- China

- /

- Electronic Equipment and Components

- /

- SHSE:603528

High Growth Tech Stocks Including DuoLun Technology With Promising Potential

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and consumer spending concerns, major U.S. indices experienced declines, with the S&P 500 Index hitting record highs early on before ending lower due to tariff fears and cost pressures. Amidst this volatile backdrop, identifying high-growth tech stocks can be appealing for investors seeking potential opportunities in sectors that demonstrate resilience and innovation despite broader market challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.86% | 26.17% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.67% | 58.73% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1187 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

DuoLun Technology (SHSE:603528)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DuoLun Technology Corporation Ltd. specializes in developing intelligent training, testing, and application systems for motor vehicle drivers in China, with a market cap of CN¥6.79 billion.

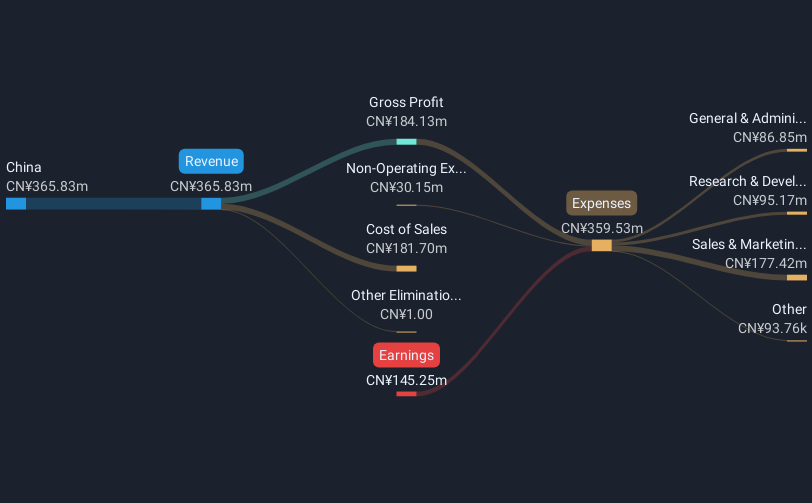

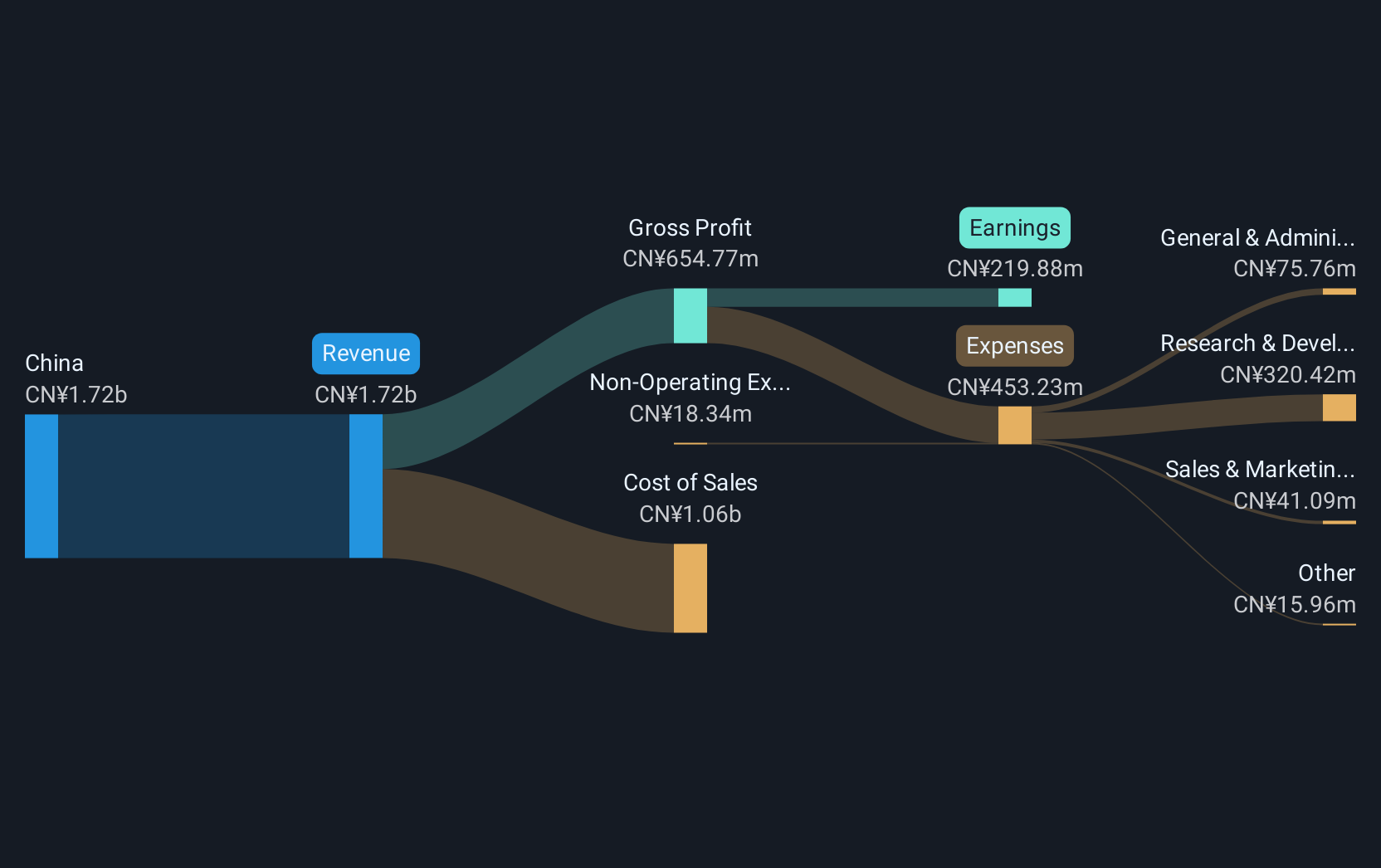

Operations: DuoLun Technology generates revenue primarily from electronic security devices, contributing CN¥527.80 million. The company's market capitalization stands at approximately CN¥6.79 billion.

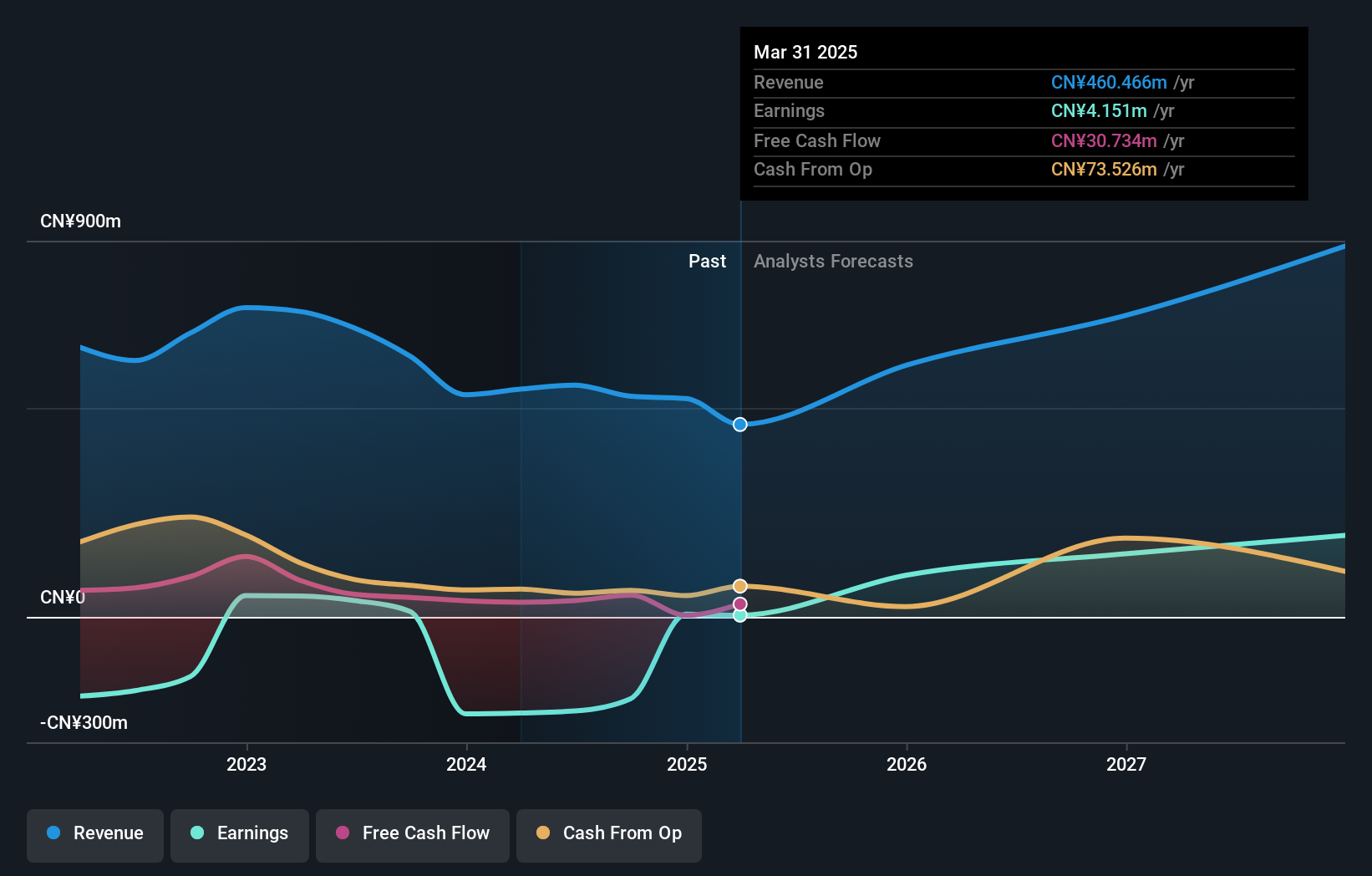

DuoLun Technology has shown promising prospects with an expected annual revenue growth of 18.3%, outpacing the Chinese market's average of 13.4%. Despite being currently unprofitable, the company is projected to transition into profitability within three years, boasting a remarkable potential earnings growth rate of 89.24% annually. Further bolstering its financial health, DuoLun maintains positive free cash flow and recently enhanced its strategic positioning through a significant M&A activity where Zhang Aoxing acquired a 5% stake for approximately CNY 270 million. This move not only reflects confidence in DuoLun's future but also aligns with broader industry trends towards consolidation and strengthening core business areas.

- Unlock comprehensive insights into our analysis of DuoLun Technology stock in this health report.

Evaluate DuoLun Technology's historical performance by accessing our past performance report.

Jilin University Zhengyuan Information Technologies (SZSE:003029)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin University Zhengyuan Information Technologies Co., Ltd. operates in the information technology sector and has a market capitalization of CN¥4.63 billion.

Operations: Jilin University Zhengyuan Information Technologies Co., Ltd. focuses on the information technology sector, with various revenue streams contributing to its operations.

Jilin University Zhengyuan Information Technologies is poised for significant growth, with revenue expected to surge by 72.9% annually, outstripping the broader Chinese market's average of 13.4%. This growth trajectory is complemented by an anticipated earnings increase of 113.88% per year, positioning the company to achieve profitability within three years. Despite a volatile share price in recent months, strategic moves like completing a share repurchase program underline confidence in its financial strategy and future prospects. The firm's commitment to innovation is evident from its substantial R&D investments which are crucial for maintaining competitive advantage in the rapidly evolving tech landscape.

Richinfo Technology (SZSE:300634)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Richinfo Technology Co., Ltd. focuses on the development and sales of software products in China, with a market capitalization of approximately CN¥13.69 billion.

Operations: Richinfo Technology Co., Ltd. specializes in developing and selling software products within China. The company's business model centers on generating revenue through these software sales, contributing to its market presence in the technology sector.

Richinfo Technology, amid a volatile market, is navigating through significant strategic changes, including a proposed adjustment to its business scope. This move could recalibrate the company's trajectory in the tech sector. Despite recent earnings contraction by 42.7%, Richinfo's revenue growth at 19.3% annually outpaces the broader Chinese market average of 13.4%. The firm is also set to boost its earnings by an impressive 28.4% annually over the next three years, signaling robust future prospects despite current challenges. Moreover, a recent special shareholders meeting underscores active governance aimed at refining operational focus and enhancing shareholder value in this dynamic industry landscape.

Taking Advantage

- Investigate our full lineup of 1187 High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603528

DuoLun Technology

Develops motor vehicle driver intelligent training, testing, and application systems in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives