As global markets navigate a complex landscape marked by cooling U.S. labor markets, escalating trade tensions, and contrasting economic indicators across regions, small-cap stocks have recently shown resilience with the Russell 2000 Index gaining momentum. In this dynamic environment, identifying undiscovered gems involves seeking companies that demonstrate strong fundamentals and the potential to capitalize on emerging trends such as artificial intelligence and evolving trade scenarios.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★★ |

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Lion Rock Group | 9.41% | 15.39% | 13.20% | ★★★★★★ |

| Thai Steel Cable | NA | 3.84% | 18.67% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 13.81% | -0.34% | -27.47% | ★★★★★☆ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| Fengyinhe Holdings | 0.60% | 39.37% | 65.41% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Ruida FuturesLtd (SZSE:002961)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ruida Futures Co., Ltd. operates as a futures company in China with a market capitalization of CN¥7.87 billion.

Operations: Ruida Futures Co., Ltd. generates revenue primarily through its futures trading operations. The company's financial performance includes a gross profit margin of 45%, reflecting its efficiency in managing costs relative to revenue generation.

Ruida Futures, a nimble player in the financial sector, showcases high-quality earnings with a notable 49.7% growth over the past year, outpacing its industry peers. Despite this robust performance, net profit margins dipped to 20.4% from last year's 32.7%. The company trades at an attractive price-to-earnings ratio of 21.9x compared to the broader CN market's 38.6x, indicating potential value for investors seeking opportunities in smaller firms. Recent announcements include a CNY 2 dividend per ten shares and solid first-quarter results with revenue climbing to CNY 382 million and net income reaching CNY 81 million compared to the previous year’s figures.

- Click here and access our complete health analysis report to understand the dynamics of Ruida FuturesLtd.

Examine Ruida FuturesLtd's past performance report to understand how it has performed in the past.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Value Rating: ★★★★★★

Overview: Doushen (Beijing) Education & Technology operates in the education and technology sector, with a market capitalization of CN¥14.36 billion.

Operations: The company generates revenue primarily from its education and technology services. It has a market capitalization of CN¥14.36 billion, indicating a significant presence in its sector.

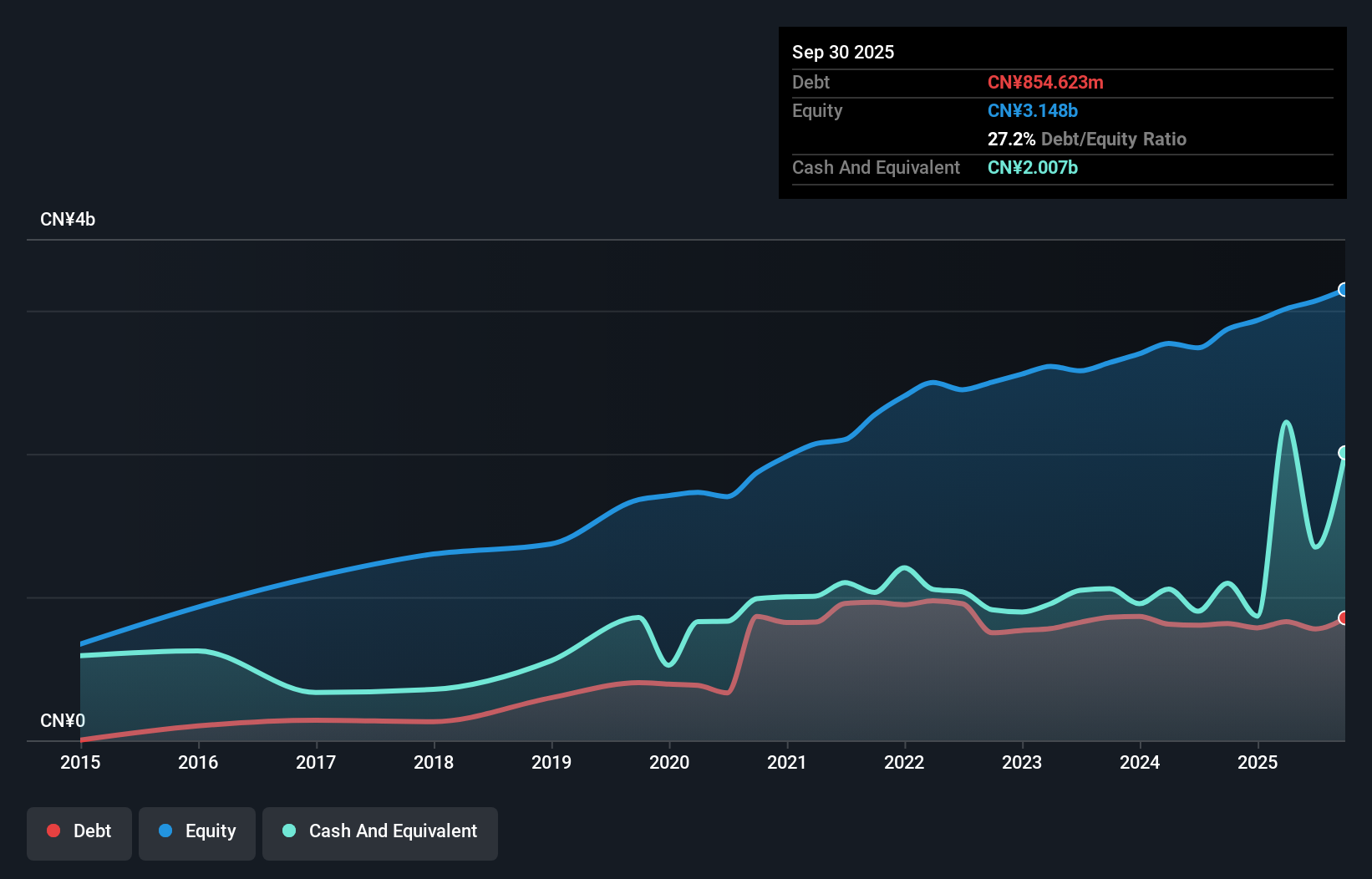

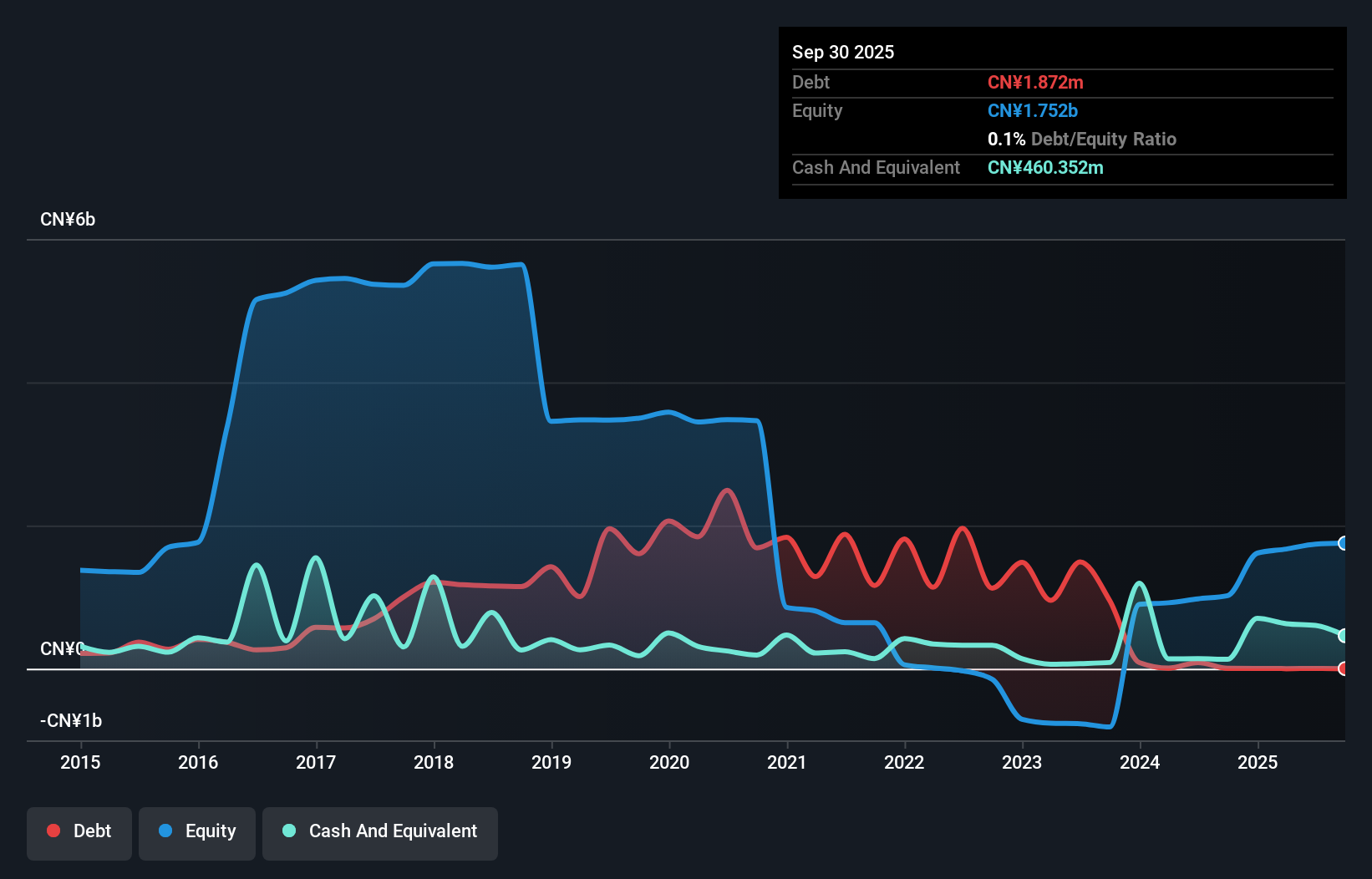

Doushen Education & Technology, a smaller player in the education tech space, has demonstrated impressive financial resilience despite a dip in sales from CNY 992.81 million to CNY 756.83 million last year. Notably, net income surged to CNY 137.13 million from CNY 31.6 million previously, highlighting efficient cost management or operational improvements. Earnings per share rose to CNY 0.0664 from CNY 0.017, reflecting strong profitability growth of over threefold compared to the industry’s negative trend of -2%. The company’s debt-to-equity ratio improved dramatically from 57% to just about zero over five years, showcasing robust financial health and strategic debt reduction efforts.

EZconn (TWSE:6442)

Simply Wall St Value Rating: ★★★★★☆

Overview: EZconn Corporation, along with its subsidiaries, specializes in manufacturing and selling precision metal components and optical fiber components for various electronic products across Taiwan, Asia, the United States, and Europe with a market capitalization of NT$36.52 billion.

Operations: The company's revenue primarily stems from optical fiber components, contributing NT$7.06 billion, and high-frequency connectors at NT$624.31 million.

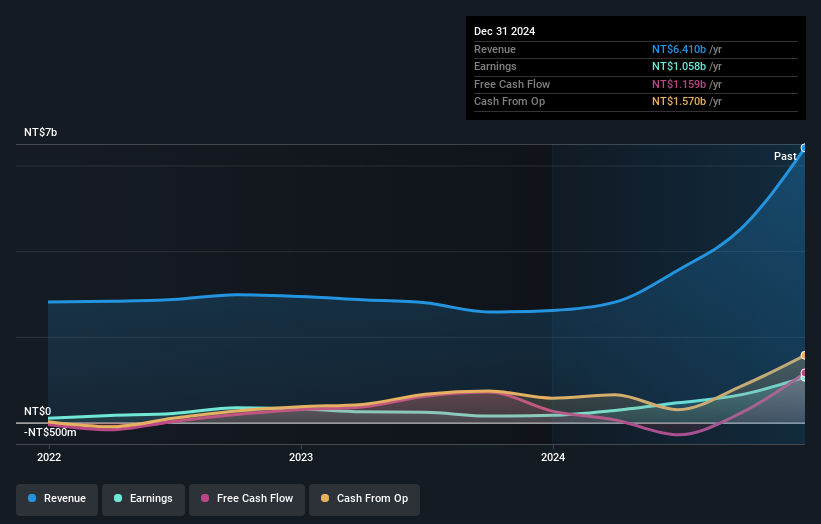

EZconn, a small cap player in the communications sector, has demonstrated impressive earnings growth of 344.7% over the past year, outpacing its industry peers who saw a -1.2% shift. The company is trading at 82% below its estimated fair value, indicating potential undervaluation. Despite an increase in debt to equity ratio from 26.3% to 34.7% over five years, EZconn's cash exceeds total debt and interest payments are well-covered by profits. Recent actions include a share repurchase program targeting up to 2 million shares and an approved dividend of TWD 8.6 per share for shareholders this year.

- Take a closer look at EZconn's potential here in our health report.

Understand EZconn's track record by examining our Past report.

Make It Happen

- Unlock more gems! Our Global Undiscovered Gems With Strong Fundamentals screener has unearthed 3169 more companies for you to explore.Click here to unveil our expertly curated list of 3172 Global Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300010

Doushen (Beijing) Education & Technology

Doushen (Beijing) Education & Technology INC.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives