As global markets grapple with economic uncertainty and inflation fears, investor sentiment has been shaken by trade policy tensions and a challenging economic outlook. In this environment, identifying undervalued stocks can be particularly appealing as they may offer potential opportunities for growth when the broader market is under pressure.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Asia Vital Components (TWSE:3017) | NT$454.00 | NT$903.18 | 49.7% |

| Chison Medical Technologies (SHSE:688358) | CN¥30.92 | CN¥61.74 | 49.9% |

| Insource (TSE:6200) | ¥800.00 | ¥1581.36 | 49.4% |

| Pharma Mar (BME:PHM) | €83.20 | €166.22 | 49.9% |

| DO & CO (WBAG:DOC) | €171.20 | €338.82 | 49.5% |

| S Foods (TSE:2292) | ¥2544.00 | ¥5084.09 | 50% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.28 | CN¥40.51 | 49.9% |

| Siam Wellness Group (SET:SPA) | THB4.58 | THB9.14 | 49.9% |

| ArcticZymes Technologies (OB:AZT) | NOK16.32 | NOK32.32 | 49.5% |

| Neosperience (BIT:NSP) | €0.53 | €1.06 | 49.9% |

We'll examine a selection from our screener results.

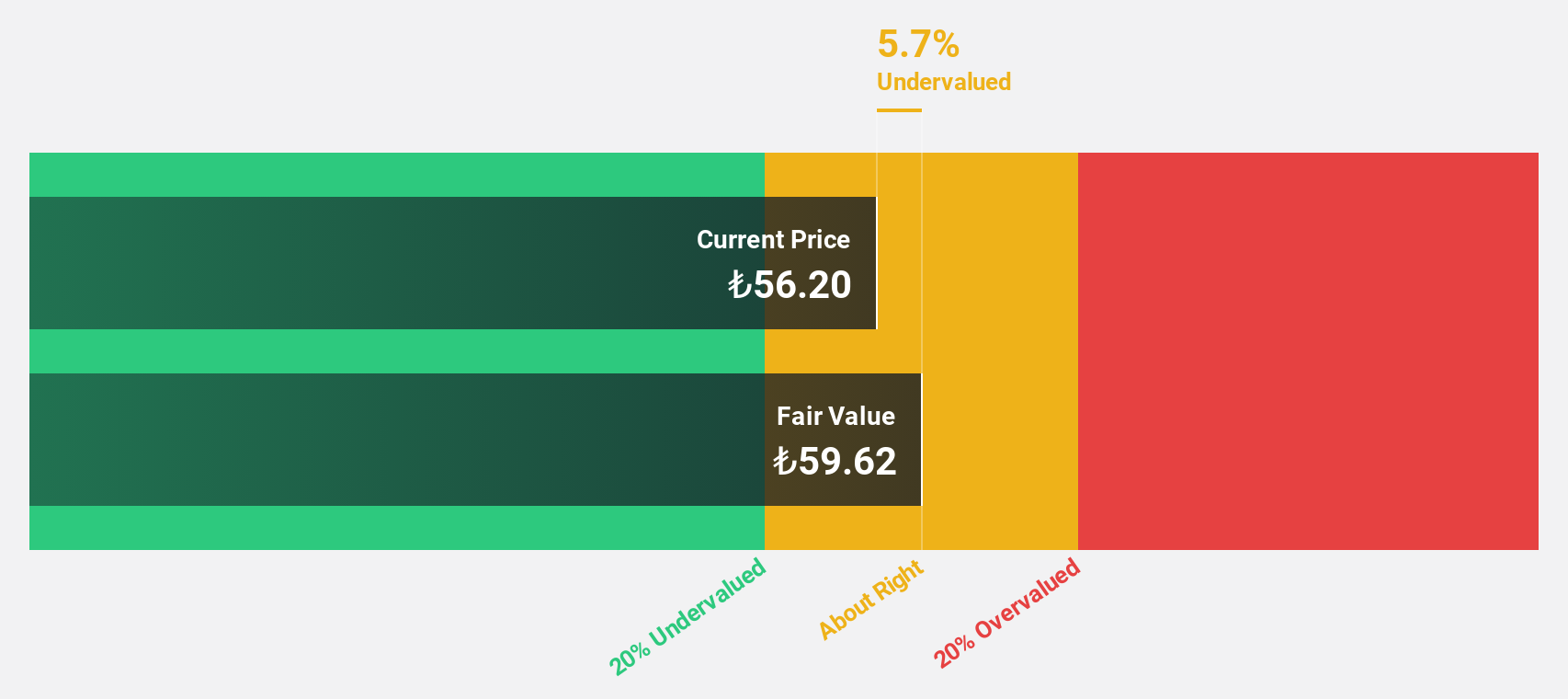

Türk Telekomünikasyon Anonim Sirketi (IBSE:TTKOM)

Overview: Türk Telekomünikasyon Anonim Sirketi, along with its subsidiaries, functions as an integrated telecommunication company in Turkey with a market capitalization of TRY171.85 billion.

Operations: The company's revenue segments consist of Mobile, generating TRY66.16 billion, and Fixed-Line, contributing TRY101.01 billion.

Estimated Discount To Fair Value: 15.9%

Türk Telekomünikasyon Anonim Sirketi, with an expected annual earnings growth of 39.95% and revenue growth of 21.6%, is trading at TRY49.1, below its estimated fair value of TRY58.38 by 15.9%. Despite a decrease in net income to TRY8.46 billion from TRY23.71 billion last year, the company anticipates operating revenue growth between 8% and 9% for 2025, driven by subscriber expansion and dynamic pricing strategies.

- Insights from our recent growth report point to a promising forecast for Türk Telekomünikasyon Anonim Sirketi's business outlook.

- Get an in-depth perspective on Türk Telekomünikasyon Anonim Sirketi's balance sheet by reading our health report here.

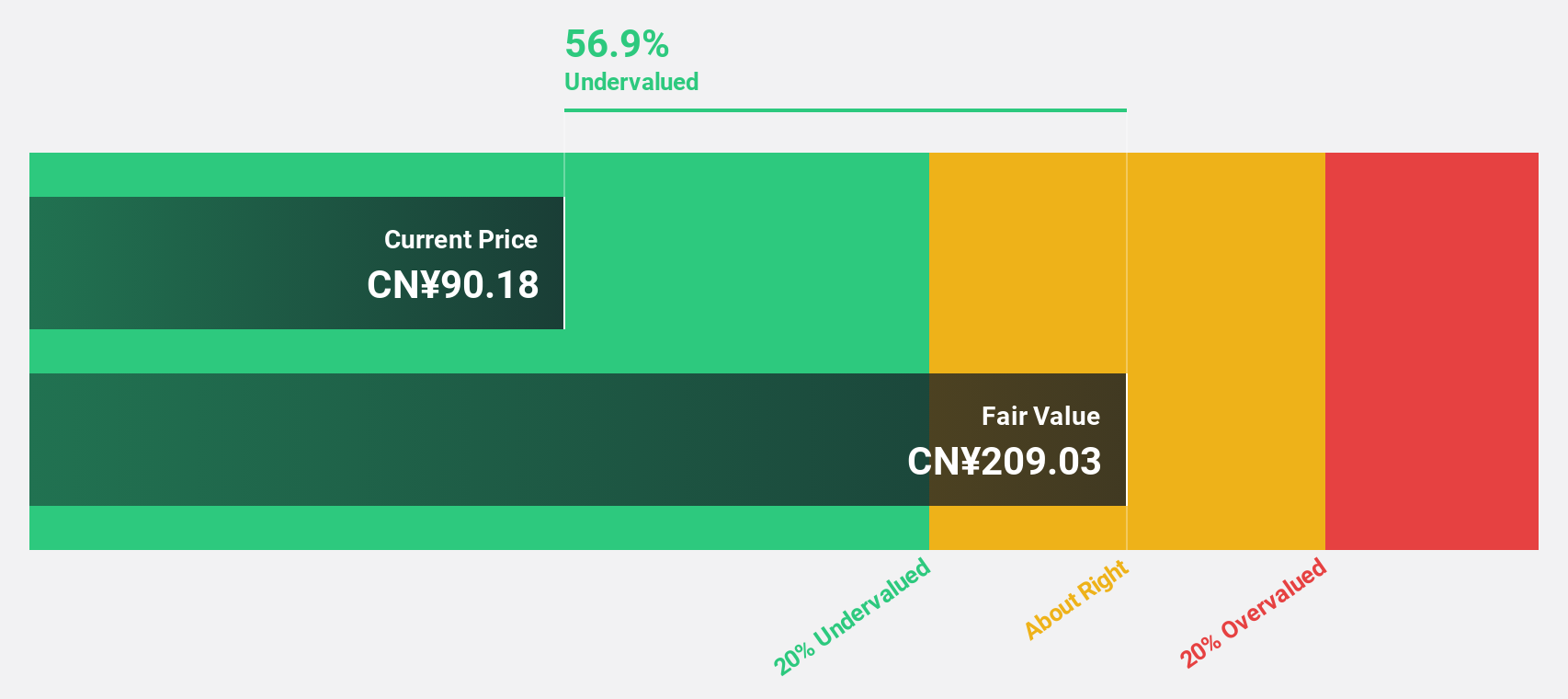

Sangfor Technologies (SZSE:300454)

Overview: Sangfor Technologies Inc. provides IT infrastructure solutions in China and internationally, with a market cap of CN¥42.97 billion.

Operations: Sangfor Technologies Inc. generates revenue through its IT infrastructure solutions both domestically and internationally.

Estimated Discount To Fair Value: 45.9%

Sangfor Technologies is trading at CN¥107.11, significantly below its estimated fair value of CN¥198.05, highlighting potential undervaluation based on discounted cash flow analysis. Despite stable earnings per share and a slight decline in sales to CN¥7.52 billion for 2024, the company forecasts robust annual earnings growth of 28.9%, outpacing the broader Chinese market's expectations. A recent share buyback program worth up to CN¥200 million further underscores management's confidence in its valuation prospects.

- According our earnings growth report, there's an indication that Sangfor Technologies might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Sangfor Technologies.

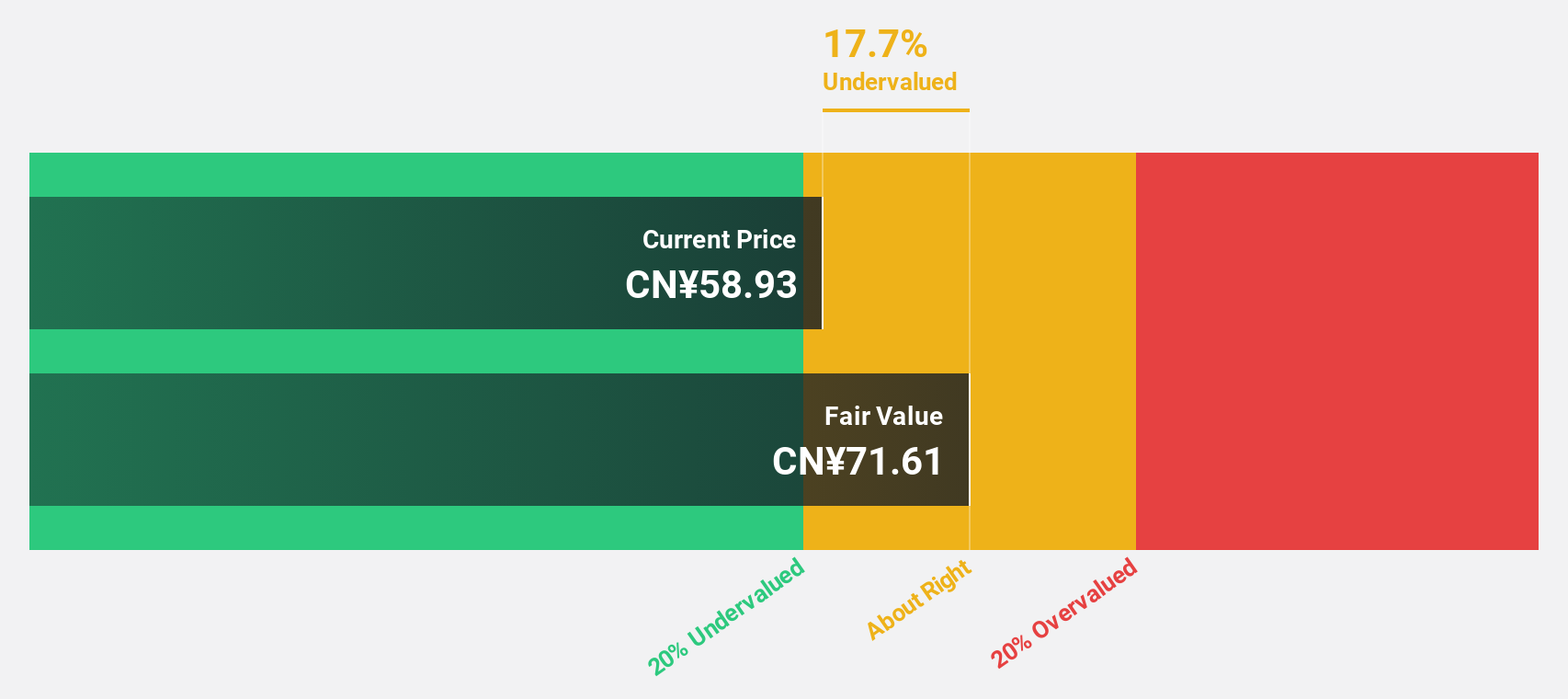

CSPC Innovation Pharmaceutical (SZSE:300765)

Overview: CSPC Innovation Pharmaceutical Co., Ltd. is involved in the research, development, production, and sales of biopharmaceuticals, APIs, and functional foods both in China and internationally with a market cap of CN¥51.53 billion.

Operations: The company's revenue is primarily derived from functional foods and raw materials amounting to CN¥1.84 billion, with additional income from biopharmaceuticals totaling CN¥87.80 million.

Estimated Discount To Fair Value: 34.7%

CSPC Innovation Pharmaceutical is trading at CN¥37.37, below its fair value estimate of CN¥57.2, suggesting undervaluation based on cash flows. Despite a volatile share price and a significant drop in net income to CN¥53.73 million for 2024 from the previous year, earnings are forecasted to grow significantly over the next three years, surpassing market expectations. However, profit margins have decreased to 2.7%, and recent dividend reductions may concern some investors.

- Our growth report here indicates CSPC Innovation Pharmaceutical may be poised for an improving outlook.

- Dive into the specifics of CSPC Innovation Pharmaceutical here with our thorough financial health report.

Make It Happen

- Take a closer look at our Undervalued Global Stocks Based On Cash Flows list of 502 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300765

CSPC Innovation Pharmaceutical

Engages in the research and development, production, and sales of biopharmaceuticals, APIs, and functional foods in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives