Discovering Nanjing Kangni Mechanical & ElectricalLtd And 2 Other Hidden Small Cap Treasures

Reviewed by Simply Wall St

As global markets navigate a turbulent start to the year, small-cap stocks have particularly felt the pressure, with the Russell 2000 Index dipping into correction territory amid inflation concerns and political uncertainties. Despite these challenges, discerning investors can still find promising opportunities in lesser-known companies that demonstrate resilience and potential for growth. In this environment, identifying strong stocks requires a keen eye for businesses with robust fundamentals and unique market positions that can withstand economic headwinds. This article explores three such hidden small-cap treasures, including Nanjing Kangni Mechanical & Electrical Ltd., which may offer intriguing prospects for those willing to look beyond the usual suspects.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Innovana Thinklabs | 6.09% | 12.62% | 20.18% | ★★★★★☆ |

| Piccadily Agro Industries | 34.60% | 14.20% | 46.61% | ★★★★★☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Nanjing Kangni Mechanical & ElectricalLtd (SHSE:603111)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanjing Kangni Mechanical & Electrical Co., Ltd specializes in the research, development, manufacture, sale, and maintenance of railway vehicle door systems and has a market capitalization of CN¥5.21 billion.

Operations: Kangni Mechanical & Electrical generates revenue primarily from the sale and maintenance of railway vehicle door systems. The company's financial performance is influenced by its cost structure, which includes expenses related to research, development, and manufacturing. It has a market capitalization of CN¥5.21 billion.

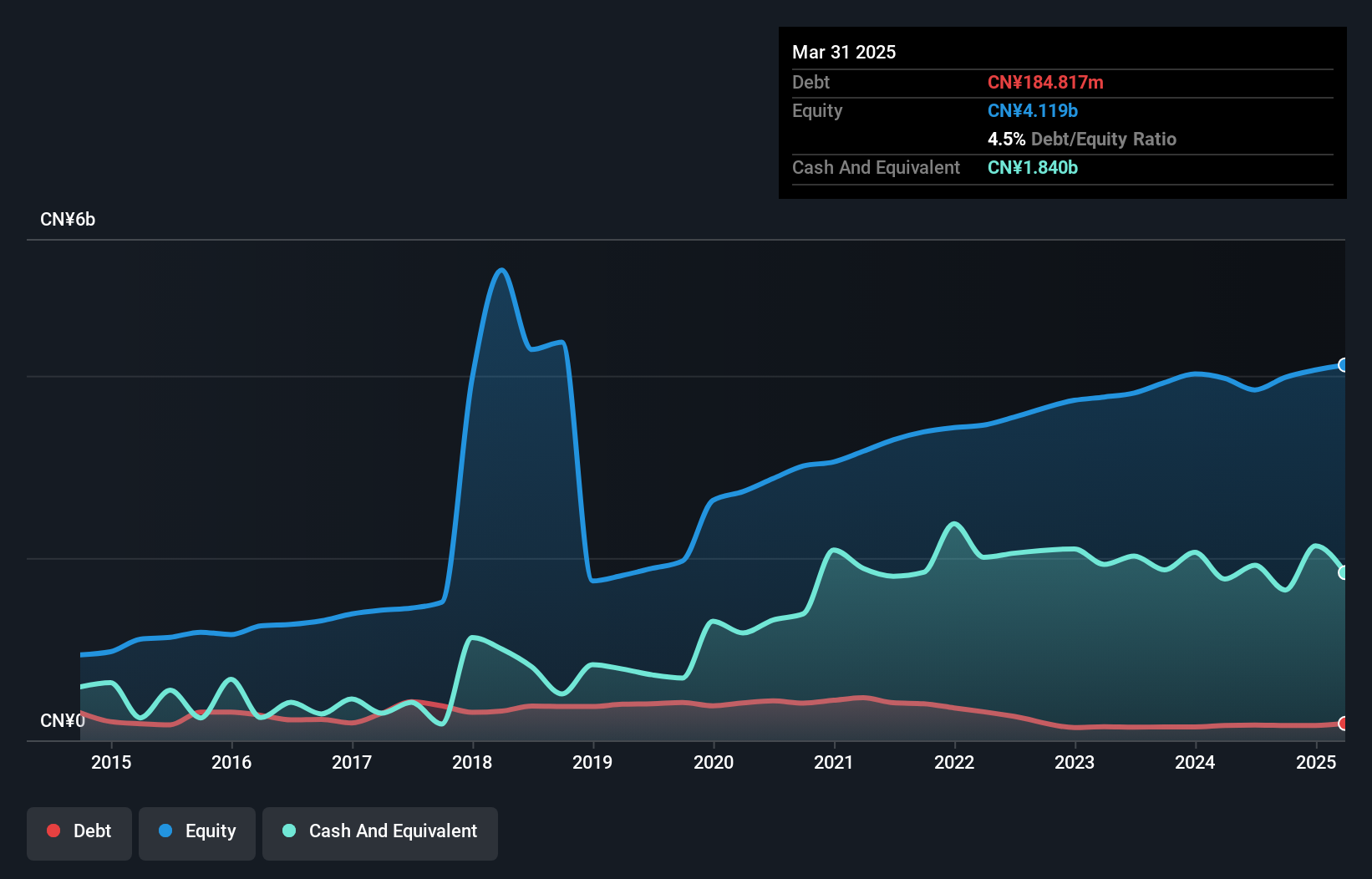

Kangni Mechanical, a smaller player in the machinery sector, showcases notable financial health with its debt-to-equity ratio dropping from 21.1% to 4.1% over five years. This reduction highlights effective debt management, while earnings growth of 41.7% outpaces the industry’s modest 0.2%. With a price-to-earnings ratio of 14.1x undercutting the broader CN market's 31.8x, it seems attractively valued for investors seeking potential upside in undervalued stocks. Recent earnings report shows sales at CNY 2.69 billion and net income at CNY 247 million for nine months ending September, reflecting robust performance compared to last year’s figures.

HAND Enterprise Solutions (SZSE:300170)

Simply Wall St Value Rating: ★★★★★☆

Overview: HAND Enterprise Solutions Co., Ltd. offers ERP implementation consulting services in China and has a market cap of CN¥11.07 billion.

Operations: HAND Enterprise Solutions generates revenue primarily from ERP implementation consulting services. The company's net profit margin has shown variability, reflecting changes in cost structure and operational efficiency.

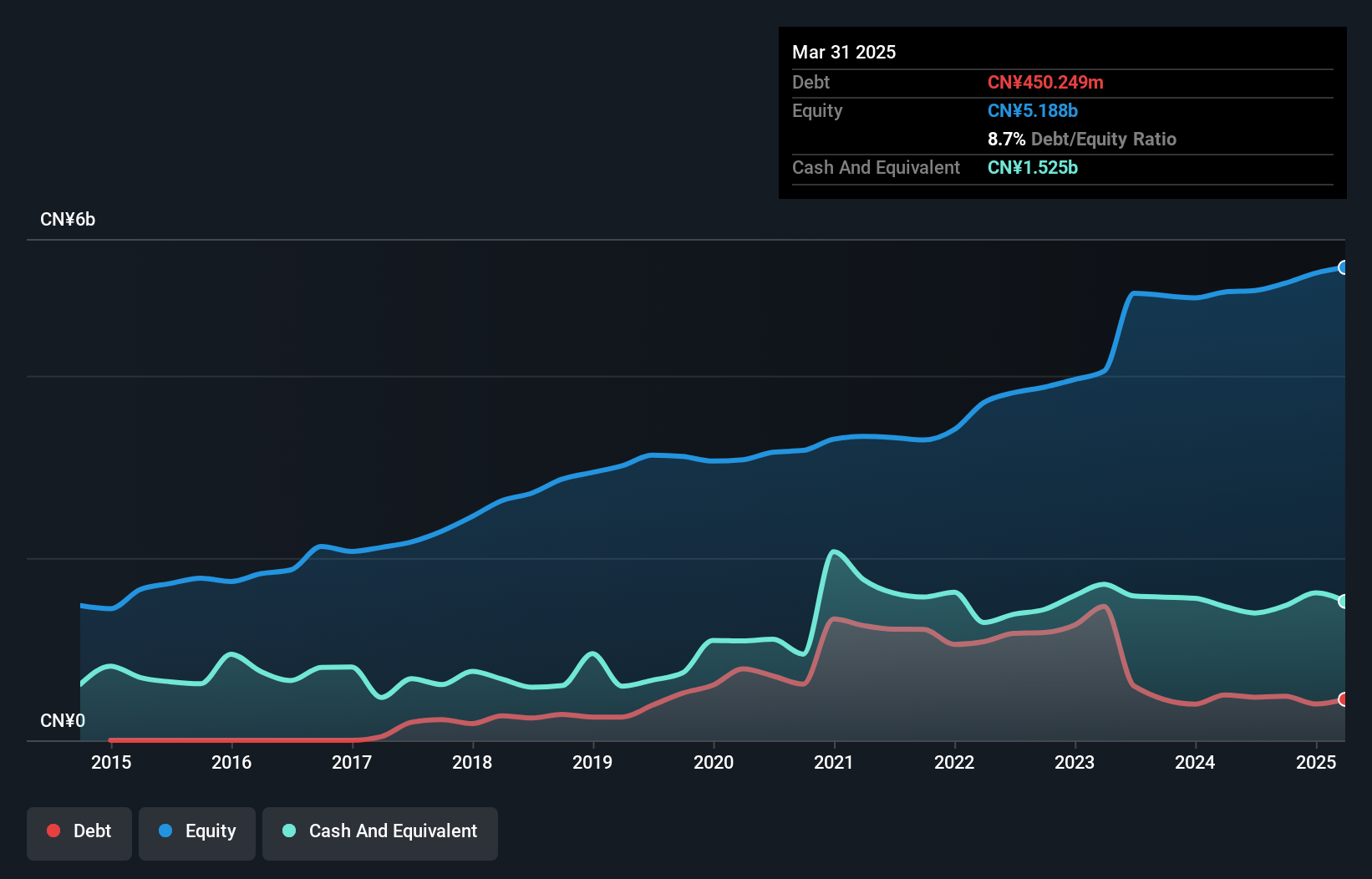

HAND Enterprise Solutions, a nimble player in the IT sector, has shown impressive earnings growth of 96.7% over the past year, outpacing the industry average. The company's revenue for nine months ending September 2024 reached CN¥2.35 billion, up from CN¥2.25 billion a year prior, while net income soared to CN¥135.79 million from CN¥40.17 million previously. Despite its highly volatile share price in recent months and large one-off gains of CN¥59 million impacting results, HAND's debt-to-equity ratio improved significantly from 16.6% to 9.6% over five years and maintains more cash than total debt suggests financial resilience amidst market fluctuations.

Ningbo CixingLtd (SZSE:300307)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ningbo Cixing Co., Ltd. is a company that manufactures and sells knitting machinery both in China and internationally, with a market cap of CN¥5.62 billion.

Operations: Ningbo Cixing Co., Ltd. generates revenue through the manufacturing and sale of knitting machinery, both domestically and internationally. The company has a market capitalization of CN¥5.62 billion.

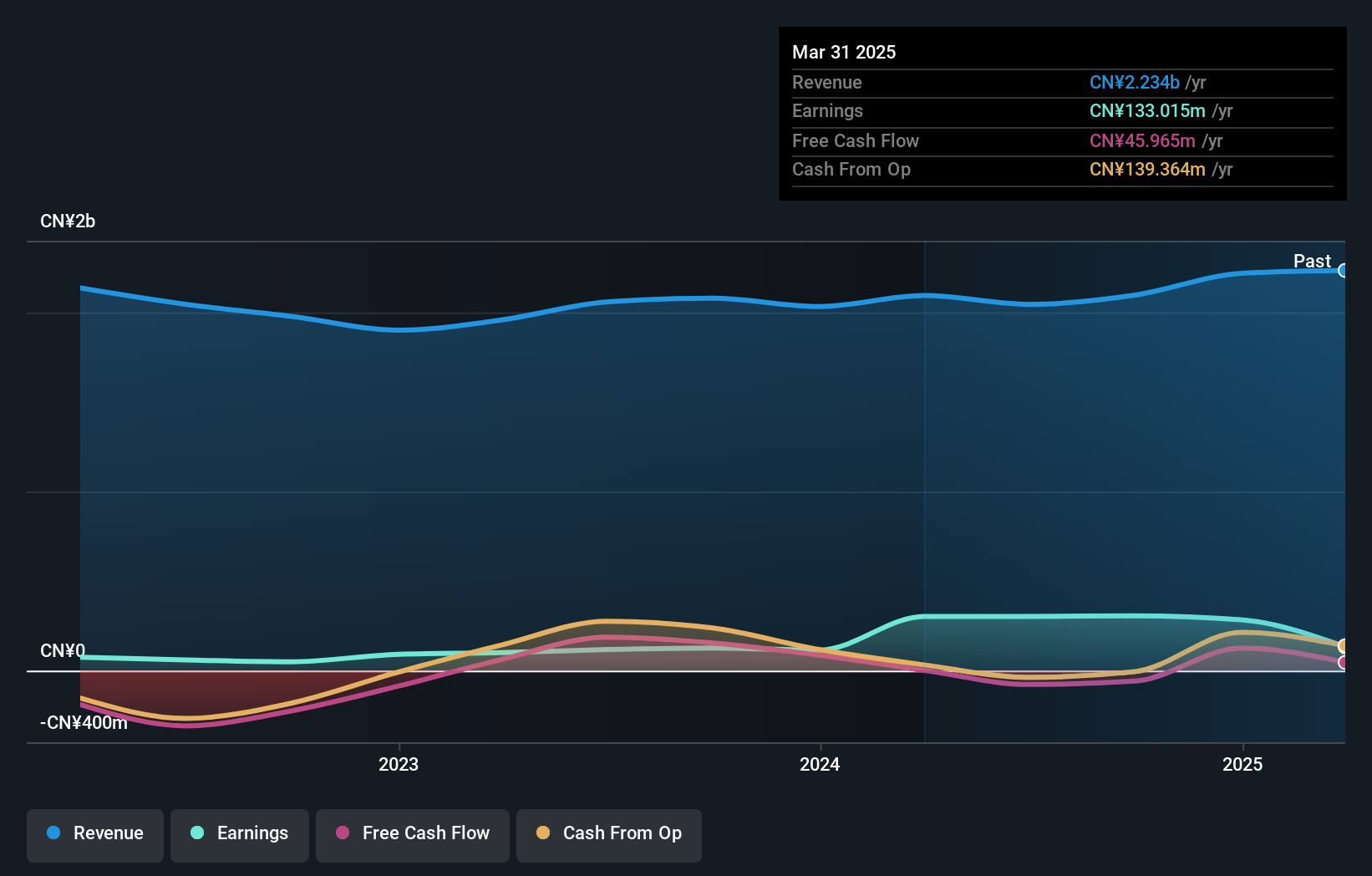

Cixing has shown impressive growth, with earnings surging 142% over the past year, outpacing the broader Machinery industry. Its net income for the nine months ending September 2024 stood at CNY 309.58 million, a significant rise from CNY 117.35 million in the previous year. Despite an increase in its debt-to-equity ratio from 7.6 to 7.8 over five years, it remains financially sound with more cash than total debt and a price-to-earnings ratio of 22x, which is attractive compared to China's market average of 31.8x. However, free cash flow remains negative despite profitability and high-quality earnings.

- Click to explore a detailed breakdown of our findings in Ningbo CixingLtd's health report.

Understand Ningbo CixingLtd's track record by examining our Past report.

Key Takeaways

- Dive into all 4556 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ningbo CixingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300307

Ningbo CixingLtd

Engages in the research, development, production, and sale of knitting machinery in China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion