Beijing Thunisoft Co., Ltd.'s (SZSE:300271) 26% Dip In Price Shows Sentiment Is Matching Revenues

The Beijing Thunisoft Co., Ltd. (SZSE:300271) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 12% share price drop.

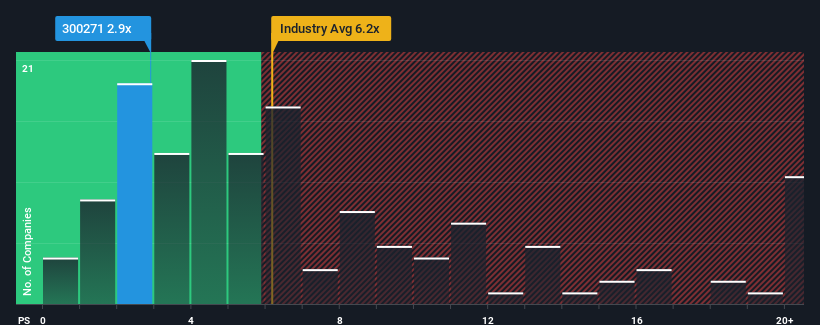

Since its price has dipped substantially, Beijing Thunisoft may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.9x, considering almost half of all companies in the Software industry in China have P/S ratios greater than 6.2x and even P/S higher than 11x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Beijing Thunisoft

What Does Beijing Thunisoft's P/S Mean For Shareholders?

Beijing Thunisoft hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Thunisoft will help you uncover what's on the horizon.How Is Beijing Thunisoft's Revenue Growth Trending?

In order to justify its P/S ratio, Beijing Thunisoft would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.9%. The last three years don't look nice either as the company has shrunk revenue by 65% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 18% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 30%, which is noticeably more attractive.

With this information, we can see why Beijing Thunisoft is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Beijing Thunisoft's P/S Mean For Investors?

Having almost fallen off a cliff, Beijing Thunisoft's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Beijing Thunisoft's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Beijing Thunisoft that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Beijing Thunisoft, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Thunisoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300271

Beijing Thunisoft

Provides software and information technology services to the government and enterprise customers in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives