Is Beijing Tongtech (SZSE:300379) Using Debt In A Risky Way?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Beijing Tongtech Co., Ltd. (SZSE:300379) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Beijing Tongtech

What Is Beijing Tongtech's Debt?

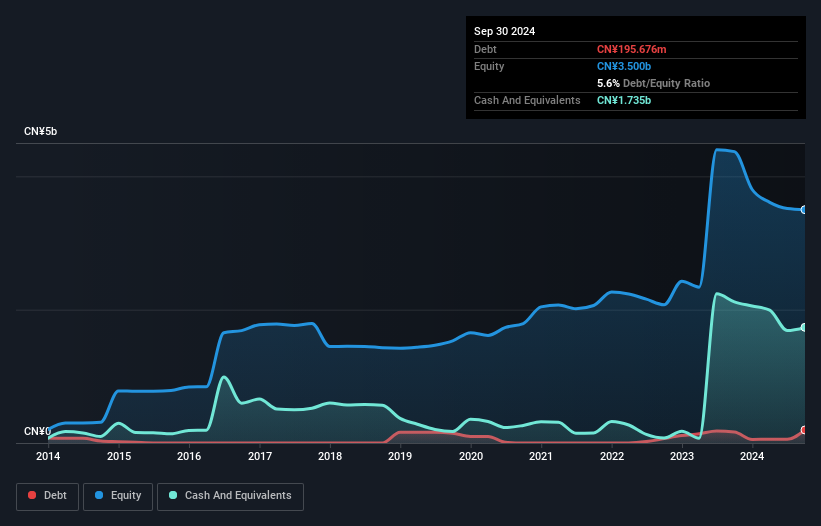

As you can see below, at the end of September 2024, Beijing Tongtech had CN¥195.7m of debt, up from CN¥165.3m a year ago. Click the image for more detail. But on the other hand it also has CN¥1.74b in cash, leading to a CN¥1.54b net cash position.

A Look At Beijing Tongtech's Liabilities

We can see from the most recent balance sheet that Beijing Tongtech had liabilities of CN¥444.7m falling due within a year, and liabilities of CN¥49.5m due beyond that. Offsetting these obligations, it had cash of CN¥1.74b as well as receivables valued at CN¥591.8m due within 12 months. So it can boast CN¥1.83b more liquid assets than total liabilities.

It's good to see that Beijing Tongtech has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Succinctly put, Beijing Tongtech boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is Beijing Tongtech's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Beijing Tongtech made a loss at the EBIT level, and saw its revenue drop to CN¥576m, which is a fall of 35%. To be frank that doesn't bode well.

So How Risky Is Beijing Tongtech?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Beijing Tongtech had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through CN¥218m of cash and made a loss of CN¥653m. But the saving grace is the CN¥1.54b on the balance sheet. That means it could keep spending at its current rate for more than two years. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Beijing Tongtech you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Tongtech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300379

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.