As global markets reach record highs driven by optimism around China’s stimulus measures and advancements in artificial intelligence, technology stocks have shown remarkable resilience and growth. In this favorable economic climate, identifying high-growth tech stocks becomes essential for investors looking to capitalize on the momentum within the sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 1283 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

China Greatwall Technology Group (SZSE:000066)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Greatwall Technology Group Co., Ltd. (SZSE:000066) operates in the system equipment and computing industry sectors with a market cap of CN¥33.43 billion.

Operations: Greatwall Technology Group generates revenue primarily from its system equipment and computing industry segments, with the latter contributing approximately CN¥10.73 billion. The company has a market cap of CN¥33.43 billion.

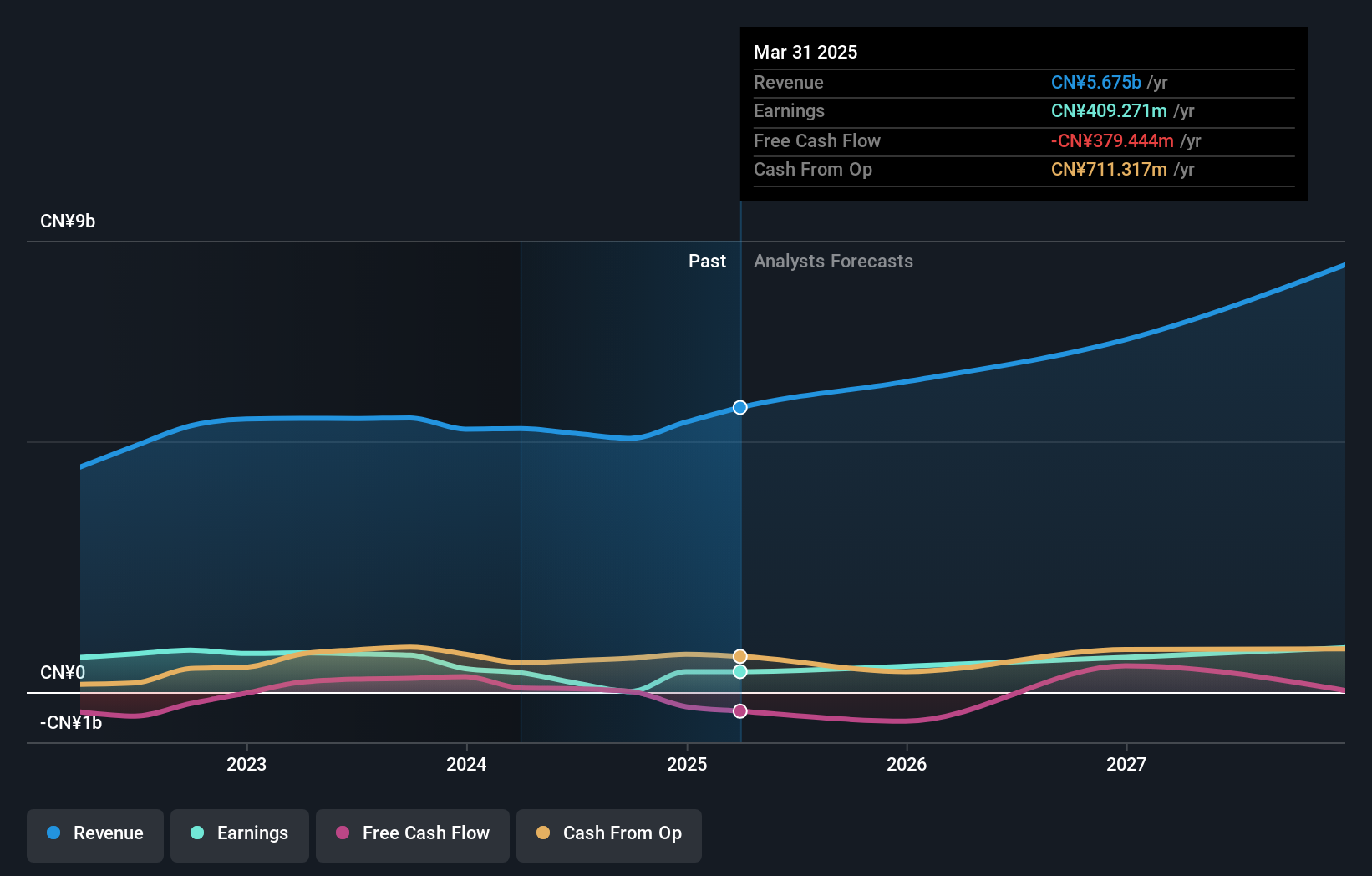

China Greatwall Technology Group is navigating a transformative phase, marked by a notable recovery in sales to CNY 5.68 billion, up from CNY 4.63 billion year-over-year, reflecting a resilient operational strategy despite its net losses decreasing to CNY 421.52 million from CNY 632.65 million previously. The company's commitment to innovation is underscored by its R&D investments, aligning with an industry trend where tech firms intensify focus on development to stay competitive. Moreover, the forecasted revenue growth at an annual rate of 17.8% outpaces the Chinese market average of 13.2%, highlighting potential in its market strategies and product offerings despite current unprofitability and challenging financial conditions indicated by inadequate debt coverage through operating cash flow. Looking ahead, China Greatwall Technology Group's strategic maneuvers like the recent shareholder meetings focusing on audit reappointments and financial structuring signal a proactive governance approach amidst financial recalibrations. While earnings are projected to surge by approximately 100% annually over the next three years, these optimistic projections must be tempered with caution due to ongoing losses and cash flow concerns which could impact long-term sustainability and operational capacity in this high-stakes tech landscape.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. engages in the research and development, production, and sale of infrared thermal imaging technology in Asia with a market cap of CN¥31.35 billion.

Operations: The company generates revenue primarily from the manufacturing of other electronic equipment (CN¥2.45 billion), followed by technical services (CN¥33.25 million) and leasing industry activities (CN¥7.68 million).

Wuhan Guide Infrared is navigating a challenging landscape with recent earnings showing a dip in net income to CNY 17.97 million from CNY 207.38 million year-over-year, despite an increase in sales to CNY 1,106.93 million. This contrast highlights the company's resilience in maintaining revenue growth at 23.3% annually, outpacing the Chinese market average of 13.2%. The firm's commitment to innovation is evident from its R&D spending trends which are crucial as it gears up for profitability forecasted over the next three years with expected earnings growth of 63.5% per annum. These figures suggest strategic positioning within the tech sector, although current unprofitability and fluctuating earnings underscore inherent risks and operational challenges.

- Unlock comprehensive insights into our analysis of Wuhan Guide Infrared stock in this health report.

Evaluate Wuhan Guide Infrared's historical performance by accessing our past performance report.

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thunder Software Technology Co., Ltd. offers operating-system products across China, Europe, the United States, Japan, and other international markets with a market cap of CN¥24.13 billion.

Operations: Thunder Software Technology Co., Ltd. specializes in providing operating-system products globally, including key markets such as China, Europe, the United States, and Japan. The company has a market capitalization of CN¥24.13 billion.

Thunder Software TechnologyLtd. demonstrates a robust commitment to growth with its R&D spending, crucial for maintaining a competitive edge in the fast-evolving tech landscape. In 2024, the company allocated 17% of its revenue towards R&D, significantly above the industry norm of 13.2%, underscoring its dedication to innovation and development in software technologies. Despite a dip in net income from CNY 387.96 million to CNY 104.37 million, Thunder Software continues to invest heavily in future capabilities, which is reflected in its projected annual earnings growth of 34.8%. This strategic focus on enhancing technological offerings and sustaining high investment in R&D could position Thunder Software favorably as it navigates the competitive tech sector.

- Navigate through the intricacies of Thunder Software TechnologyLtd with our comprehensive health report here.

Understand Thunder Software TechnologyLtd's track record by examining our Past report.

Next Steps

- Dive into all 1283 of the High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thunder Software TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300496

Thunder Software TechnologyLtd

Provides operating-system products in China, Europe, the United States, Japan, and internationally.

Excellent balance sheet and good value.