Some Confidence Is Lacking In JinXianDai Information Industry Co.,Ltd. (SZSE:300830) As Shares Slide 26%

The JinXianDai Information Industry Co.,Ltd. (SZSE:300830) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

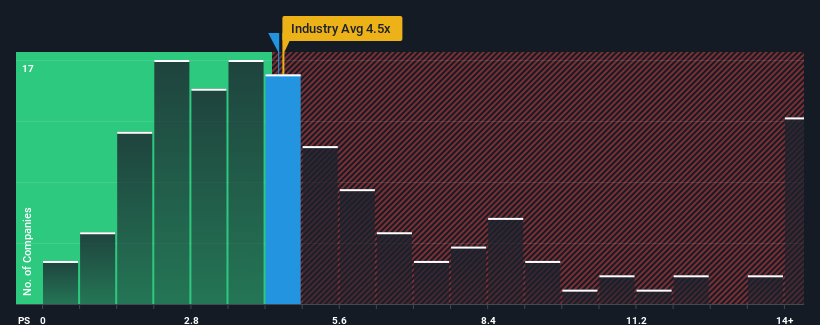

In spite of the heavy fall in price, there still wouldn't be many who think JinXianDai Information IndustryLtd's price-to-sales (or "P/S") ratio of 4.4x is worth a mention when the median P/S in China's Software industry is similar at about 4.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for JinXianDai Information IndustryLtd

How JinXianDai Information IndustryLtd Has Been Performing

For instance, JinXianDai Information IndustryLtd's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on JinXianDai Information IndustryLtd will help you shine a light on its historical performance.How Is JinXianDai Information IndustryLtd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like JinXianDai Information IndustryLtd's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 19%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 30% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that JinXianDai Information IndustryLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

With its share price dropping off a cliff, the P/S for JinXianDai Information IndustryLtd looks to be in line with the rest of the Software industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that JinXianDai Information IndustryLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

And what about other risks? Every company has them, and we've spotted 4 warning signs for JinXianDai Information IndustryLtd (of which 1 is concerning!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300830

JinXianDai Information IndustryLtd

Provides electric power, rail transit, and petrochemical related solutions in China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives