As the Asian markets experience a surge, driven by robust performances in technology-focused shares and a strategic push towards self-reliance in science and technology, investors are closely monitoring the region's economic resilience amid global trade tensions and domestic challenges. In this dynamic environment, identifying high-growth tech stocks involves assessing companies that demonstrate strong innovation capabilities and adaptability to evolving market demands, positioning themselves favorably within Asia's rapidly advancing technological landscape.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 36.03% | 47.77% | ★★★★★★ |

| Eoptolink Technology | 38.08% | 35.42% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi TechnologyLtd | 20.20% | 31.67% | ★★★★★★ |

| Shengyi Electronics | 23.62% | 31.31% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Foxconn Industrial Internet | 30.02% | 29.48% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Unicomp Technology Group (SHSE:688531)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Unicomp Technology Group Co., Ltd. focuses on the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China with a market cap of CN¥11.80 billion.

Operations: Unicomp Technology Group Co., Ltd. specializes in developing and producing X-ray technology and intelligent detection equipment for the Chinese market. The company operates with a market capitalization of CN¥11.80 billion, reflecting its significant presence in the industry.

Unicomp Technology Group has demonstrated robust financial performance with a 27% annual revenue growth, outpacing the Chinese market average of 14.1%. This surge is mirrored in its earnings, which have increased by 9.4% over the past year, exceeding the electronics industry's growth rate of 5.7%. The company's commitment to innovation is evident from its recent R&D expenditures, crucial for sustaining its competitive edge in a rapidly evolving tech landscape. Moreover, Unicomp has actively returned value to shareholders through a strategic buyback program, repurchasing shares worth CNY 10.09 million recently. These financial maneuvers underscore Unicomp’s solid market positioning and potential for continued growth amidst fierce industry competition.

- Unlock comprehensive insights into our analysis of Unicomp Technology Group stock in this health report.

Learn about Unicomp Technology Group's historical performance.

Richinfo Technology (SZSE:300634)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Richinfo Technology Co., Ltd. focuses on the development and sales of software products in China, with a market cap of CN¥11.44 billion.

Operations: Richinfo Technology Co., Ltd. specializes in software development and sales within the Chinese market.

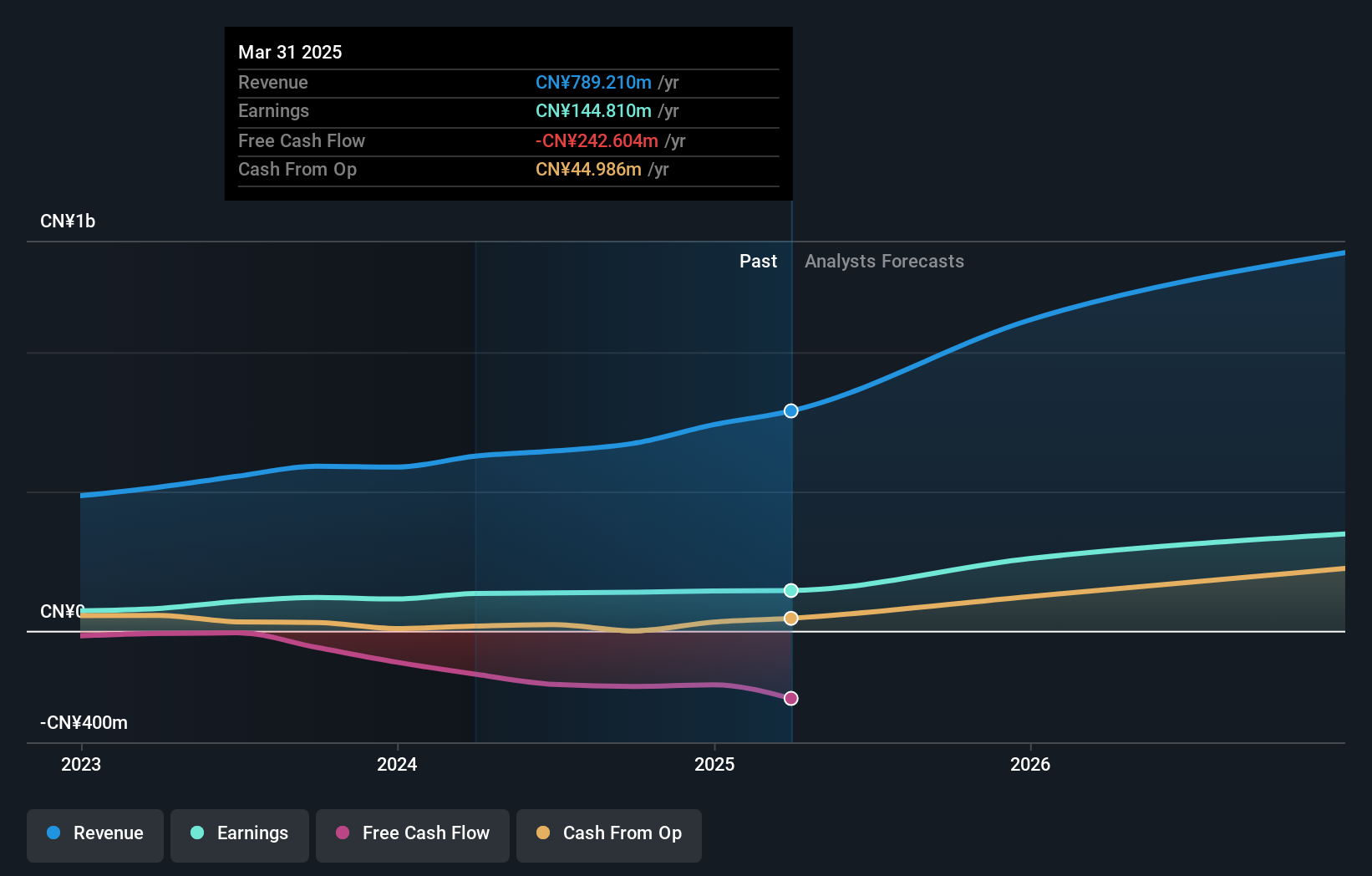

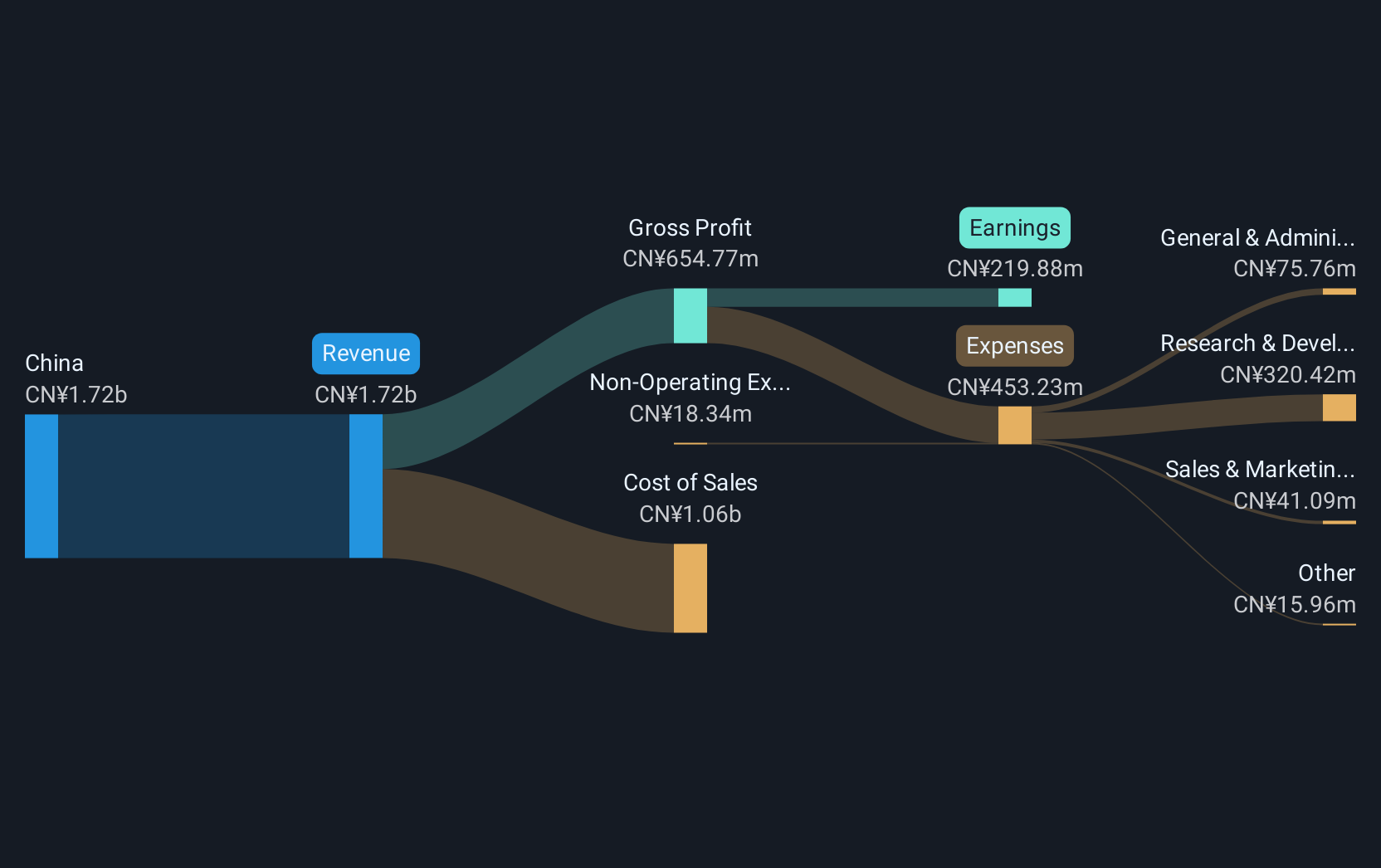

Richinfo Technology has shown a notable uptick in its financial metrics, with revenue climbing to CNY 1.34 billion, marking an increase from the previous year's CNY 1.21 billion. This growth is complemented by a steady earnings per share at CNY 0.44, reflecting stable profitability despite market fluctuations. The company's commitment to innovation is underscored by its R&D investments, which are crucial for maintaining competitiveness in the fast-evolving tech sector of Asia. Additionally, Richinfo's recent shareholder meetings and dividend adjustments indicate active financial management strategies aimed at sustaining growth and shareholder value in a dynamic economic environment.

- Click to explore a detailed breakdown of our findings in Richinfo Technology's health report.

Gain insights into Richinfo Technology's past trends and performance with our Past report.

Shenzhen Phoenix Telecom TechnologyLtd (SZSE:301191)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Phoenix Telecom Technology Co., Ltd. operates in the telecommunications sector, focusing on communication terminal equipment, with a market capitalization of CN¥6.77 billion.

Operations: The company generates revenue primarily from its communication terminal equipment segment, totaling CN¥1.58 billion.

Shenzhen Phoenix Telecom TechnologyLtd. faces challenges, as evidenced by a revenue drop to CNY 721.62 million from CNY 823.7 million year-over-year and a significant decrease in net income from CNY 76.31 million to CNY 21.88 million. Despite these setbacks, the company is poised for recovery with projected annual earnings growth of 48.8% and revenue increases expected at an annual rate of 29.5%. These figures highlight its potential resilience and adaptability in the competitive tech landscape of Asia, particularly as it navigates through market fluctuations and invests in innovation to secure its standing in the industry.

Next Steps

- Delve into our full catalog of 184 Asian High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300634

Richinfo Technology

Engages in the development and sales of software products in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives