance, positioning them well for sustained advancements in high-tech sectors. With revenue projected to grow at 18.2% annually, surpassing the Chinese market forecast of 13.6%, Fenghua's trajectory is set to capitalize on expanding market demands while nurturing high-quality earnings reflected in their recent financial outcomes.

Jushri Technologies (SZSE:300762)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jushri Technologies, Inc. focuses on the development, production, and after-sales service of communication equipment with a market cap of CN¥12.87 billion.

Operations: The company generates revenue through the development, production, and after-sales service of communication equipment. It has a market capitalization of CN¥12.87 billion.

Jushri Technologies has shown a remarkable annual revenue growth rate of 61.9%, outstripping the broader Chinese market's forecast of 13.6%. Despite current unprofitability, projections indicate a substantial earnings increase of 102.6% annually, positioning the company on a trajectory towards profitability within three years. This growth is underpinned by significant R&D investments, aligning with industry demands for innovative tech solutions. Recent corporate activities, including an extraordinary shareholders meeting focused on governance enhancements, signal strategic adjustments poised to bolster future performance amidst volatile market conditions.

- Navigate through the intricacies of Jushri Technologies with our comprehensive health report here.

Assess Jushri Technologies' past performance with our detailed historical performance reports.

Semitronix (SZSE:301095)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Semitronix Corporation offers characterization and yield improvement solutions for the semiconductor industry both in China and internationally, with a market capitalization of CN¥9.85 billion.

Operations: Semitronix focuses on delivering semiconductor characterization and yield improvement solutions across China and international markets. The company's revenue is primarily driven by its specialized services in the semiconductor sector, targeting efficiency and performance enhancements.

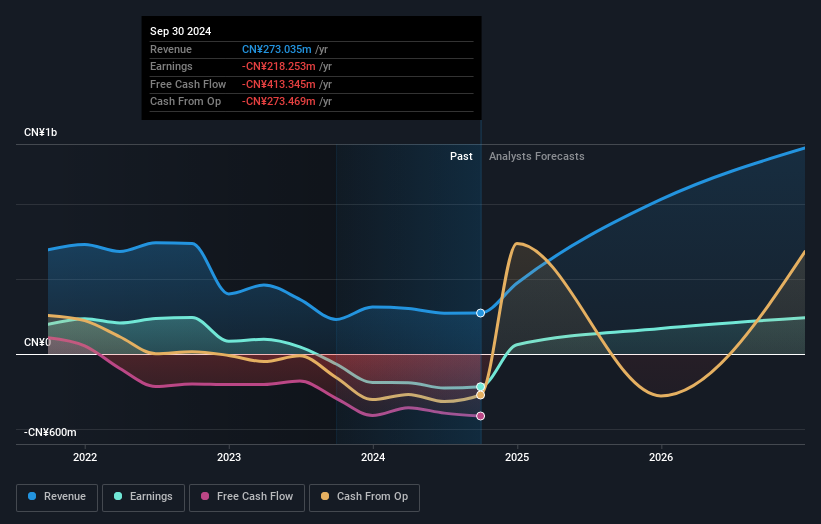

Semitronix's recent performance reveals a challenging landscape with a significant drop in net income from CNY 51.04 million to CNY 7.71 million year-over-year, despite an increase in revenue to CNY 287.32 million. This contrast highlights the company's current struggle to convert revenue growth into profit, exacerbated by a volatile share price and lower profit margins compared to last year (16.8% down from 32%). However, the company is actively managing its capital through share buybacks, having repurchased over 3.2 million shares for CNY 139.65 million this year alone, reflecting confidence in its future prospects amidst these challenges.

- Click to explore a detailed breakdown of our findings in Semitronix's health report.

Examine Semitronix's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Take a closer look at our High Growth Tech and AI Stocks list of 1263 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301095

Semitronix

Provides characterization and yield improvement solutions for the semiconductor industry in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives