- China

- /

- Communications

- /

- SZSE:300394

3 Chinese Stocks That May Be Undervalued By Up To 49.6%

Reviewed by Simply Wall St

China's recent announcement of robust stimulus measures has invigorated its stock market, with the Shanghai Composite Index and the CSI 300 seeing significant gains. This economic boost comes as a welcome sign for investors looking to capitalize on undervalued opportunities in the Chinese market. In this context, identifying stocks that are trading below their intrinsic value can offer substantial potential for growth. Here are three Chinese stocks that may be undervalued by up to 49.6%.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| JinGuan Electric (SHSE:688517) | CN¥14.82 | CN¥29.00 | 48.9% |

| Arctech Solar Holding (SHSE:688408) | CN¥83.96 | CN¥158.73 | 47.1% |

| Sinomine Resource Group (SZSE:002738) | CN¥36.54 | CN¥70.76 | 48.4% |

| Neusoft (SHSE:600718) | CN¥10.25 | CN¥19.45 | 47.3% |

| Zhejiang Huahai Pharmaceutical (SHSE:600521) | CN¥19.59 | CN¥37.02 | 47.1% |

| Zhejiang Great Shengda PackagingLtd (SHSE:603687) | CN¥7.11 | CN¥14.16 | 49.8% |

| Crystal Growth & Energy EquipmentLtd (SHSE:688478) | CN¥29.28 | CN¥56.39 | 48.1% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥29.46 | CN¥55.70 | 47.1% |

| Jiangsu Hualan New Pharmaceutical MaterialLtd (SZSE:301093) | CN¥24.74 | CN¥47.01 | 47.4% |

| Thunder Software TechnologyLtd (SZSE:300496) | CN¥52.55 | CN¥104.19 | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

Suzhou TFC Optical Communication (SZSE:300394)

Overview: Suzhou TFC Optical Communication Co., Ltd. (SZSE:300394) operates in the optical communication industry and has a market cap of approximately CN¥55.67 billion.

Operations: Suzhou TFC Optical Communication Co., Ltd. generates revenue primarily from its Optical Communication Device segment, amounting to CN¥2.82 billion.

Estimated Discount To Fair Value: 41.9%

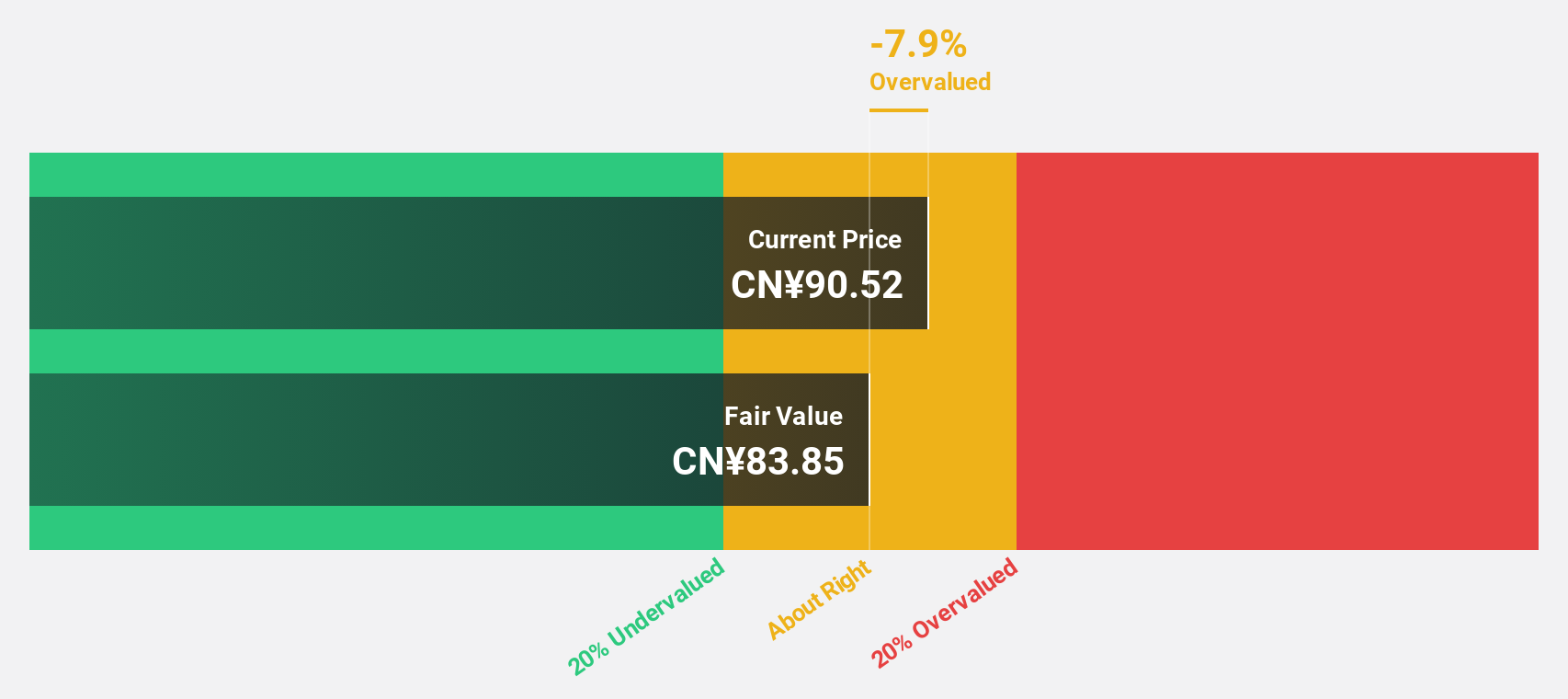

Suzhou TFC Optical Communication reported significant growth in revenue (CNY 1.56 billion) and net income (CNY 654.2 million) for the first half of 2024, reflecting a strong year-over-year performance. The stock is trading at CNY 100.5, which is substantially below its estimated fair value of CNY 172.85, suggesting it may be undervalued based on cash flows despite its volatile share price and unstable dividend history. Earnings are forecast to grow significantly over the next three years at an annual rate of 31.8%.

- Upon reviewing our latest growth report, Suzhou TFC Optical Communication's projected financial performance appears quite optimistic.

- Dive into the specifics of Suzhou TFC Optical Communication here with our thorough financial health report.

Range Intelligent Computing Technology Group (SZSE:300442)

Overview: Range Intelligent Computing Technology Group Company Limited (SZSE:300442) develops data centers and other technology campuses, with a market cap of CN¥55.14 billion.

Operations: The company's revenue segments include IDC Services, which generated CN¥6.24 billion.

Estimated Discount To Fair Value: 45.6%

Range Intelligent Computing Technology Group reported strong earnings for the first half of 2024, with revenue reaching CNY 3.58 billion and net income at CNY 966.53 million, both significantly higher than the previous year. Despite high volatility in its share price and dividends not well covered by free cash flows, the stock is trading at a substantial discount to its estimated fair value of CNY 58.93 per share (current price: CNY 32.05).

- The analysis detailed in our Range Intelligent Computing Technology Group growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Range Intelligent Computing Technology Group stock in this financial health report.

Thunder Software TechnologyLtd (SZSE:300496)

Overview: Thunder Software Technology Co., Ltd. provides operating-system products globally, including in China, Europe, the United States, and Japan, with a market cap of CN¥24.13 billion.

Operations: Thunder Software Technology Co., Ltd. generates revenue through its operating-system products across multiple regions, including China, Europe, the United States, Japan, and other international markets.

Estimated Discount To Fair Value: 49.6%

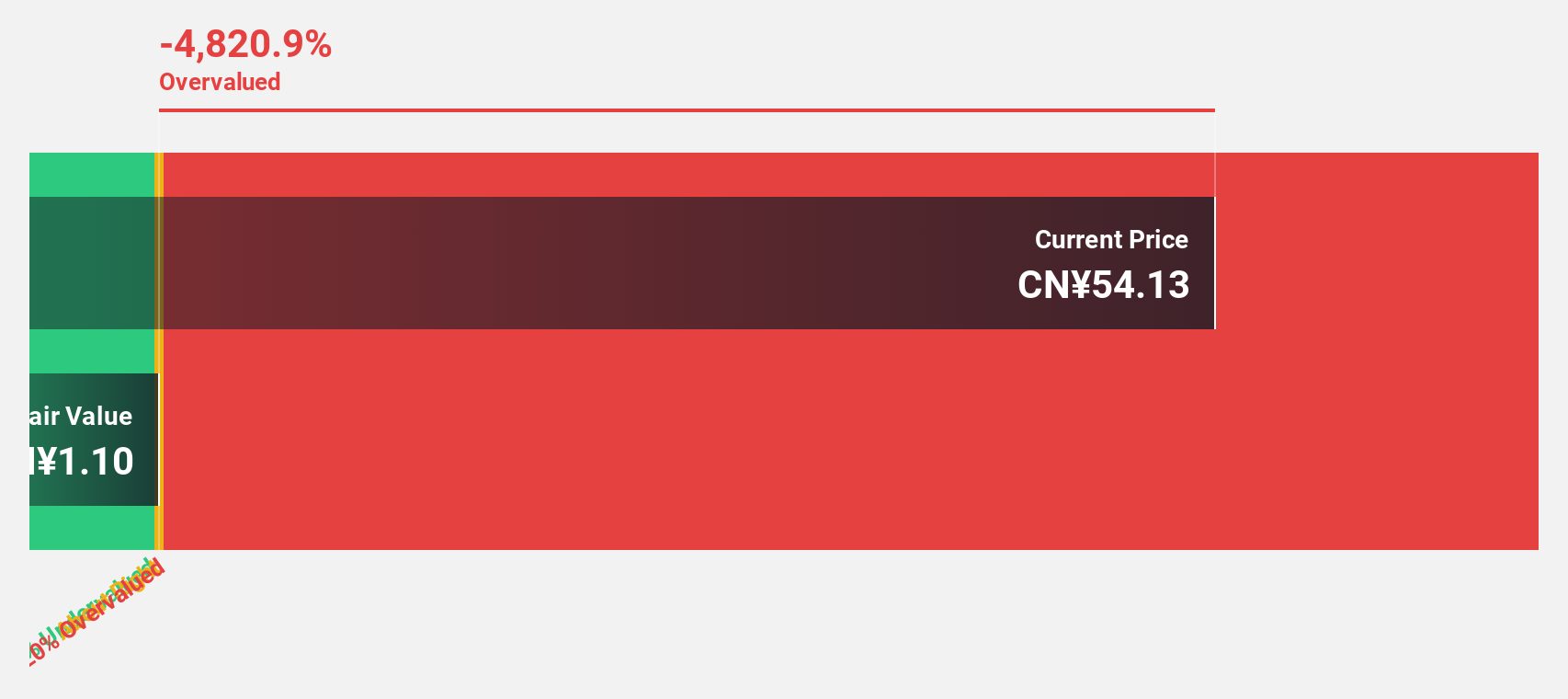

Thunder Software Technology Ltd. is trading at CN¥52.55, significantly below its estimated fair value of CN¥104.19, suggesting it may be undervalued based on cash flows. Despite a recent decline in net income from CN¥387.96 million to CN¥104.37 million and lower profit margins, the company's earnings are expected to grow significantly over the next three years, outpacing market averages. Additionally, Thunder Software has announced consistent interim dividends for 2024, reflecting stable shareholder returns amidst volatility.

- Our growth report here indicates Thunder Software TechnologyLtd may be poised for an improving outlook.

- Navigate through the intricacies of Thunder Software TechnologyLtd with our comprehensive financial health report here.

Taking Advantage

- Explore the 114 names from our Undervalued Chinese Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300394

Suzhou TFC Optical Communication

Suzhou TFC Optical Communication Co., Ltd.

Exceptional growth potential, undervalued and pays a dividend.