- China

- /

- Electronic Equipment and Components

- /

- SZSE:300782

Exploring Three High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuations in consumer confidence and economic indicators, major stock indexes have recently experienced moderate gains, with technology stocks leading the charge before a slight pullback. In this environment, identifying high-growth tech stocks that align with evolving market dynamics can potentially enhance a portfolio by capitalizing on innovation and resilience amid broader economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1265 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. specializes in producing quantum information technology-based security products and services for the information and communication technology sector in China, with a market cap of CN¥21.98 billion.

Operations: QuantumCTek Co., Ltd. focuses on the production of security products and services leveraging quantum information technology within China's ICT sector. The company's revenue model is centered around these specialized offerings, contributing to its position in the market with a valuation of CN¥21.98 billion.

QuantumCTek, amidst a challenging fiscal landscape marked by a net loss reduction from CNY 79.12 million to CNY 55.12 million year-over-year, shows promising signs of recovery with substantial revenue growth up to CNY 99.71 million from the previous CNY 73.26 million. This uptick represents a robust annualized revenue increase of 24.3%. Despite current unprofitability, the company is on a trajectory for profitability with expected earnings growth at an impressive rate of 106.54% annually over the next three years, signaling potential resilience and adaptability in its market segment.

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thunder Software Technology Co., Ltd. develops operating-system products for a global market, including China, Europe, the United States, and Japan, with a market capitalization of CN¥25.76 billion.

Operations: Thunder Software Technology Co., Ltd. focuses on developing operating-system products across various international markets. The company generates revenue primarily from its software solutions, catering to diverse regions including China, Europe, the United States, and Japan. With a market capitalization of CN¥25.76 billion, it serves a global customer base through its innovative technology offerings.

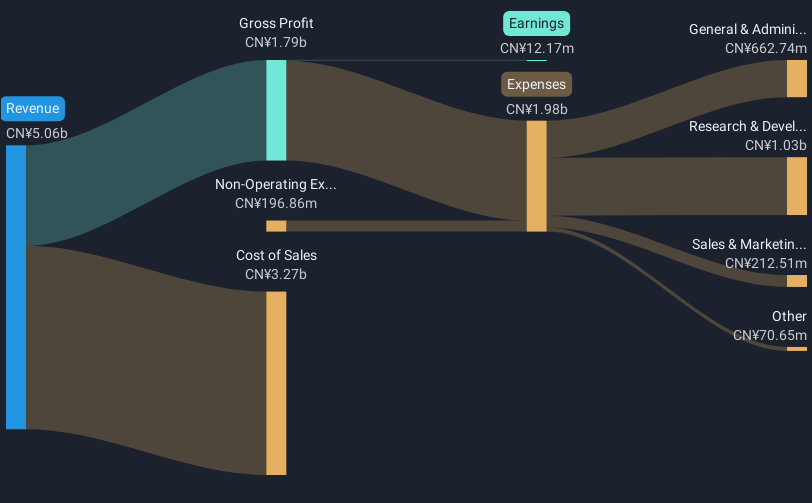

Thunder Software TechnologyLtd., despite a revenue dip to CNY 3.69 billion from CNY 3.88 billion year-over-year, shows resilience with strategic alliances boosting its market position. The partnership with HERE Technologies leverages ThunderSoft's Aqua Drive OS and HERE's advanced mapping solutions, setting a new standard in intelligent navigation systems crucial for future mobility ecosystems. This collaboration not only enhances product offerings but also expands global reach, underpinning ThunderSoft's commitment to innovation amidst challenging financial dynamics, where net income fell sharply to CNY 151.97 million from CNY 605.98 million.

Maxscend Microelectronics (SZSE:300782)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maxscend Microelectronics Company Limited focuses on the research, development, production, and sale of radio frequency integrated circuits in China, with a market capitalization of CN¥45.32 billion.

Operations: Maxscend Microelectronics generates revenue primarily from the sale of radio frequency integrated circuits. The company's operations are based in China, and it is involved in both the development and production aspects of these circuits.

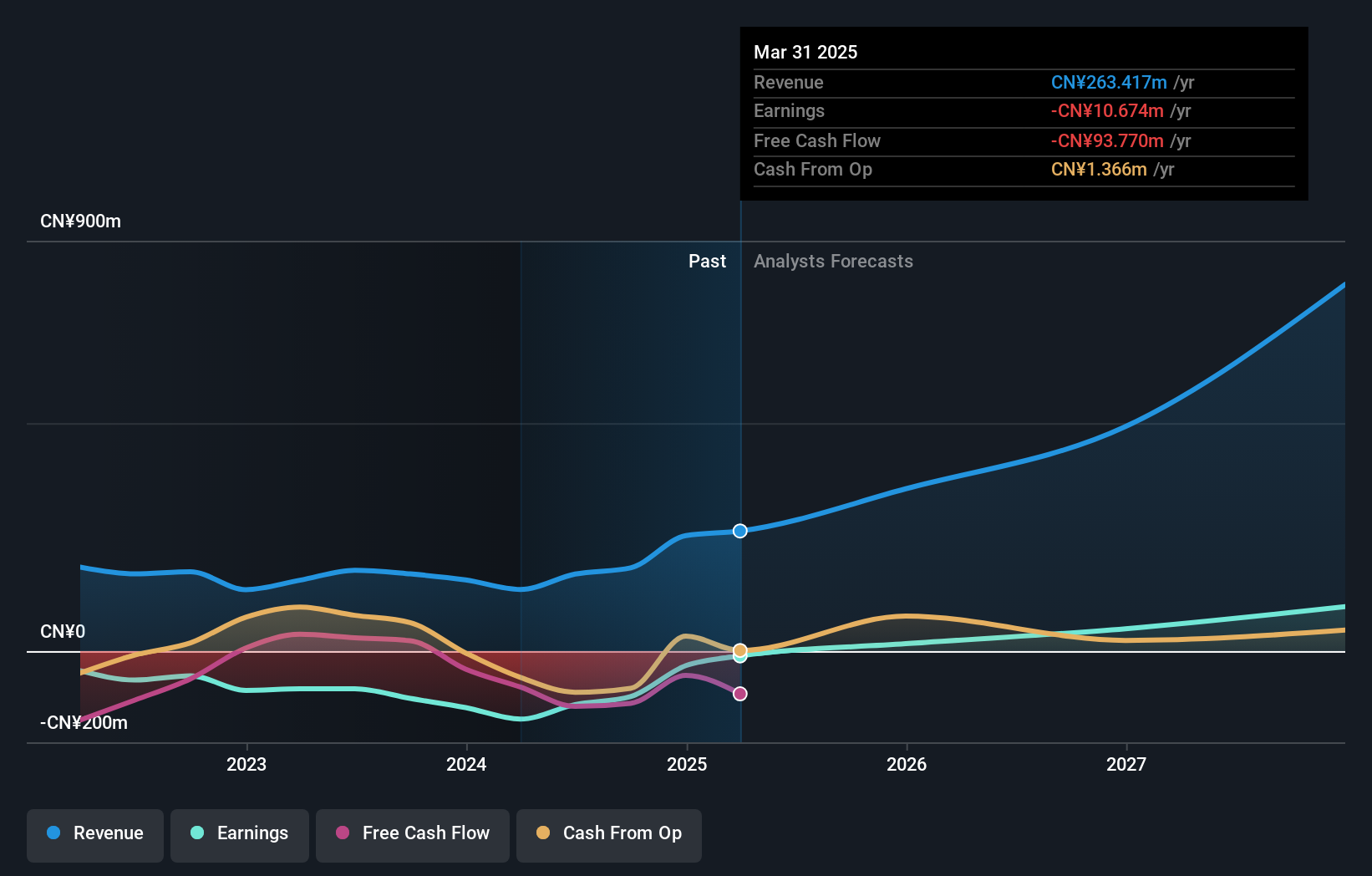

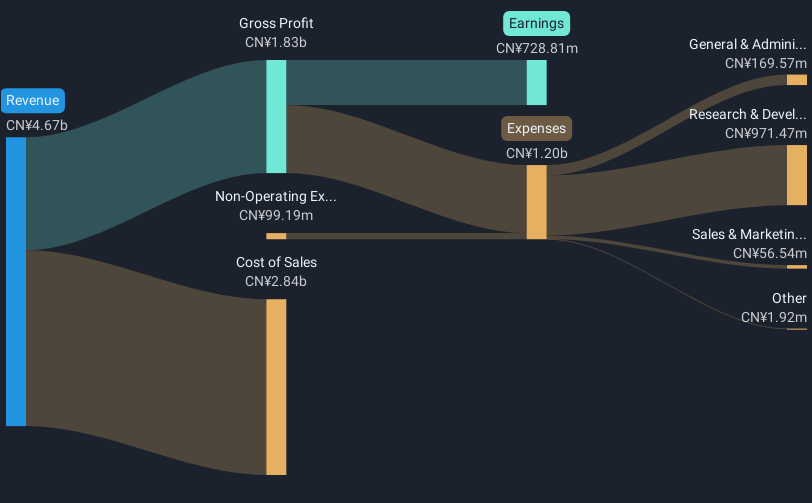

Maxscend Microelectronics has demonstrated robust growth, with revenue climbing to CNY 3.37 billion, marking a 9.6% increase year-over-year. This performance is supported by an impressive annual revenue growth rate of 17.4%, surpassing the broader Chinese market's expansion of 13.6%. Despite facing challenges reflected in a net income drop to CNY 425.42 million from CNY 818.95 million, the firm continues to prioritize innovation with significant R&D investments aimed at sustaining its competitive edge in the tech sector and potentially reversing the downward trend in profitability.

- Delve into the full analysis health report here for a deeper understanding of Maxscend Microelectronics.

Understand Maxscend Microelectronics' track record by examining our Past report.

Turning Ideas Into Actions

- Discover the full array of 1265 High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300782

Maxscend Microelectronics

Engages in the research, development, production, and sale of radio frequency integrated circuits in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives