- China

- /

- Basic Materials

- /

- SZSE:002271

3 Top Dividend Stocks Yielding 5.6%

Reviewed by Simply Wall St

With global markets reaching record highs on the back of China's stimulus measures and a robust performance in technology stocks, investors are keenly observing opportunities to capitalize on steady returns. Amidst this backdrop, dividend stocks yielding 5.6% present an attractive option for those seeking consistent income streams. A good dividend stock not only offers reliable payouts but also demonstrates resilience in fluctuating market conditions, making it a valuable addition to any portfolio in today's economic environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.71% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.17% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.14% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.28% | ★★★★★★ |

| Kondotec (TSE:7438) | 3.79% | ★★★★★★ |

| CVB Financial (NasdaqGS:CVBF) | 4.49% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.45% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.25% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.79% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

Click here to see the full list of 2011 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Hisense Visual Technology (SHSE:600060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hisense Visual Technology Co., Ltd. engages in the research, development, production, and sale of display products and related industry chain products both in China and internationally, with a market cap of CN¥28.69 billion.

Operations: Hisense Visual Technology Co., Ltd. generates revenue primarily from its multimedia segment, which accounted for CN¥54.20 billion.

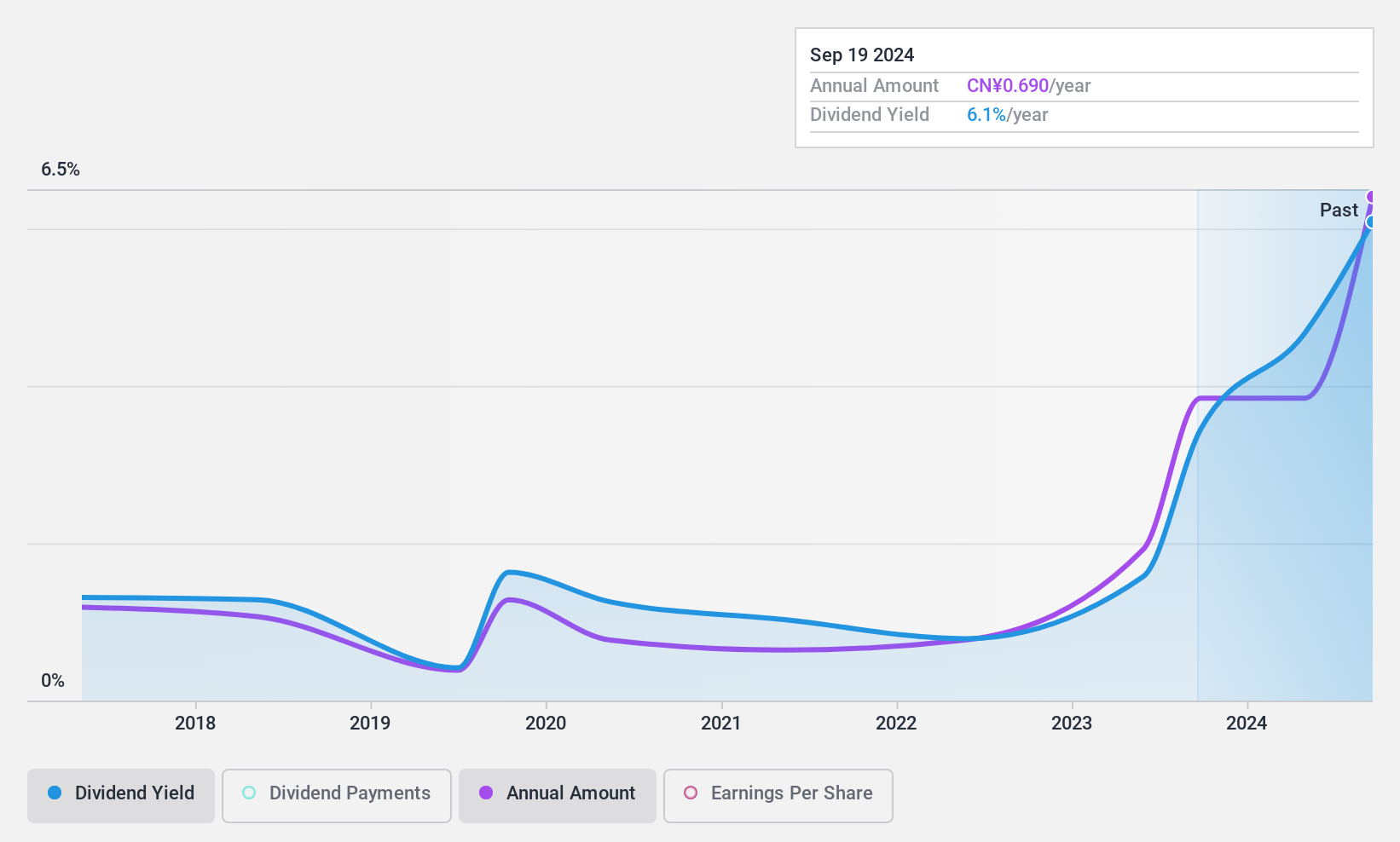

Dividend Yield: 3.6%

Hisense Visual Technology has a price-to-earnings ratio of 15.2x, well below the CN market average of 33.5x, indicating good value. The company reported H1 2024 earnings with CNY 25.46 billion in revenue and CNY 834 million in net income, down from last year’s CNY 1.04 billion net income. Despite a volatile dividend history, its current payout ratios (55% earnings and 37.8% cash flows) suggest dividends are sustainable and covered by both earnings and free cash flow.

- Click here to discover the nuances of Hisense Visual Technology with our detailed analytical dividend report.

- Our expertly prepared valuation report Hisense Visual Technology implies its share price may be lower than expected.

Beijing Oriental Yuhong Waterproof Technology (SZSE:002271)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Oriental Yuhong Waterproof Technology Co., Ltd., along with its subsidiaries, focuses on the research, development, production, and sale of waterproof materials primarily in China and has a market cap of CN¥32.72 billion.

Operations: Beijing Oriental Yuhong Waterproof Technology Co., Ltd. generates revenue from various segments including CN¥21.44 billion from Waterproof Materials, CN¥4.42 billion from Mortar Powder, CN¥3.13 billion from Project Construction, and CN¥489.43 million from the Sale of Materials.

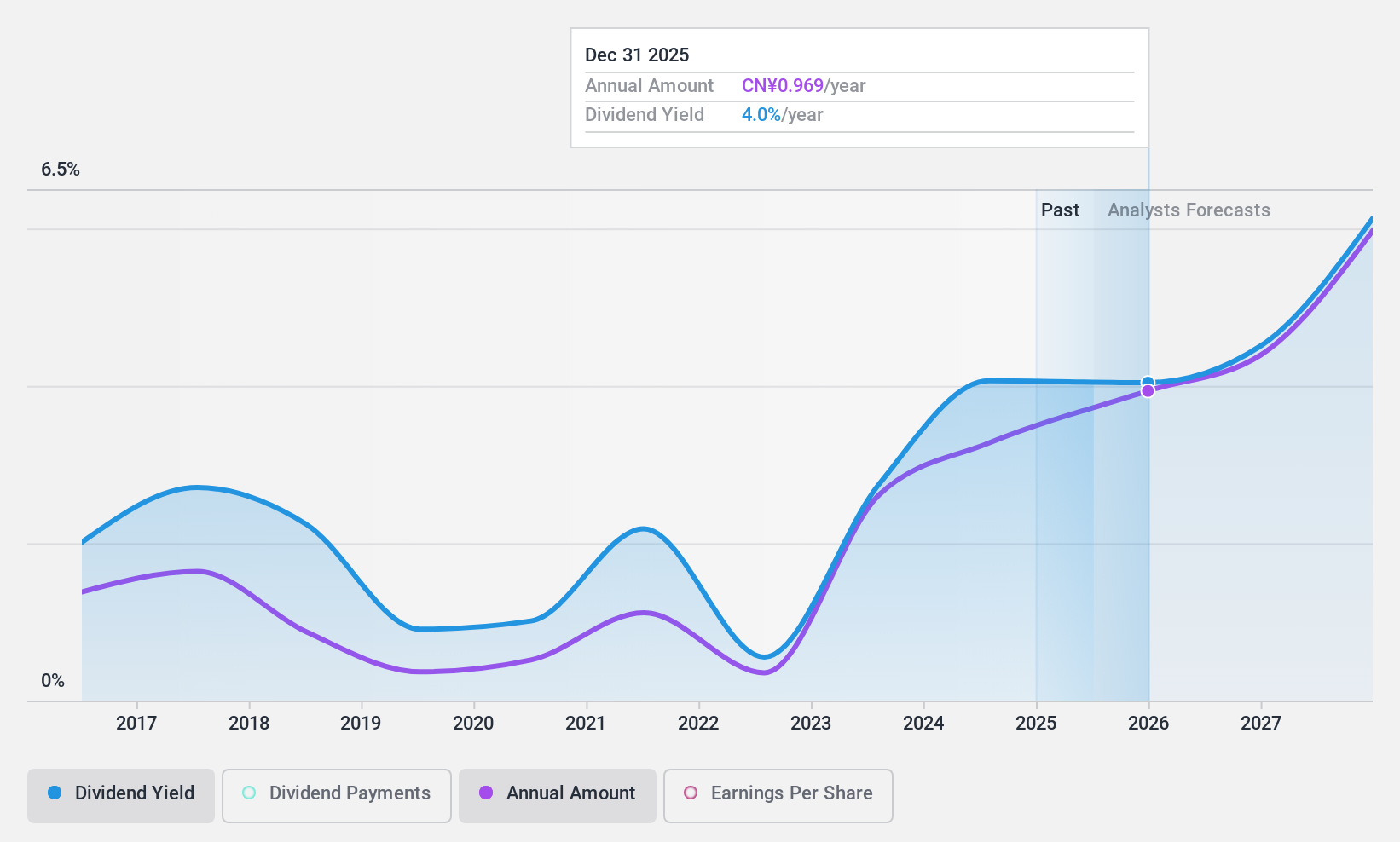

Dividend Yield: 4.4%

Beijing Oriental Yuhong Waterproof Technology announced an interim cash dividend of CNY 6.00 per 10 shares for 2024, with recent earnings showing a decline to CNY 943.24 million from CNY 1.33 billion year-over-year. Despite a high payout ratio (156.1%) indicating dividends are not well covered by earnings, the cash payout ratio (48.5%) suggests better coverage by cash flows. The company’s price-to-earnings ratio of 17.4x indicates good value compared to the CN market average of 33.5x.

- Click to explore a detailed breakdown of our findings in Beijing Oriental Yuhong Waterproof Technology's dividend report.

- The valuation report we've compiled suggests that Beijing Oriental Yuhong Waterproof Technology's current price could be inflated.

New Trend International Logis-TechLtd (SZSE:300532)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Trend International Logis-Tech Co., Ltd. (ticker: SZSE:300532) operates in the logistics technology sector and has a market cap of CN¥5.49 billion.

Operations: New Trend International Logis-Tech Co., Ltd. (ticker: SZSE:300532) generates revenue from various segments in the logistics technology sector, amounting to CN¥5.49 billion.

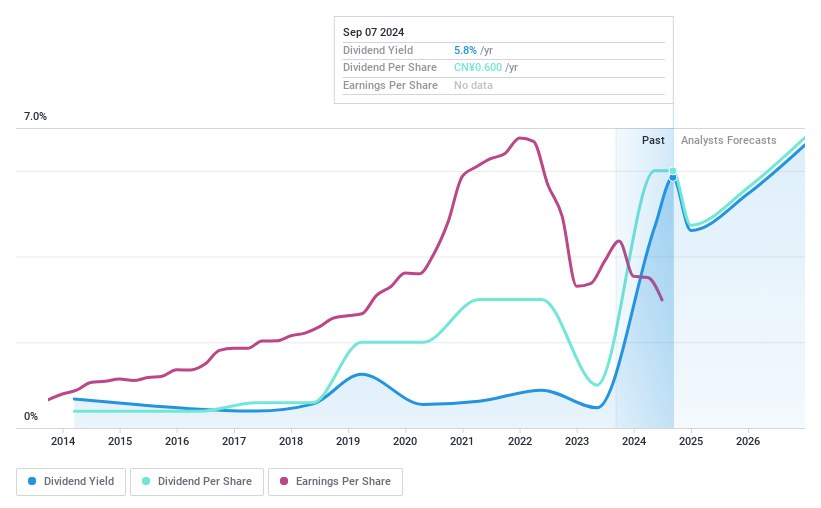

Dividend Yield: 5.7%

New Trend International Logis-Tech Ltd. announced a CNY 5.00 per 10 shares interim dividend for 2024, reflecting an attractive yield in the top 25% of CN market payers. Despite a volatile dividend history over its seven-year payout period, the current payout ratio (59.7%) ensures earnings coverage, while cash flow coverage stands at 81.4%. The company's price-to-earnings ratio (13.2x) suggests good value compared to the CN market average of 33.5x.

- Dive into the specifics of New Trend International Logis-TechLtd here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that New Trend International Logis-TechLtd is trading beyond its estimated value.

Summing It All Up

- Gain an insight into the universe of 2011 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Oriental Yuhong Waterproof Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002271

Beijing Oriental Yuhong Waterproof Technology

Engages in research and development, production, and sale of waterproof materials primarily in China.

Flawless balance sheet average dividend payer.