Shenzhen Sunline Tech Co., Ltd. (SZSE:300348) Stocks Pounded By 27% But Not Lagging Industry On Growth Or Pricing

Shenzhen Sunline Tech Co., Ltd. (SZSE:300348) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 28%, which is great even in a bull market.

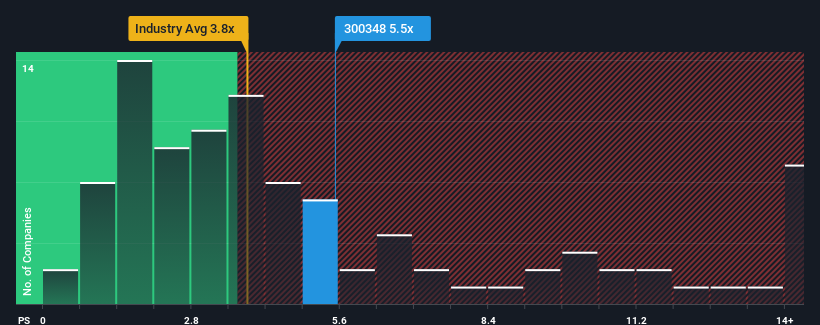

Although its price has dipped substantially, given close to half the companies operating in China's IT industry have price-to-sales ratios (or "P/S") below 3.8x, you may still consider Shenzhen Sunline Tech as a stock to potentially avoid with its 5.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Shenzhen Sunline Tech

How Shenzhen Sunline Tech Has Been Performing

Shenzhen Sunline Tech hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenzhen Sunline Tech.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Shenzhen Sunline Tech would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.7% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 27% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 17%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Shenzhen Sunline Tech's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Shenzhen Sunline Tech's P/S

There's still some elevation in Shenzhen Sunline Tech's P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shenzhen Sunline Tech maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the IT industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shenzhen Sunline Tech (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300348

Shenzhen Sunline Tech

Provides IT solutions and services for commercial banks and financial institutions in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026