Revenues Not Telling The Story For Jilin Jlu Communication Design Institute Co.,Ltd. (SZSE:300597)

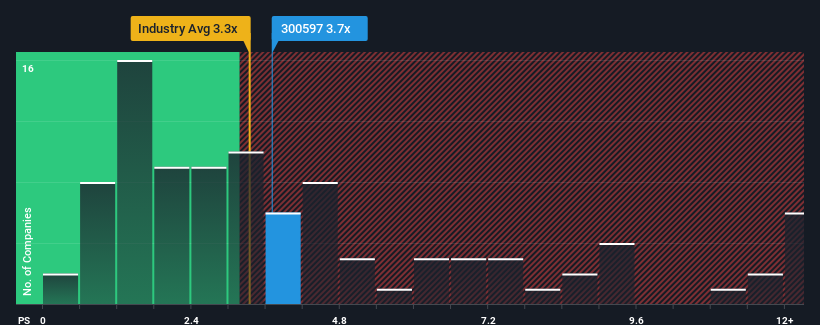

It's not a stretch to say that Jilin Jlu Communication Design Institute Co.,Ltd.'s (SZSE:300597) price-to-sales (or "P/S") ratio of 3.7x right now seems quite "middle-of-the-road" for companies in the IT industry in China, where the median P/S ratio is around 3.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Jilin Jlu Communication Design InstituteLtd

What Does Jilin Jlu Communication Design InstituteLtd's Recent Performance Look Like?

The recent revenue growth at Jilin Jlu Communication Design InstituteLtd would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jilin Jlu Communication Design InstituteLtd will help you shine a light on its historical performance.How Is Jilin Jlu Communication Design InstituteLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Jilin Jlu Communication Design InstituteLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.9% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 9.2% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 28% shows it's noticeably less attractive.

With this information, we find it interesting that Jilin Jlu Communication Design InstituteLtd is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Jilin Jlu Communication Design InstituteLtd's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Jilin Jlu Communication Design InstituteLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Jilin Jlu Communication Design InstituteLtd (1 doesn't sit too well with us!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300597

Jilin Jlu Communication Design InstituteLtd

Jilin Jlu Communication Design Institute Co.,Ltd.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives