Eastone Century Technology Co.,Ltd. (SZSE:300310) Stock Catapults 34% Though Its Price And Business Still Lag The Industry

Those holding Eastone Century Technology Co.,Ltd. (SZSE:300310) shares would be relieved that the share price has rebounded 34% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.8% in the last twelve months.

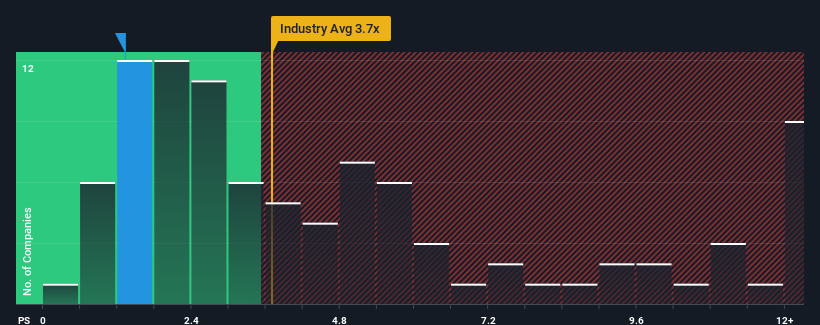

Even after such a large jump in price, Eastone Century TechnologyLtd's price-to-sales (or "P/S") ratio of 1.3x might still make it look like a strong buy right now compared to the wider IT industry in China, where around half of the companies have P/S ratios above 3.7x and even P/S above 7x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Eastone Century TechnologyLtd

How Has Eastone Century TechnologyLtd Performed Recently?

Revenue has risen at a steady rate over the last year for Eastone Century TechnologyLtd, which is generally not a bad outcome. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Eastone Century TechnologyLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Eastone Century TechnologyLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

Eastone Century TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.0%. The latest three year period has also seen a 14% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 40% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Eastone Century TechnologyLtd is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Even after such a strong price move, Eastone Century TechnologyLtd's P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Eastone Century TechnologyLtd confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Eastone Century TechnologyLtd that you should be aware of.

If you're unsure about the strength of Eastone Century TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Eastone Century TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300310

Eastone Century TechnologyLtd

Provides communication network technology services and system solutions to telecom operators and equipment manufacturers in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives