- Saudi Arabia

- /

- IT

- /

- SASE:7203

High Growth Tech Stocks Including ALTEOGEN With Potential For Global Expansion

Reviewed by Simply Wall St

Amidst a backdrop of economic uncertainty and inflation concerns, global markets have experienced a downturn, with U.S. stock indexes falling due to trade policy uncertainties and growth worries. In such volatile times, identifying high-growth tech stocks with potential for global expansion requires a focus on companies that can navigate these challenges effectively while capitalizing on technological innovation and market demand.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 22.87% | 27.29% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Delton Technology (Guangzhou) | 29.41% | 27.82% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.68% | 36.76% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Ascentage Pharma Group International | 23.93% | 83.57% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of ₩18.97 billion.

Operations: The company is engaged in the biotechnology sector, focusing on innovative therapeutics such as long-acting biobetters and proprietary antibody-drug conjugates. It also develops antibody biosimilars, contributing to its diverse revenue streams.

ALTEOGEN's recent performance and strategic moves underscore its potential in the high-growth tech sector. With an annual revenue growth rate of 74.4% and earnings expansion at 96.3%, the company outpaces both the general Korean market and its industry benchmarks significantly, reflecting robust operational efficiency and market demand. Recent private placements totaling KRW 154.99 billion, aimed at funding further research and development, highlight ALTEOGEN's commitment to innovation in biotechnology—a sector poised for substantial growth due to advancements in personalized medicine and biopharmaceuticals. This financial injection is expected to bolster their already impressive R&D efforts which are critical for maintaining their competitive edge in a rapidly evolving industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of ALTEOGEN.

Explore historical data to track ALTEOGEN's performance over time in our Past section.

Elm (SASE:7203)

Simply Wall St Growth Rating: ★★★★☆☆

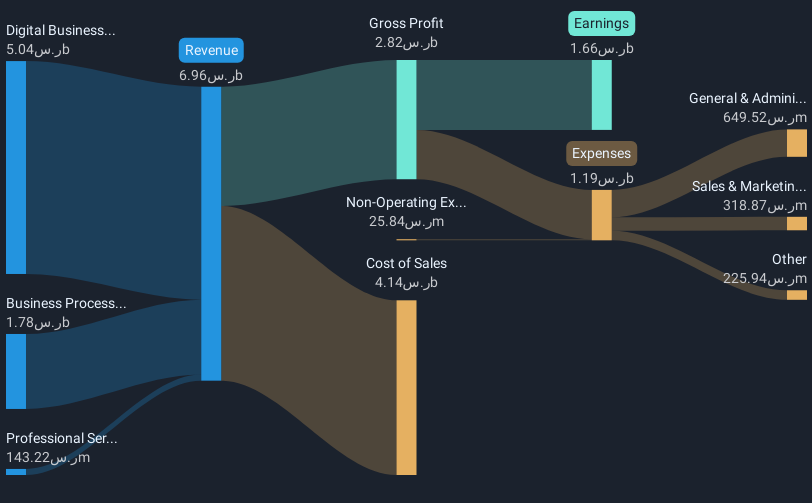

Overview: Elm Company, with a market cap of SAR75.38 billion, offers information security services to government entities, individuals, and private sector companies in Saudi Arabia through its subsidiaries.

Operations: Elm generates revenue primarily from Digital Business, contributing SAR5.47 billion, followed by Business Process Outsourcing at SAR1.78 billion, and Professional Services at SAR152.57 million.

Elm's recent financial performance underscores its robust position in the tech sector, with a notable increase in sales from SAR 5.9 billion to SAR 7.4 billion and an uplift in net income to SAR 1.83 billion from SAR 1.36 billion year-over-year. This growth trajectory is complemented by a strategic focus on R&D, evidenced by significant investments that drive innovation and competitive advantage within its market segment. The company also declared a cash dividend of SAR 4.00, reflecting confidence in ongoing profitability and shareholder value creation amidst dynamic industry shifts towards advanced technologies and services.

Range Intelligent Computing Technology Group (SZSE:300442)

Simply Wall St Growth Rating: ★★★★★☆

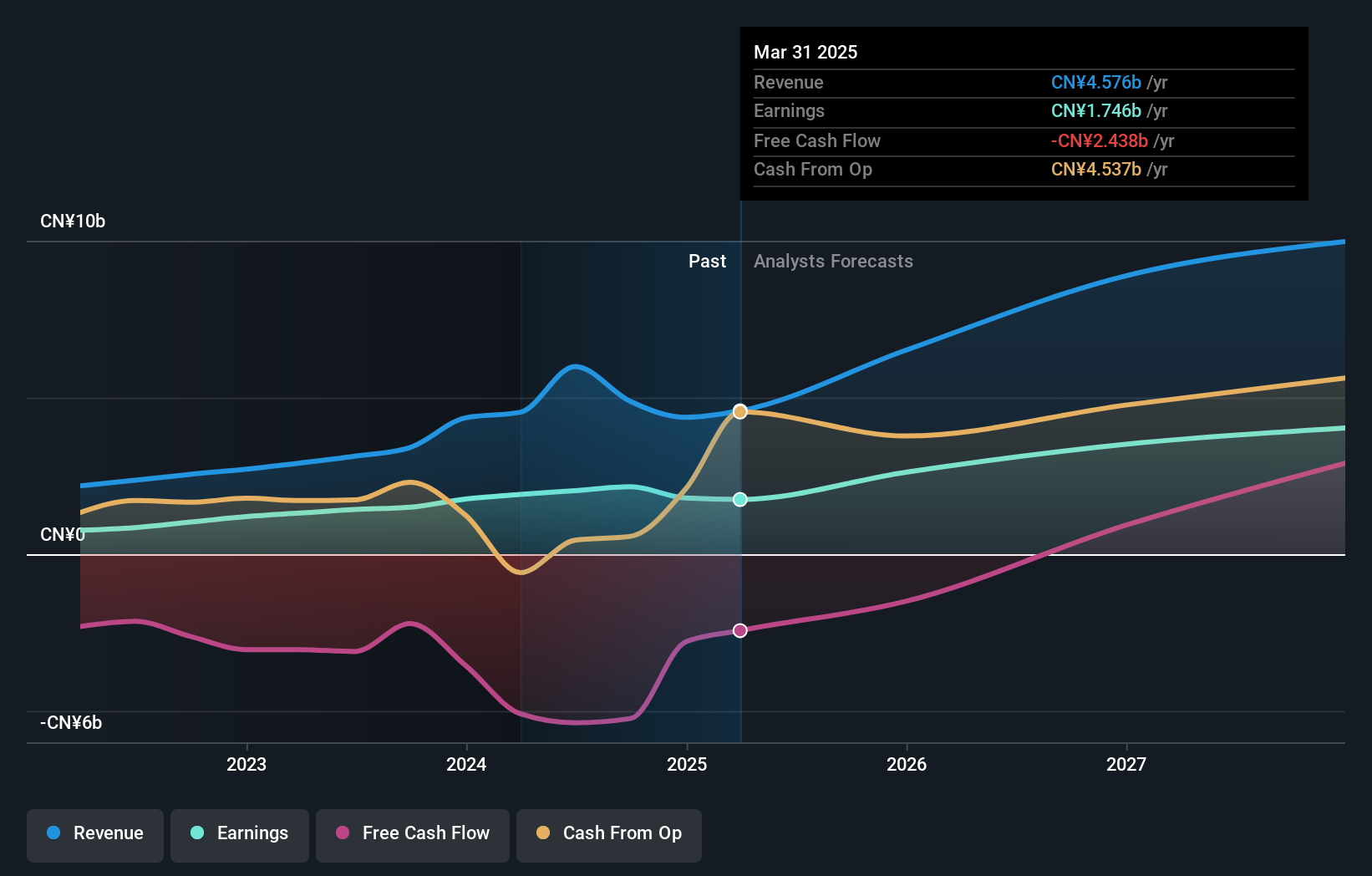

Overview: Range Intelligent Computing Technology Group Company Limited specializes in offering server hosting services to internet companies and large cloud vendors in China, with a market capitalization of CN¥98.37 billion.

Operations: The company generates revenue primarily through its IDC services, amounting to CN¥8.08 billion.

Range Intelligent Computing Technology Group has demonstrated a robust growth pattern, with its revenue climbing by 17.7% annually, outpacing the broader CN market's 12.9% increase. This surge is underpinned by an impressive annual earnings growth of 30.7%, significantly higher than the market average of 24.6%. The company's commitment to innovation is evident from its R&D investments, which are crucial for maintaining its competitive edge in the rapidly evolving tech landscape. Despite challenges such as a highly volatile share price and profit margins that have dipped from last year’s 44% to 26.7%, Range’s strategic focus on high-quality earnings and significant market share gains positions it well for future advancements within the tech sector.

Summing It All Up

- Gain an insight into the universe of 784 Global High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:7203

Elm

Provides information security services for government entities, individuals, and private sector companies in Saudi Arabia.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion