Is Eastone Century TechnologyLtd (SZSE:300310) Using Debt Sensibly?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Eastone Century Technology Co.,Ltd. (SZSE:300310) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Eastone Century TechnologyLtd

What Is Eastone Century TechnologyLtd's Net Debt?

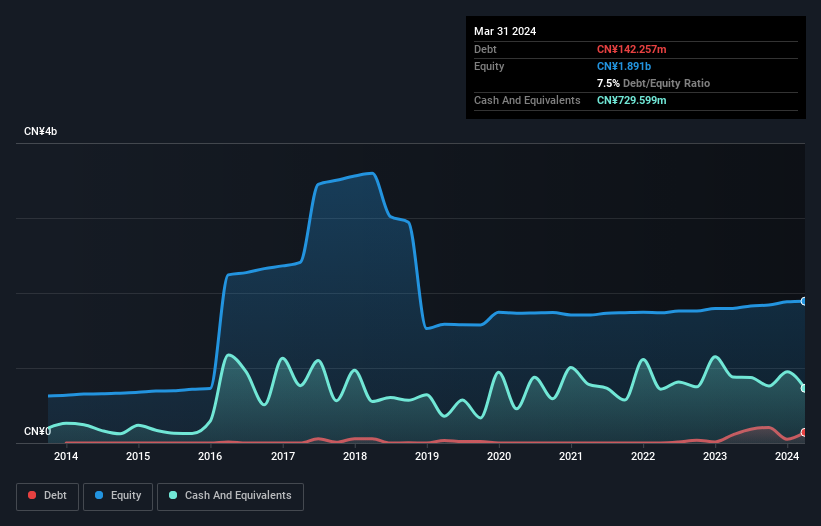

As you can see below, at the end of March 2024, Eastone Century TechnologyLtd had CN¥142.3m of debt, up from CN¥108.8m a year ago. Click the image for more detail. However, its balance sheet shows it holds CN¥729.6m in cash, so it actually has CN¥587.3m net cash.

How Healthy Is Eastone Century TechnologyLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Eastone Century TechnologyLtd had liabilities of CN¥1.06b due within 12 months and liabilities of CN¥27.0m due beyond that. Offsetting this, it had CN¥729.6m in cash and CN¥982.1m in receivables that were due within 12 months. So it actually has CN¥628.1m more liquid assets than total liabilities.

This surplus suggests that Eastone Century TechnologyLtd is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders. Simply put, the fact that Eastone Century TechnologyLtd has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is Eastone Century TechnologyLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Eastone Century TechnologyLtd reported revenue of CN¥2.7b, which is a gain of 8.0%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Eastone Century TechnologyLtd?

Although Eastone Century TechnologyLtd had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of CN¥51m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Eastone Century TechnologyLtd you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Eastone Century TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300310

Eastone Century TechnologyLtd

Provides communication network technology services and system solutions to telecom operators and equipment manufacturers in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026