As global markets enter December 2025, major U.S. stock indexes have continued their upward trajectory, buoyed by investor optimism regarding a potential interest rate cut from the Federal Reserve, with the Nasdaq Composite and small-cap Russell 2000 Index leading gains. Amid this backdrop of cautious economic optimism and mixed signals from various sectors such as manufacturing and services, high-growth tech stocks remain a focal point for investors seeking opportunities in an evolving market landscape where innovation and adaptability are key attributes of promising investments.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Pharma Mar | 21.68% | 41.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 38.67% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We'll examine a selection from our screener results.

Beijing Vastdata Technology (SHSE:603138)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Vastdata Technology Co., Ltd. offers database products and services in China, with a market capitalization of CN¥4.26 billion.

Operations: Vastdata Technology generates revenue primarily from software and information technology services, amounting to CN¥419.67 million.

Beijing Vastdata Technology, amidst a challenging financial landscape, reported a significant revenue increase to CNY 314.07 million from CNY 266.87 million year-over-year, despite widening net losses to CNY 75.43 million. This surge aligns with an anticipated revenue growth rate of 41.5% annually, outpacing the Chinese market's average of 14.4%. The company's R&D commitment is reflected in its strategy to transition into profitability within three years, supported by robust earnings forecasts projecting an annual growth of 117.58%. Although currently unprofitable with a modest forecasted Return on Equity of 9.7%, these investments in innovation could position Beijing Vastdata favorably as it navigates towards future profitability and industry competitiveness.

Shennan Circuit (SZSE:002916)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shennan Circuit Company Limited specializes in the design, manufacture, and sale of printed circuit boards, packaging substrates, and electronic assemblies both in China and internationally, with a market cap of CN¥126.65 billion.

Operations: Shennan Circuit focuses on producing printed circuit boards, packaging substrates, and electronic assemblies for both domestic and international markets.

Shennan Circuit has demonstrated robust financial performance with a notable increase in sales, reaching CNY 16.75 billion, up from CNY 13.05 billion the previous year, marking an impressive growth trajectory. This surge is complemented by a significant rise in net income to CNY 2.33 billion from CNY 1.49 billion and an earnings per share increase from CNY 2.9 to CNY 3.49 over the same period. The company's commitment to innovation is evident in its R&D strategy, maintaining a competitive edge within the tech sector and promising future growth prospects amidst market challenges.

- Dive into the specifics of Shennan Circuit here with our thorough health report.

Assess Shennan Circuit's past performance with our detailed historical performance reports.

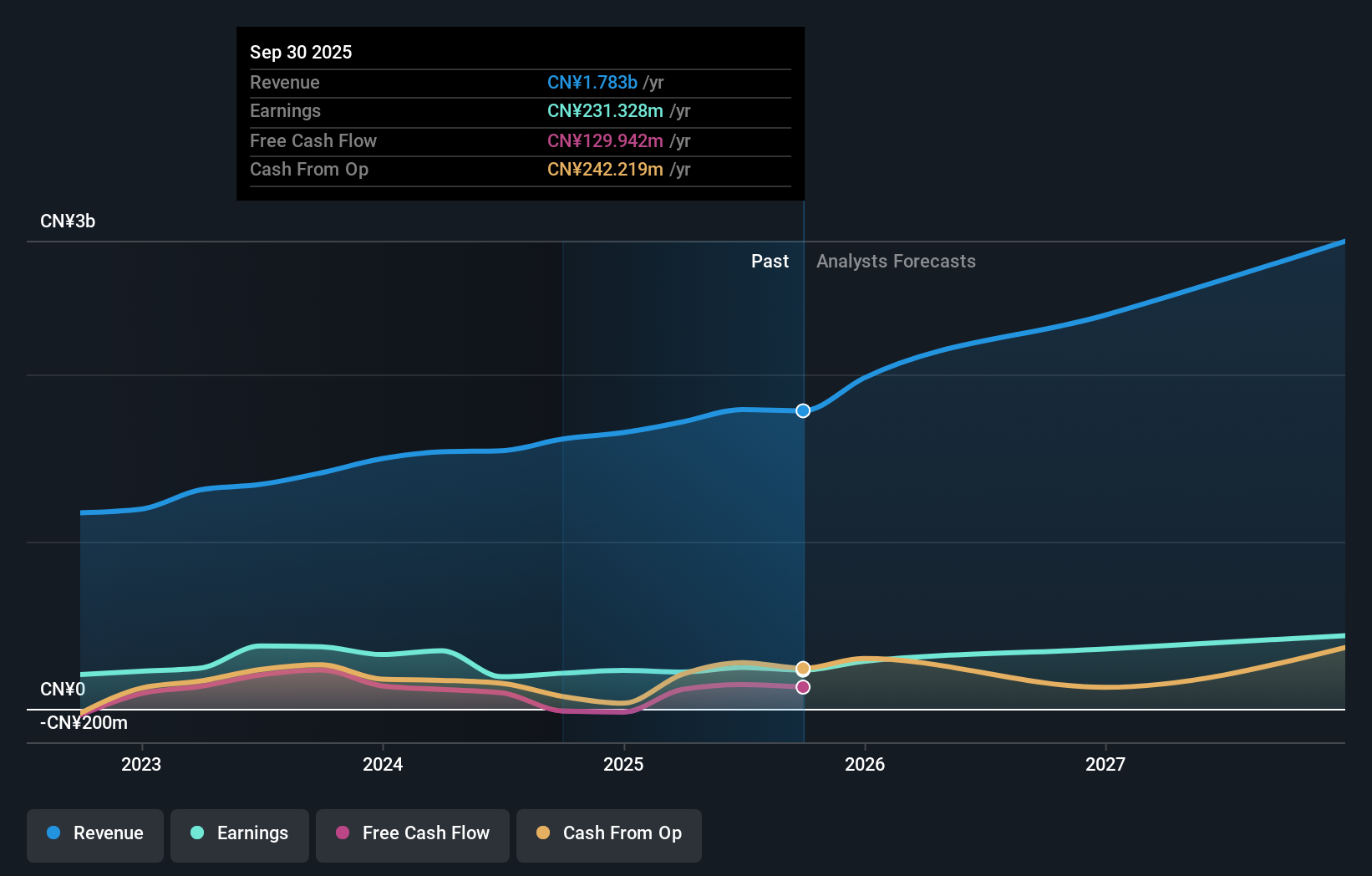

Richinfo Technology (SZSE:300634)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Richinfo Technology Co., Ltd. focuses on developing and selling software products in China, with a market capitalization of CN¥11.14 billion.

Operations: The company specializes in software product development and sales within China. It operates with a market capitalization of CN¥11.14 billion.

Richinfo Technology has shown resilience with a modest revenue increase to CNY 1.34 billion, up from CNY 1.21 billion year-over-year, reflecting a growth of approximately 10.8%. Despite the competitive market dynamics, the company's net income slightly improved to CNY 196.36 million. Notably, its commitment to R&D is reflected in consistent earnings per share at CNY 0.44, signaling stable profitability amidst strategic financial maneuvers like dividend adjustments and special shareholder meetings focused on fund management strategies. This approach could bolster Richinfo's positioning in the evolving tech landscape, especially considering its revenue growth outpacing the broader Chinese market forecast of 14.4%.

- Delve into the full analysis health report here for a deeper understanding of Richinfo Technology.

Gain insights into Richinfo Technology's past trends and performance with our Past report.

Where To Now?

- Unlock our comprehensive list of 244 Global High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Vastdata Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603138

Beijing Vastdata Technology

Provides database products and services in China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026