Investors Appear Satisfied With Fujian Boss Software Corp.'s (SZSE:300525) Prospects As Shares Rocket 32%

Fujian Boss Software Corp. (SZSE:300525) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.8% over the last year.

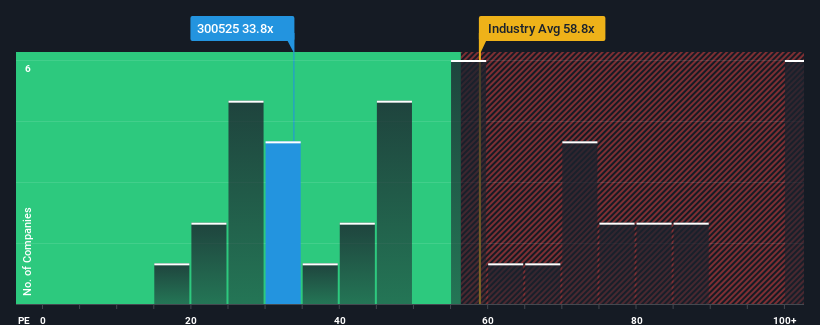

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Fujian Boss Software as a stock to potentially avoid with its 33.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Fujian Boss Software certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Fujian Boss Software

Is There Enough Growth For Fujian Boss Software?

The only time you'd be truly comfortable seeing a P/E as high as Fujian Boss Software's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 25% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 114% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 23% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 19% each year, which is noticeably less attractive.

In light of this, it's understandable that Fujian Boss Software's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Fujian Boss Software's P/E?

The large bounce in Fujian Boss Software's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Fujian Boss Software's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Fujian Boss Software you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300525

Flawless balance sheet and fair value.

Market Insights

Community Narratives