Exploring Three High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets experience a wave of optimism driven by easing trade tensions and robust earnings reports, U.S. stocks have seen significant gains, with the technology-heavy Nasdaq Composite rising by 3.42%. In this buoyant environment, identifying high-growth tech stocks that exhibit strong potential can be particularly appealing to investors seeking to capitalize on promising opportunities amidst positive market sentiment.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Range Intelligent Computing Technology Group | 28.40% | 29.29% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| KebNi | 21.07% | 67.27% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. engages in the development and production of optoelectronic devices, with a market capitalization of approximately CN¥7.22 billion.

Operations: Wuxi Taclink Optoelectronics Technology primarily focuses on the development and production of optoelectronic devices. The company's revenue streams are not detailed in the provided text, but it operates within a specialized industry that typically involves manufacturing costs related to advanced technology components.

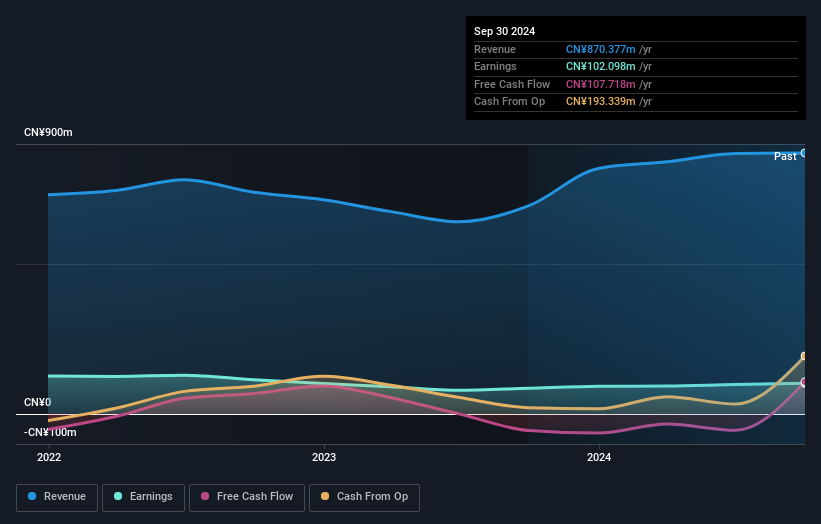

Wuxi Taclink Optoelectronics Technology demonstrates robust growth with a 34.6% annual increase in revenue and a 44.7% surge in earnings, outpacing the broader Chinese market significantly. Despite recent volatility in share price, the company's commitment to innovation is evident from its R&D spending which aligns closely with its revenue gains, ensuring sustained advancements in optoelectronic technologies. Recent financial reports reveal a slight dip in net income for Q1 2025 compared to the previous year; however, the overall upward trajectory in sales underscores strong market demand for their specialized products. This blend of high earnings growth and strategic reinvestment into research positions Wuxi Taclink well within an industry leaning heavily on technological evolution.

Guangdong Aofei Data Technology (SZSE:300738)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Aofei Data Technology Co., Ltd. operates in the data technology sector and has a market capitalization of CN¥23.15 billion.

Operations: The company generates revenue primarily through its data technology services. It operates within the sector with a market capitalization of CN¥23.15 billion.

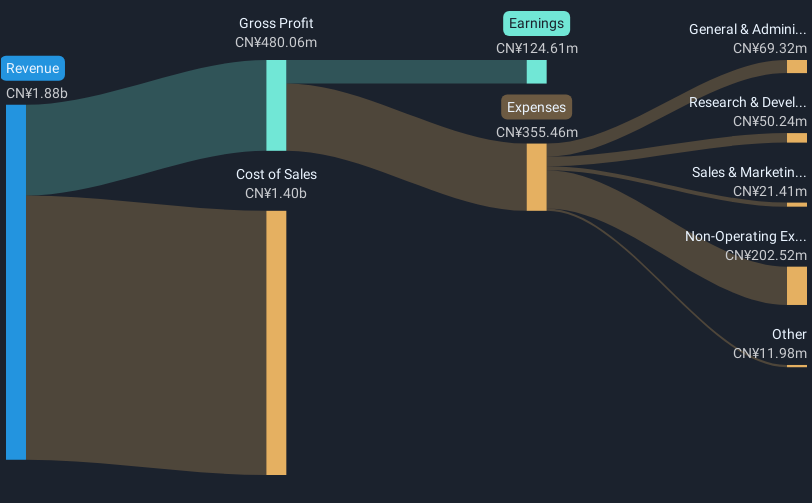

Guangdong Aofei Data Technology has shown promise with a notable 21.4% annual revenue growth and an impressive 39.41% forecast in earnings growth per year, outperforming broader market expectations. Despite a volatile share price, the company's strategic focus on R&D is evident; they invested significantly in innovation, which is critical for maintaining competitive advantage in the rapidly evolving tech landscape. This commitment to research not only fuels technological advancements but also aligns with the industry's shift towards more sustainable and efficient data solutions. Recent financials indicate a slight increase in net income from CNY 50.5 million to CNY 51.75 million as of Q1 2025, suggesting steady financial health amid challenging market conditions.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sharetronic Data Technology Co., Ltd. is a provider of wireless IoT products operating both in China and internationally, with a market capitalization of CN¥25.65 billion.

Operations: Sharetronic Data Technology focuses on the development and sale of wireless IoT products, serving both domestic and international markets. The company leverages its expertise in IoT technology to generate revenue through the sale of these products.

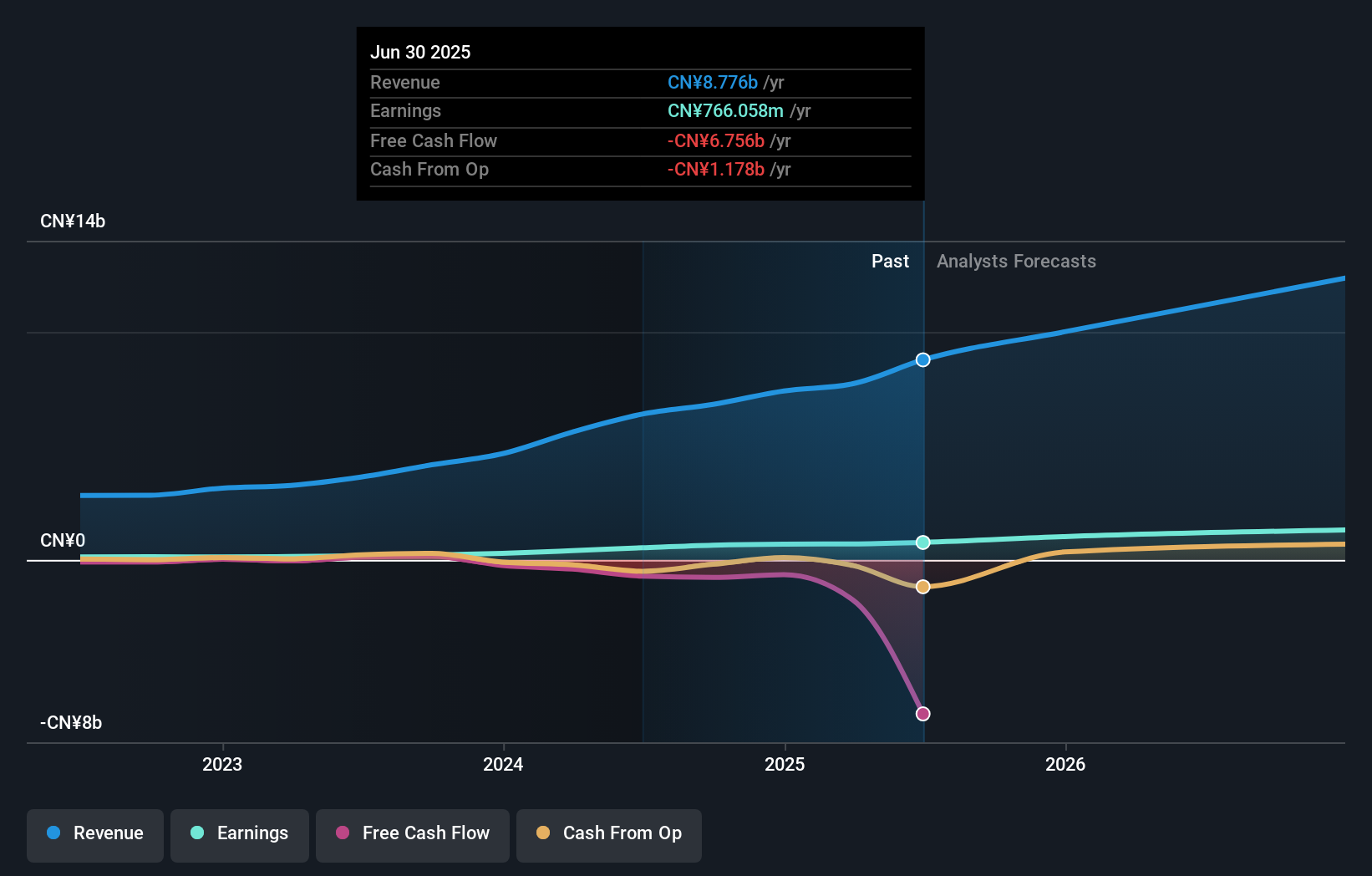

Sharetronic Data Technology has demonstrated robust growth, with a 25.2% annual increase in revenue and an impressive 32.17% projected annual earnings growth, surpassing the broader Chinese market's expectations. This performance is underpinned by substantial R&D investments, reflecting a strategic commitment to innovation amid evolving tech demands. The company also reported a significant rise in net income from CNY 162.25 million to CNY 169.21 million in Q1 2025, alongside increasing dividends, signaling strong financial health and shareholder confidence. These factors collectively underscore Sharetronic's potential to maintain its momentum within the competitive tech landscape.

Taking Advantage

- Investigate our full lineup of 736 Global High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300738

Guangdong Aofei Data Technology

Guangdong Aofei Data Technology Co., Ltd.

High growth potential slight.

Market Insights

Community Narratives