Improved Earnings Required Before Richinfo Technology Co., Ltd. (SZSE:300634) Stock's 27% Jump Looks Justified

Those holding Richinfo Technology Co., Ltd. (SZSE:300634) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.5% over the last year.

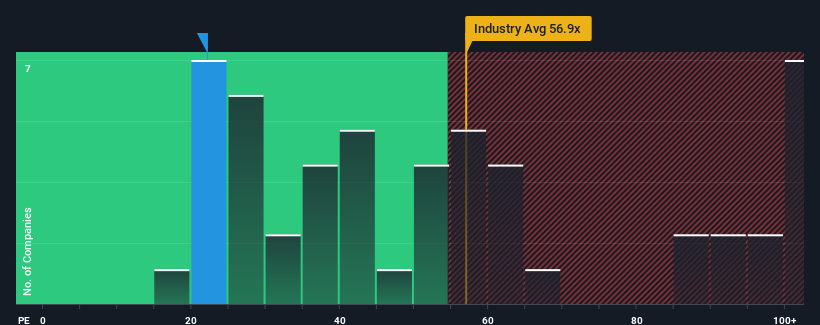

Even after such a large jump in price, Richinfo Technology's price-to-earnings (or "P/E") ratio of 22.1x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 31x and even P/E's above 56x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Richinfo Technology certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Richinfo Technology

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Richinfo Technology's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 84% gain to the company's bottom line. The latest three year period has also seen an excellent 151% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 5.3% as estimated by the six analysts watching the company. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's understandable that Richinfo Technology's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Richinfo Technology's P/E?

Richinfo Technology's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Richinfo Technology maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Richinfo Technology that you should be aware of.

You might be able to find a better investment than Richinfo Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300634

Richinfo Technology

Engages in the development and sales of software products in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives