There's Reason For Concern Over Business-intelligence of Oriental Nations Corporation Ltd.'s (SZSE:300166) Massive 25% Price Jump

Those holding Business-intelligence of Oriental Nations Corporation Ltd. (SZSE:300166) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 13% over that time.

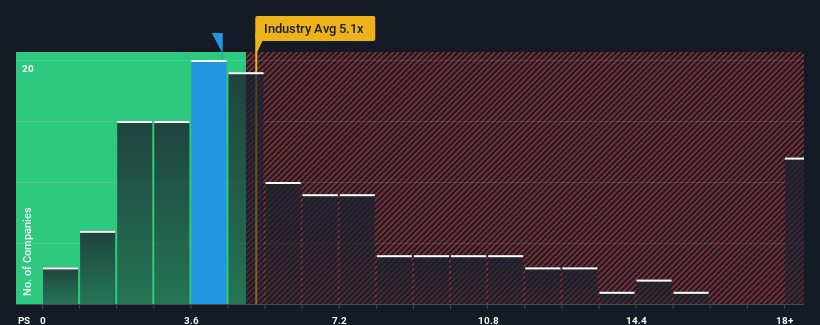

Although its price has surged higher, it's still not a stretch to say that Business-intelligence of Oriental Nations' price-to-sales (or "P/S") ratio of 4.3x right now seems quite "middle-of-the-road" compared to the Software industry in China, where the median P/S ratio is around 5.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Business-intelligence of Oriental Nations

What Does Business-intelligence of Oriental Nations' Recent Performance Look Like?

Business-intelligence of Oriental Nations hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Business-intelligence of Oriental Nations will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Business-intelligence of Oriental Nations' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 3.6% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 5.1% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 18% during the coming year according to the one analyst following the company. That's shaping up to be materially lower than the 34% growth forecast for the broader industry.

With this in mind, we find it intriguing that Business-intelligence of Oriental Nations' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Business-intelligence of Oriental Nations' P/S Mean For Investors?

Its shares have lifted substantially and now Business-intelligence of Oriental Nations' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Business-intelligence of Oriental Nations' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 1 warning sign for Business-intelligence of Oriental Nations that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Business-intelligence of Oriental Nations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300166

Business-intelligence of Oriental Nations

Business-intelligence of Oriental Nations Corporation Ltd.

Moderate growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026