Business-intelligence of Oriental Nations Corporation Ltd. (SZSE:300166) Surges 30% Yet Its Low P/S Is No Reason For Excitement

Business-intelligence of Oriental Nations Corporation Ltd. (SZSE:300166) shareholders have had their patience rewarded with a 30% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 68% in the last year.

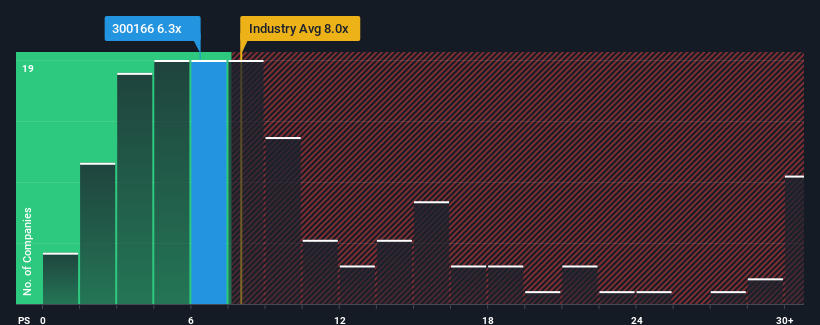

Although its price has surged higher, Business-intelligence of Oriental Nations' price-to-sales (or "P/S") ratio of 6.3x might still make it look like a buy right now compared to the Software industry in China, where around half of the companies have P/S ratios above 8x and even P/S above 15x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Business-intelligence of Oriental Nations

How Business-intelligence of Oriental Nations Has Been Performing

Recent times have been advantageous for Business-intelligence of Oriental Nations as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Business-intelligence of Oriental Nations.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Business-intelligence of Oriental Nations would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 4.3% gain to the company's revenues. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 18% as estimated by the sole analyst watching the company. With the industry predicted to deliver 27% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Business-intelligence of Oriental Nations' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Business-intelligence of Oriental Nations' P/S Mean For Investors?

Business-intelligence of Oriental Nations' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Business-intelligence of Oriental Nations maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Business-intelligence of Oriental Nations is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Business-intelligence of Oriental Nations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300166

Business-intelligence of Oriental Nations

Business-intelligence of Oriental Nations Corporation Ltd.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success