Beijing Sinnet Technology Co.,Ltd's (SZSE:300383) Business And Shares Still Trailing The Industry

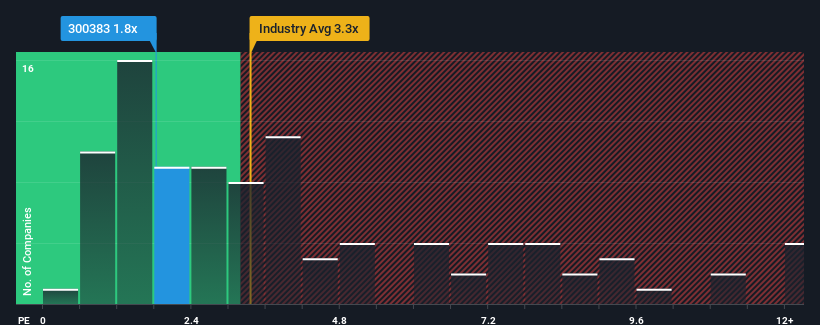

With a price-to-sales (or "P/S") ratio of 1.8x Beijing Sinnet Technology Co.,Ltd (SZSE:300383) may be sending bullish signals at the moment, given that almost half of all the IT companies in China have P/S ratios greater than 3.3x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Beijing Sinnet TechnologyLtd

How Beijing Sinnet TechnologyLtd Has Been Performing

With revenue growth that's inferior to most other companies of late, Beijing Sinnet TechnologyLtd has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Beijing Sinnet TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Beijing Sinnet TechnologyLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.9%. The latest three year period has also seen a 7.2% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 9.1% per annum during the coming three years according to the eleven analysts following the company. With the industry predicted to deliver 14% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Beijing Sinnet TechnologyLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Beijing Sinnet TechnologyLtd's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Beijing Sinnet TechnologyLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Beijing Sinnet TechnologyLtd has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Beijing Sinnet TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Sinnet TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300383

Beijing Sinnet TechnologyLtd

Provides internet data center (IDC), cloud computing, and internet access services in China and Hong Kong.

Excellent balance sheet and fair value.

Market Insights

Community Narratives