Longshine Technology Group Co., Ltd. Just Missed Earnings - But Analysts Have Updated Their Models

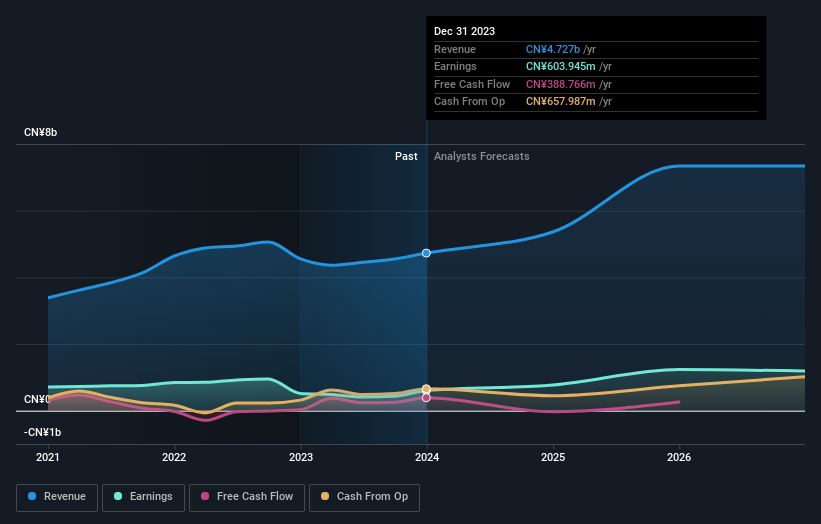

It's shaping up to be a tough period for Longshine Technology Group Co., Ltd. (SZSE:300682), which a week ago released some disappointing yearly results that could have a notable impact on how the market views the stock. It wasn't a great result overall - while revenue fell marginally short of analyst estimates at CN¥4.7b, statutory earnings missed forecasts by 14%, coming in at just CN¥0.56 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Check out our latest analysis for Longshine Technology Group

After the latest results, the eleven analysts covering Longshine Technology Group are now predicting revenues of CN¥5.36b in 2024. If met, this would reflect a notable 13% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to surge 25% to CN¥0.70. Before this earnings report, the analysts had been forecasting revenues of CN¥6.29b and earnings per share (EPS) of CN¥0.90 in 2024. Indeed, we can see that the analysts are a lot more bearish about Longshine Technology Group's prospects following the latest results, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

It'll come as no surprise then, to learn that the analysts have cut their price target 7.0% to CN¥17.59. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Longshine Technology Group analyst has a price target of CN¥26.70 per share, while the most pessimistic values it at CN¥13.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Longshine Technology Group's past performance and to peers in the same industry. The period to the end of 2024 brings more of the same, according to the analysts, with revenue forecast to display 13% growth on an annualised basis. That is in line with its 13% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 21% per year. So it's pretty clear that Longshine Technology Group is expected to grow slower than similar companies in the same industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Longshine Technology Group. On the negative side, they also downgraded their revenue estimates, and forecasts imply they will perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Longshine Technology Group going out to 2026, and you can see them free on our platform here.

You still need to take note of risks, for example - Longshine Technology Group has 1 warning sign we think you should be aware of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300682

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026