Even With A 50% Surge, Cautious Investors Are Not Rewarding Beijing Forever Technology Co., Ltd.'s (SZSE:300365) Performance Completely

Beijing Forever Technology Co., Ltd. (SZSE:300365) shareholders have had their patience rewarded with a 50% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.3% over the last year.

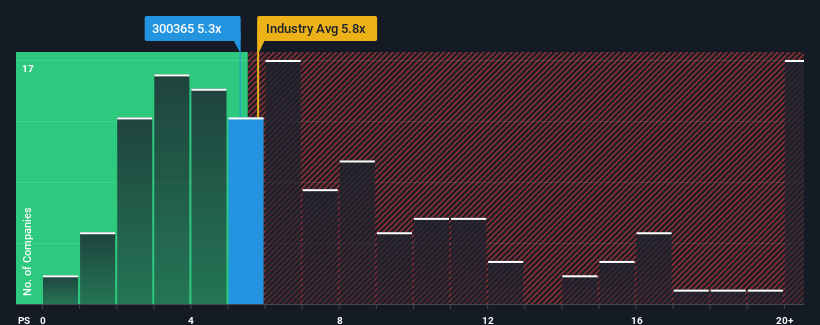

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Beijing Forever Technology's P/S ratio of 5.3x, since the median price-to-sales (or "P/S") ratio for the Software industry in China is also close to 5.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Beijing Forever Technology

What Does Beijing Forever Technology's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Beijing Forever Technology has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Forever Technology.Do Revenue Forecasts Match The P/S Ratio?

Beijing Forever Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 21% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 31% during the coming year according to the only analyst following the company. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Beijing Forever Technology is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Its shares have lifted substantially and now Beijing Forever Technology's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Beijing Forever Technology's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You always need to take note of risks, for example - Beijing Forever Technology has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Beijing Forever Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Forever Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300365

Beijing Forever Technology

Provides software development and technical services in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026