Beijing Forever Technology (SZSE:300365) earnings and shareholder returns have been trending downwards for the last five years, but the stock swells 27% this past week

This week we saw the Beijing Forever Technology Co., Ltd. (SZSE:300365) share price climb by 27%. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 59% in that time. So we're hesitant to put much weight behind the short term increase. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

The recent uptick of 27% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Beijing Forever Technology

We don't think that Beijing Forever Technology's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over half a decade Beijing Forever Technology reduced its trailing twelve month revenue by 11% for each year. That puts it in an unattractive cohort, to put it mildly. Arguably, the market has responded appropriately to this business performance by sending the share price down 10% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. This looks like a really risky stock to buy, at a glance.

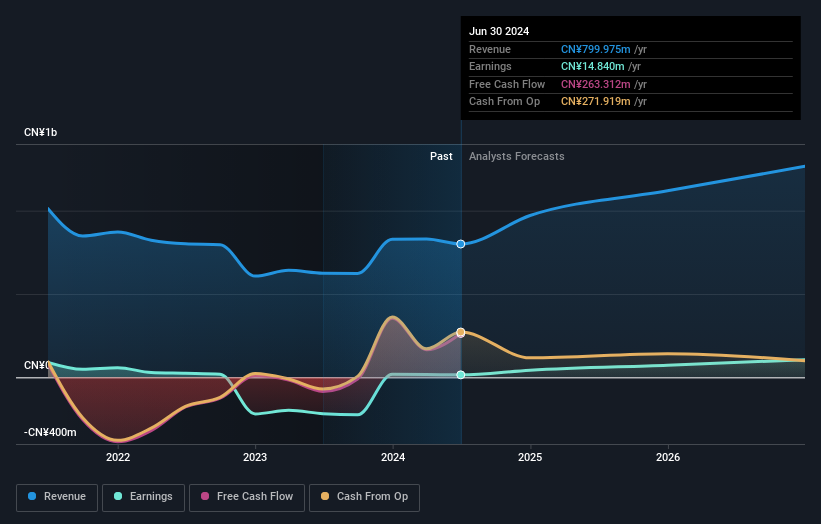

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Beijing Forever Technology has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Beijing Forever Technology

A Different Perspective

We regret to report that Beijing Forever Technology shareholders are down 12% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 6.0%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Beijing Forever Technology is showing 2 warning signs in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Forever Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300365

Beijing Forever Technology

Provides smart grid solutions and services in the People’s Republic of China and internationally.

Excellent balance sheet and good value.