As Chinese equities experienced a decline over a holiday-shortened week, with the Shanghai Composite Index and the CSI 300 both seeing notable drops, investors are closely watching for signs of recovery amid Beijing's ongoing stimulus efforts. In this environment, identifying stocks that demonstrate resilience through innovative strategies and strong fundamentals could offer promising opportunities in China's evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| HangZhou Everfine Photo-e-info | NA | 1.86% | 38.27% | ★★★★★★ |

| Changsha Tongcheng HoldingsLtd | 8.27% | -12.36% | -6.10% | ★★★★★★ |

| Hangzhou Seck Intelligent Technology | NA | 14.62% | 6.98% | ★★★★★★ |

| Shanghai Chlor-Alkali Chemical | 7.56% | 3.92% | 3.37% | ★★★★★★ |

| Sublime China Information | NA | 6.24% | 1.49% | ★★★★★★ |

| Power HF | 2.38% | -7.39% | -24.40% | ★★★★★★ |

| TKD Science and TechnologyLtd | NA | 8.38% | 26.68% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 30.34% | 9.84% | -2.45% | ★★★★★☆ |

| Qijing Machinery | 46.41% | 3.46% | -1.40% | ★★★★★☆ |

| Shanghai Feilo AcousticsLtd | 36.01% | -17.85% | 55.43% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

China West Construction Group (SZSE:002302)

Simply Wall St Value Rating: ★★★★★★

Overview: China West Construction Group Co., Ltd operates in the building materials industry across China, Malaysia, Indonesia, Cambodia, and internationally with a market cap of CN¥10.29 billion.

Operations: China West Construction Group generates revenue primarily from the production and sale of commercial concrete, amounting to CN¥21.96 billion. The company's net profit margin reflects its profitability in managing costs relative to its revenue streams.

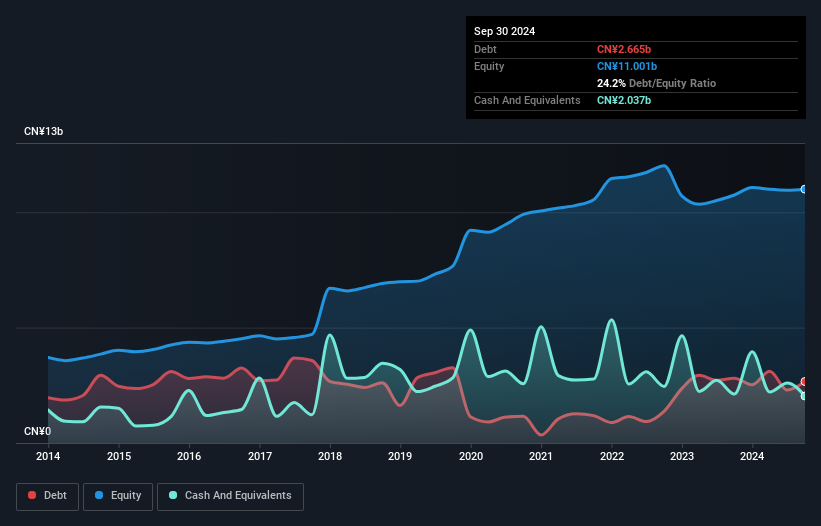

China West Construction Group, a relatively small player in the construction sector, has shown mixed financial performance recently. Despite a significant earnings growth of 43.5% over the past year, its net income for the first half of 2024 plummeted to CNY 5.63 million from CNY 164.96 million last year. The company's debt-to-equity ratio improved from 41.6% to 20.9% over five years, indicating better financial health, yet its share price remains volatile and trades at a notable discount to estimated fair value by about 71%.

Shenzhen Forms Syntron InformationLtd (SZSE:300468)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Forms Syntron Information Co., Ltd. is engaged in the software and information services industry, with a market cap of CN¥12.13 billion.

Operations: Forms Syntron generates revenue primarily from its software and information services segment, which accounts for CN¥725.52 million. The company's financial performance is highlighted by a notable gross profit margin of 53.75%.

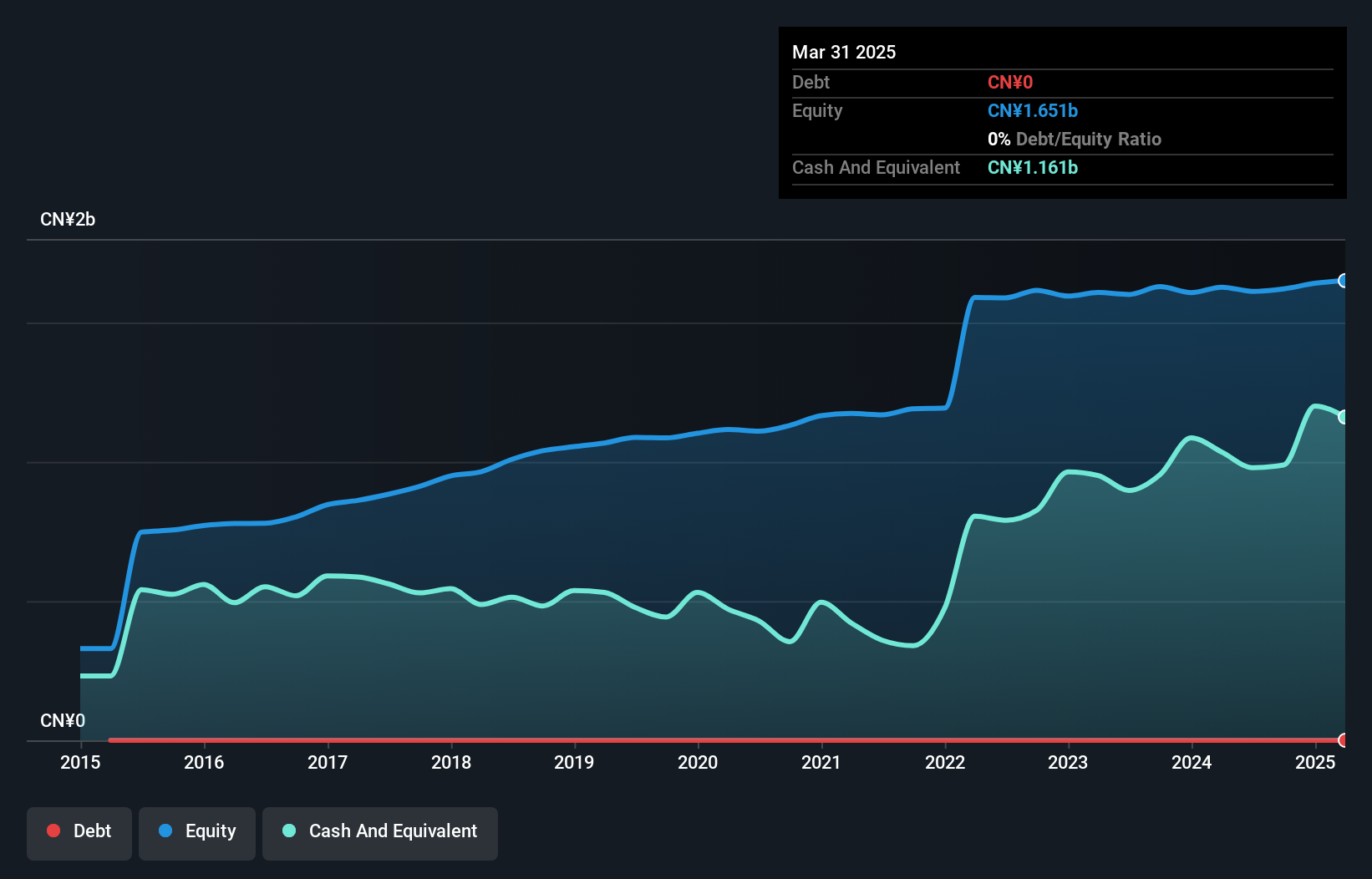

Shenzhen Forms Syntron, a small player in the IT sector, has shown resilience with earnings growth of 12.4% over the past year, outpacing the industry average of -11.5%. The company remains debt-free for five years and boasts high-quality earnings. Despite experiencing a volatile share price recently, its free cash flow is positive at CNY 86.54 million as of June 2024. Recent half-year results reveal stable net income at CNY 36.8 million against CNY 35.44 million last year, indicating steady performance amidst challenging conditions.

Jiangsu Zhengdan Chemical Industry (SZSE:300641)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zhengdan Chemical Industry Co., Ltd. operates in the chemical industry and has a market capitalization of CN¥14.03 billion.

Operations: Jiangsu Zhengdan Chemical Industry generates revenue primarily through its chemical products. The company's financial performance can be analyzed by examining its net profit margin, which has shown a notable trend over recent periods.

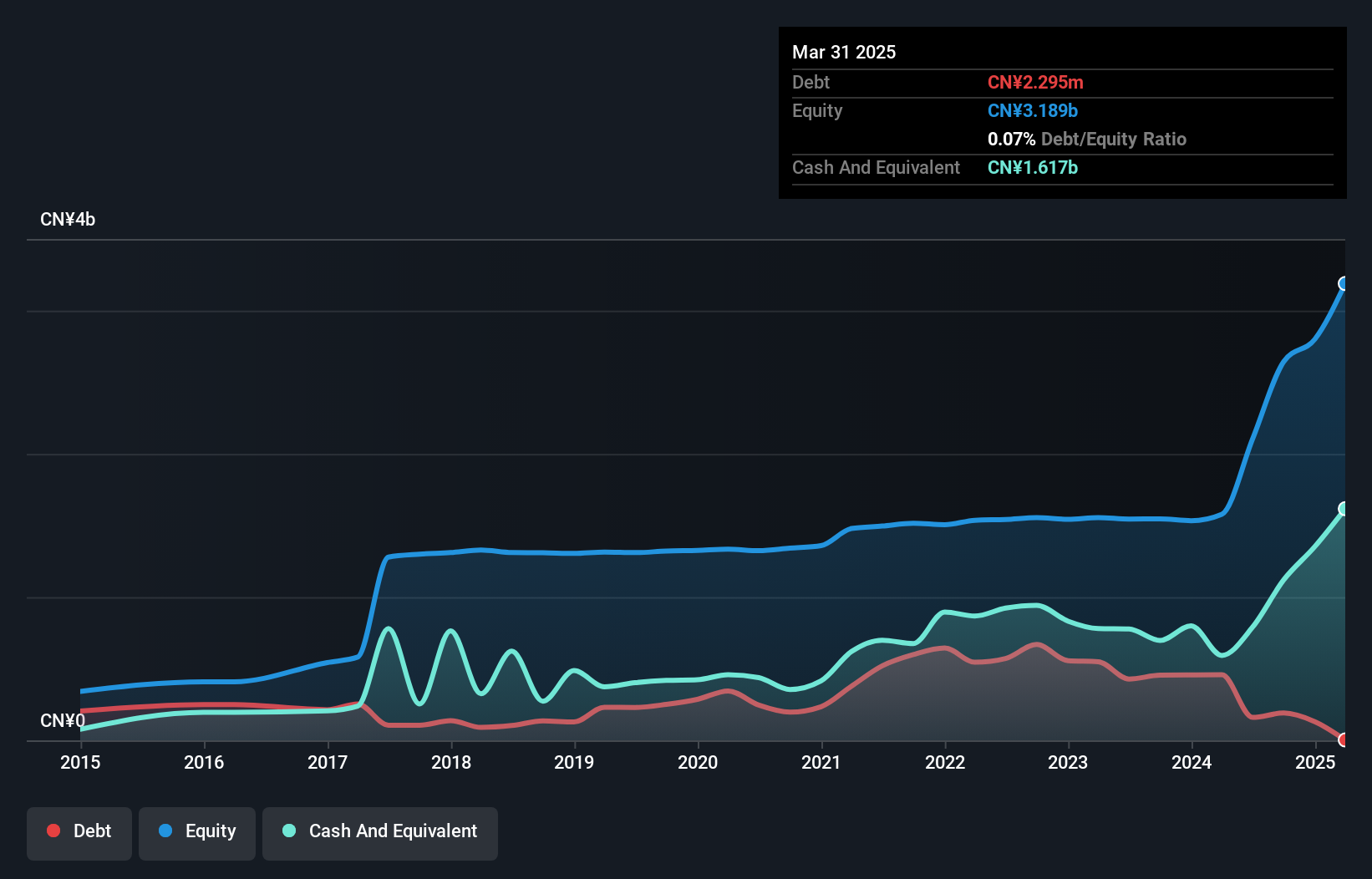

Jiangsu Zhengdan, a nimble player in the chemical industry, has shown impressive growth with earnings surging 8,942% over the past year. The company's sales for the nine months ended September 2024 reached ¥2.60 billion, up from ¥1.13 billion last year. Net income also saw a significant jump to ¥824.87 million from just ¥27.05 million previously. Despite some shareholder dilution due to recent private placements worth ¥428 million, its price-to-earnings ratio remains attractive at 16.8x compared to the broader CN market's 31.7x.

Seize The Opportunity

- Dive into all 900 of the Chinese Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300468

Shenzhen Forms Syntron InformationLtd

Shenzhen Forms Syntron Information Co.,Ltd.

Flawless balance sheet low.