High Growth Tech And 2 Other Stocks With Promising Expansion

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Russell 2000 experiencing significant gains, investors are closely monitoring how these political shifts might influence economic growth and regulatory changes. In this dynamic environment, identifying stocks with strong growth potential—particularly in sectors like high-growth tech—requires careful consideration of factors such as earnings prospects, market positioning, and adaptability to evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1278 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

MBC Group (SASE:4072)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MBC Group is a media company operating in the United Arab Emirates, Saudi Arabia, Egypt, Iraq, North Africa, and internationally with a market cap of SAR15.66 billion.

Operations: MBC Group generates revenue primarily from its media operations across various regions, including the UAE, Saudi Arabia, Egypt, Iraq, and North Africa. The company focuses on delivering diverse content through television broadcasting and digital platforms.

MBC Group, amidst a dynamic media landscape, has demonstrated robust financial growth with earnings surging by 76.5% over the past year, significantly outpacing the industry's modest 0.9% increase. This performance is underpinned by an aggressive research and development strategy that allocates substantial resources to innovation—evident from R&D expenses that are integral to its operational focus. Looking ahead, MBC is poised for continued expansion with projected annual revenue and earnings growth rates of 20.6% and 33.9%, respectively, which starkly contrast with broader market expectations of 1.7% and 7.5%. The recent strategic acquisition by Public Investment Fund, purchasing a majority stake for SAR 7.469 billion, not only injects capital but also potentially broadens MBC’s market influence and resource pool, setting a solid foundation for sustained technological advancement and market leadership in high-growth sectors.

- Get an in-depth perspective on MBC Group's performance by reading our health report here.

Understand MBC Group's track record by examining our Past report.

Beijing YJK Building SoftwareLtd (SZSE:300935)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing YJK Building Software Co., Ltd. specializes in the development and sale of building structure design software and BIM-related products, serving both domestic and international markets, with a market cap of approximately CN¥1.80 billion.

Operations: The company focuses on creating and distributing software for building structure design and BIM-related products, catering to both domestic and international clientele. It operates within the technology sector, leveraging its expertise in software development to serve the construction industry.

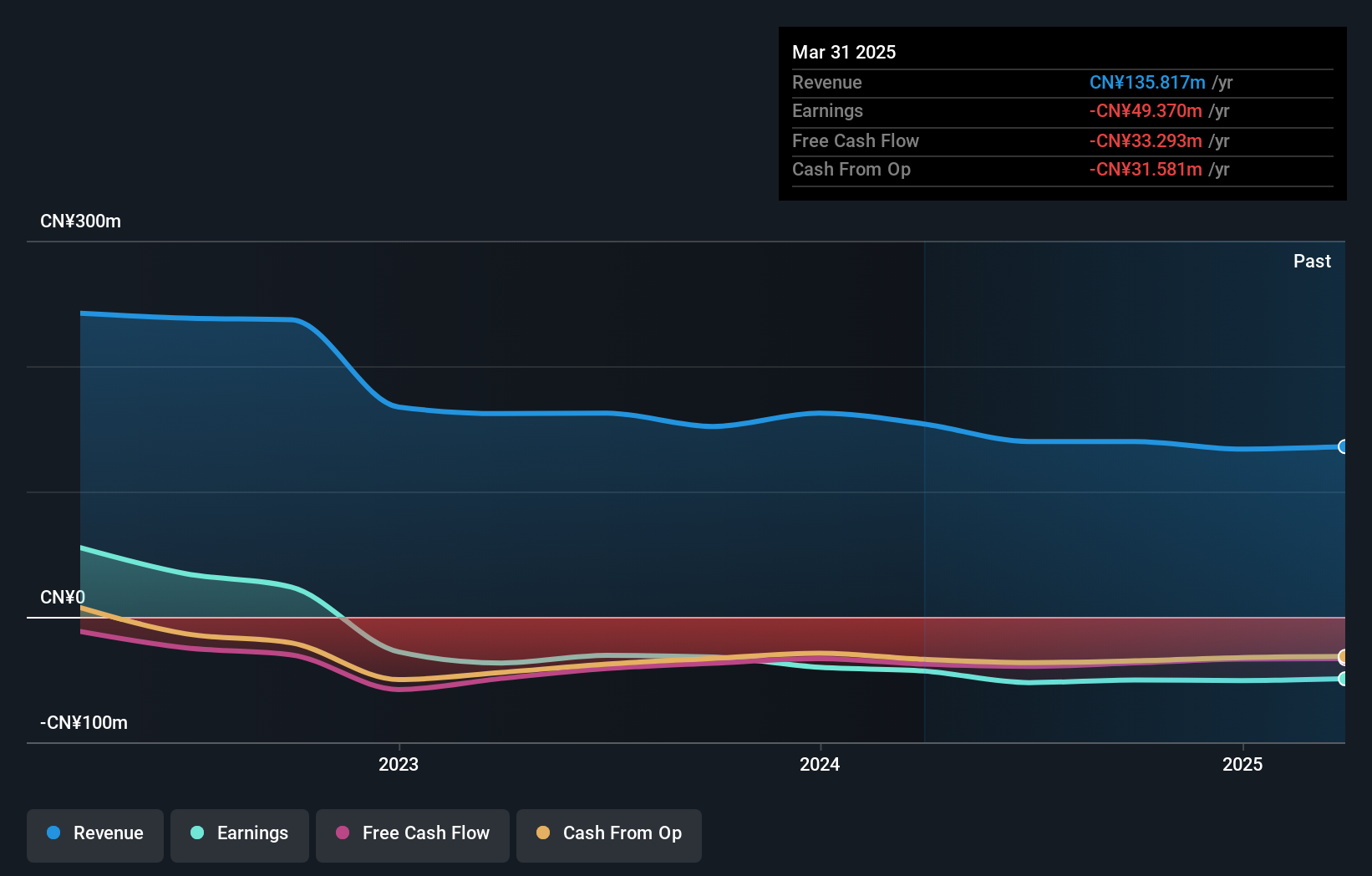

Despite recent financial setbacks, Beijing YJK Building Software Co., Ltd. remains a focal point in the tech landscape due to its strategic emphasis on R&D, which is integral for rebounding and future growth. The company's revenue is projected to increase by 34.2% annually, positioning it well above the average market growth of 13.9%. This focus on innovation could be pivotal as they navigate through current losses—CNY 37.67 million reported in the latest nine-month period—and strive towards profitability with an anticipated profit surge of 84.75% per year over the next three years. These efforts underscore a commitment to evolving within the software sector and overcoming present challenges through technological advancements and market adaptation.

Macbee Planet (TSE:7095)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Macbee Planet, Inc. is a Japanese company specializing in analytics consulting and marketing technology, with a market capitalization of ¥38.78 billion.

Operations: The company generates revenue primarily from its LTV Marketing Business, which accounts for ¥41.43 billion. The focus is on providing analytics consulting and marketing technology services within Japan.

Macbee Planet, Inc. is demonstrating robust financial health and strategic foresight in the tech sector. With a revenue growth forecast at 16.2% annually, the company outpaces the Japanese market's average of 4.2%, signaling strong market positioning and potential for sustained expansion. Notably, its commitment to innovation is underscored by significant R&D investments, aligning with an earnings growth expectation of 21.1% per year—twice the national average of 9.1%. Recent strategic moves include a share repurchase program where Macbee reacquired approximately 4.08% of its shares for ¥1,556 million, reflecting confidence in its financial stability and commitment to shareholder value.

- Click here to discover the nuances of Macbee Planet with our detailed analytical health report.

Examine Macbee Planet's past performance report to understand how it has performed in the past.

Next Steps

- Navigate through the entire inventory of 1278 High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing YJK Building SoftwareLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300935

Beijing YJK Building SoftwareLtd

Engages in the development, sale, and technical services of building structure design and BIM-related software products in China.

Flawless balance sheet minimal.

Market Insights

Community Narratives