Beijing Thunisoft Co., Ltd.'s (SZSE:300271) 33% Dip In Price Shows Sentiment Is Matching Revenues

Beijing Thunisoft Co., Ltd. (SZSE:300271) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

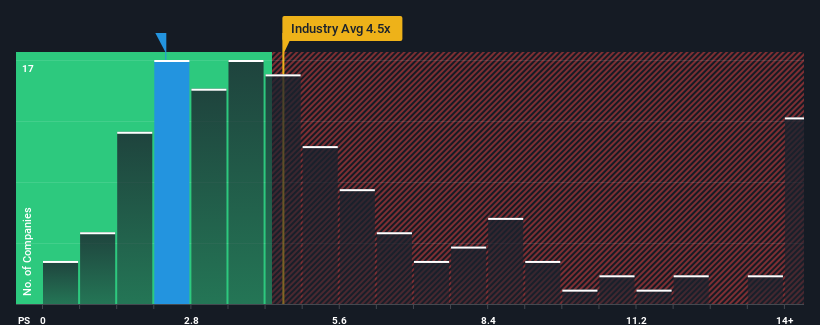

Since its price has dipped substantially, Beijing Thunisoft's price-to-sales (or "P/S") ratio of 2.3x might make it look like a buy right now compared to the Software industry in China, where around half of the companies have P/S ratios above 4.5x and even P/S above 8x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beijing Thunisoft

What Does Beijing Thunisoft's Recent Performance Look Like?

Beijing Thunisoft hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Thunisoft.How Is Beijing Thunisoft's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Beijing Thunisoft's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 51%. The last three years don't look nice either as the company has shrunk revenue by 34% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 21% over the next year. With the industry predicted to deliver 30% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Beijing Thunisoft's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Beijing Thunisoft's P/S

Beijing Thunisoft's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Beijing Thunisoft maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Beijing Thunisoft that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Thunisoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300271

Beijing Thunisoft

Provides software and information technology services to the government and enterprise customers in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives