- South Korea

- /

- Pharma

- /

- KOSE:A000100

Asian Stocks Estimated To Be Trading Below Intrinsic Value In July 2025

Reviewed by Simply Wall St

In recent weeks, Asian markets have shown mixed performance, with China's stock indices experiencing modest gains while Japan's indices faced declines amid trade negotiation uncertainties. Amid these fluctuations, investors are increasingly looking for opportunities in stocks that may be trading below their intrinsic value, as undervalued stocks can present potential growth prospects when the broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Leapmotor Technology (SEHK:9863) | HK$57.90 | HK$115.32 | 49.8% |

| Taiyo Yuden (TSE:6976) | ¥2575.00 | ¥5105.39 | 49.6% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥23.15 | CN¥46.04 | 49.7% |

| JRCLtd (TSE:6224) | ¥1161.00 | ¥2302.99 | 49.6% |

| Evergreen Aviation Technologies (TWSE:2645) | NT$99.00 | NT$195.53 | 49.4% |

| Darbond Technology (SHSE:688035) | CN¥39.65 | CN¥78.34 | 49.4% |

| cottaLTD (TSE:3359) | ¥427.00 | ¥853.17 | 50% |

| Astroscale Holdings (TSE:186A) | ¥673.00 | ¥1345.95 | 50% |

| APAC Realty (SGX:CLN) | SGD0.48 | SGD0.95 | 49.2% |

| Accton Technology (TWSE:2345) | NT$813.00 | NT$1600.19 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

Yuhan (KOSE:A000100)

Overview: Yuhan Corporation is involved in the manufacturing and sale of prescription drugs, over-the-counter drugs, veterinary drugs, and household goods both in South Korea and internationally, with a market cap of ₩8.38 trillion.

Operations: The company's revenue segments include biotechnology startups, contributing ₩2.11 billion.

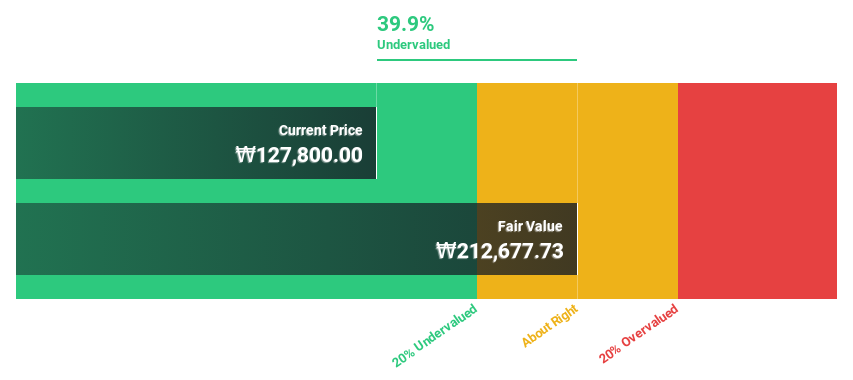

Estimated Discount To Fair Value: 22.1%

Yuhan Corporation is trading at ₩112,100, significantly below its estimated fair value of ₩143,953.77. The company has announced a share repurchase program to enhance shareholder value, which could positively impact stock valuation. Despite a decline in profit margins from 6.8% to 3.1%, Yuhan's earnings are expected to grow substantially at 44.1% annually over the next three years, outpacing the Korean market's growth rate of 20.9%.

- Our earnings growth report unveils the potential for significant increases in Yuhan's future results.

- Delve into the full analysis health report here for a deeper understanding of Yuhan.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. operates in the high-tech sector with a focus on advanced material technologies and has a market cap of CN¥14.79 billion.

Operations: Beijing Zhong Ke San Huan High-Tech Co., Ltd. generates its revenue from advanced material technologies, contributing to its market presence in the high-tech sector.

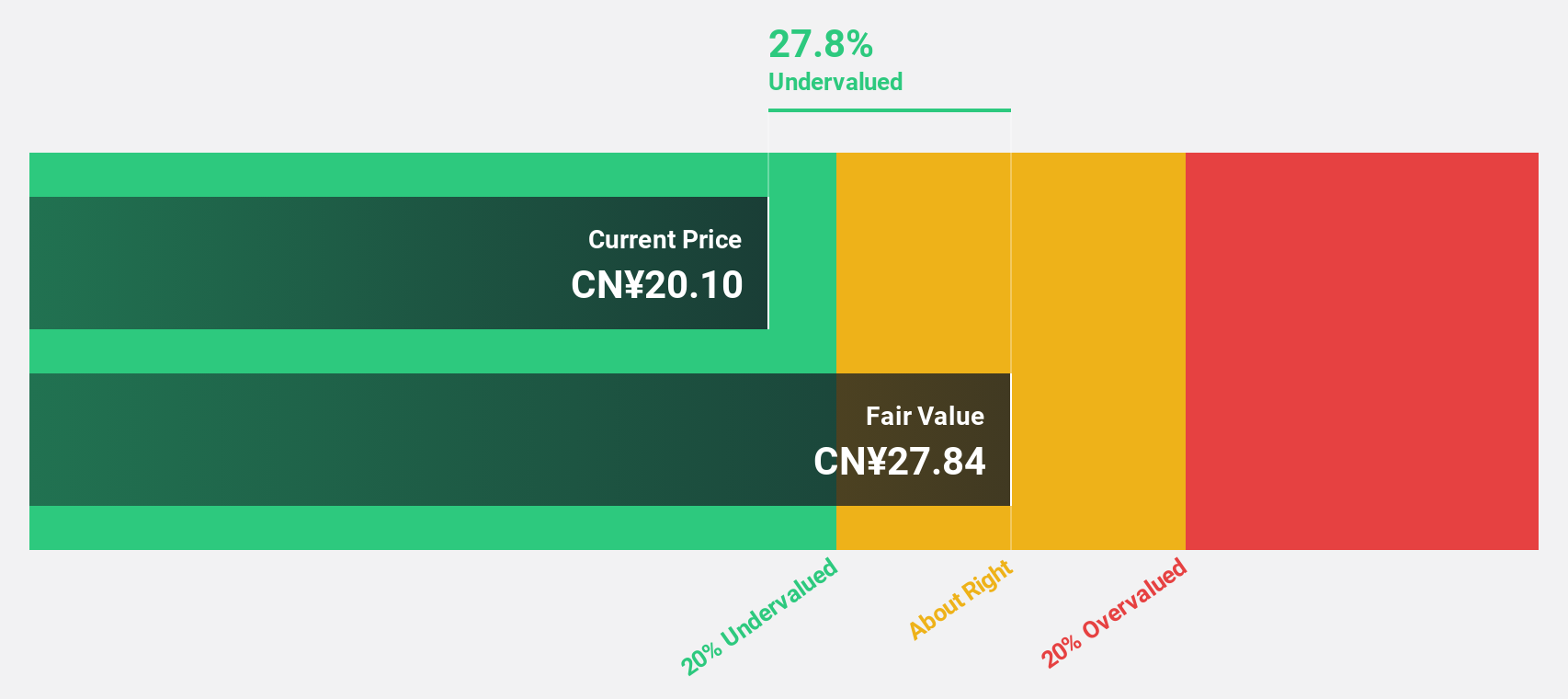

Estimated Discount To Fair Value: 39.7%

Beijing Zhong Ke San Huan High-Tech is trading at CN¥12.29, significantly below its estimated fair value of CN¥20.38, indicating it may be undervalued based on cash flows. Despite a recent dividend decrease, the company reported a net income of CN¥13.49 million for Q1 2025, rebounding from a loss last year. Earnings are projected to grow substantially at 43.92% annually over the next three years, outpacing the Chinese market's growth rate of 23.4%.

- In light of our recent growth report, it seems possible that Beijing Zhong Ke San Huan High-Tech's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Beijing Zhong Ke San Huan High-Tech.

Pansoft (SZSE:300996)

Overview: Pansoft Company Limited offers management information solutions and IT integrated services for large enterprises in China, with a market cap of CN¥5.34 billion.

Operations: Pansoft generates revenue through its management information solutions and IT integrated services for large enterprises in China.

Estimated Discount To Fair Value: 31.8%

Pansoft Company Limited is currently trading at CN¥19.08, below its estimated fair value of CN¥27.98, suggesting it could be undervalued based on cash flows. Despite a challenging first quarter with a net loss of CNY 13.95 million and volatile share price, earnings are forecast to grow significantly at 32.2% annually over the next three years, surpassing market expectations. However, investors should note its unstable dividend history amidst recent changes in company bylaws and capital structure adjustments.

- Insights from our recent growth report point to a promising forecast for Pansoft's business outlook.

- Navigate through the intricacies of Pansoft with our comprehensive financial health report here.

Next Steps

- Click here to access our complete index of 270 Undervalued Asian Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000100

Yuhan

Manufactures and sells prescription drugs, over-the-counter drugs, veterinary drugs, and household goods in South Korea and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives