As global markets continue to reach record highs, driven by positive sentiment from domestic policy developments and geopolitical events, investors are keenly observing the performance of indices like the Dow Jones Industrial Average and S&P 500. Amidst this backdrop, growth companies with high insider ownership, such as ALTEOGEN, stand out as potential leaders due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's dive into some prime choices out of the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company that develops long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩16.10 trillion.

Operations: The company's revenue is primarily derived from its biotechnology segment, amounting to ₩74.38 billion.

Insider Ownership: 25.9%

Alteogen's high insider ownership aligns with its promising growth prospects, as evidenced by a forecasted revenue increase of 78.4% annually, significantly outpacing the Korean market average. The company is expected to achieve profitability within three years, with earnings projected to grow at 130.71% per year. Despite recent shareholder dilution and share price volatility, Alteogen's strategic license agreement with Daiichi Sankyo for ALT-B4 could enhance future revenue streams through milestone and royalty payments.

- Take a closer look at ALTEOGEN's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that ALTEOGEN is trading beyond its estimated value.

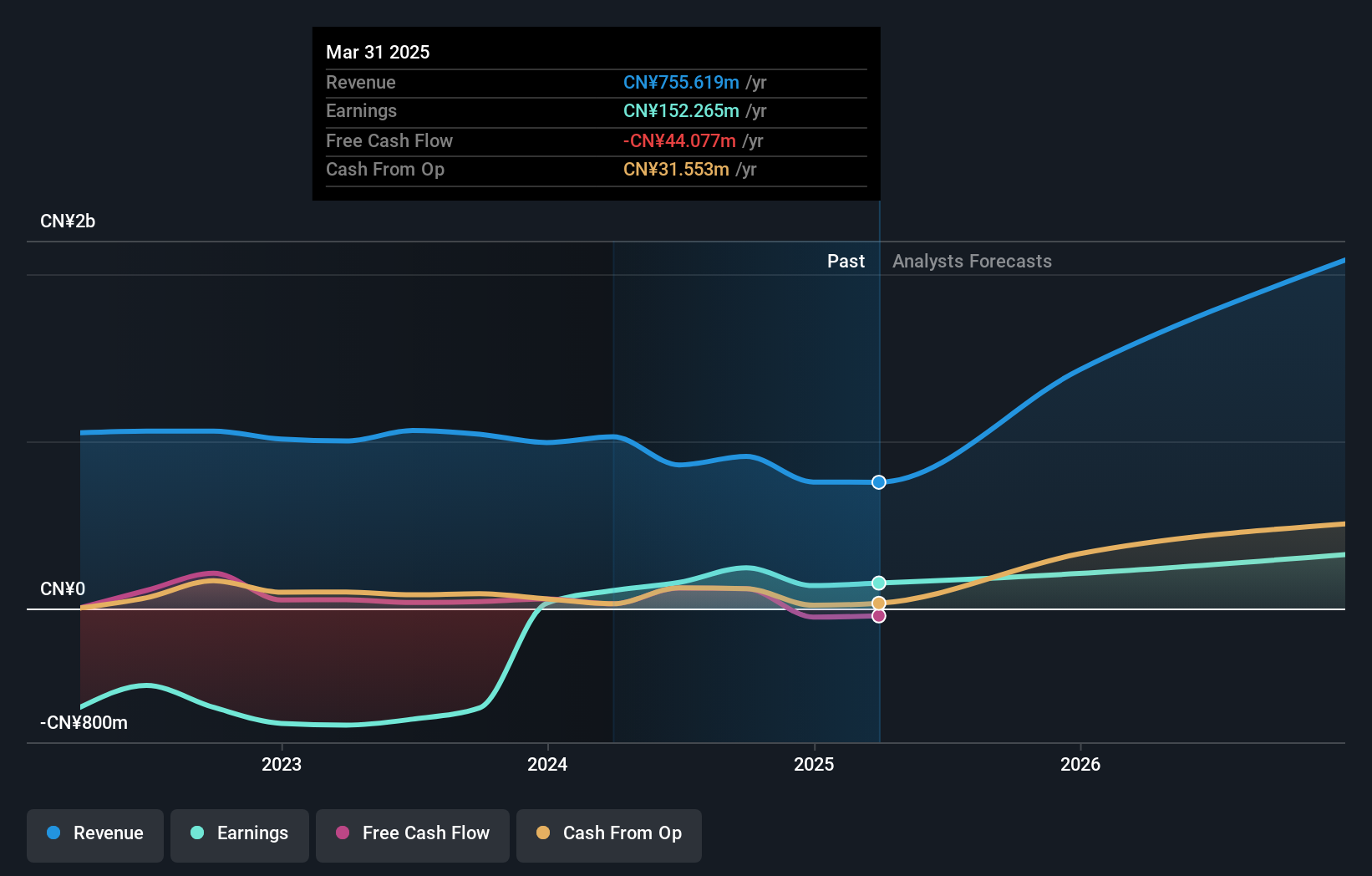

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doushen (Beijing) Education & Technology is a company focused on providing educational and technological solutions, with a market cap of CN¥21.10 billion.

Operations: The company's revenue is primarily generated from its Information Technology Service segment, amounting to CN¥910.10 million.

Insider Ownership: 24.7%

Doushen (Beijing) Education & Technology shows potential for growth with forecasted revenue increases of 38.4% annually, outpacing the Chinese market average. The company recently transitioned to profitability, reporting a net income of CNY 110.87 million for the first nine months of 2024, reversing a prior loss. Despite its high price-to-earnings ratio and past shareholder dilution, Doushen's inclusion in the S&P Global BMI Index may enhance visibility among investors seeking high insider ownership stakes.

- Click here and access our complete growth analysis report to understand the dynamics of Doushen (Beijing) Education & Technology.

- According our valuation report, there's an indication that Doushen (Beijing) Education & Technology's share price might be on the expensive side.

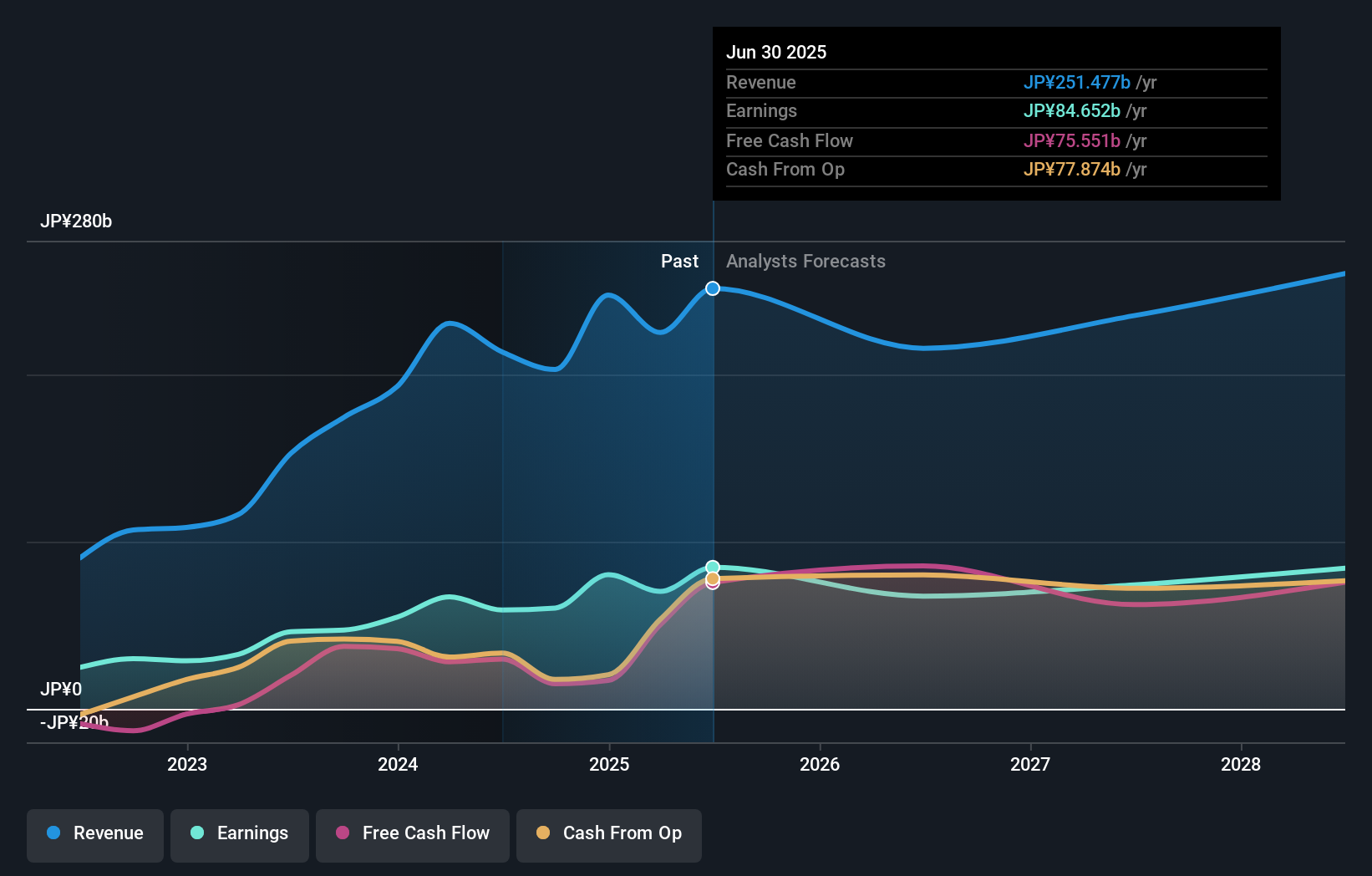

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment both in Japan and internationally, with a market cap of ¥1.47 trillion.

Operations: The company's revenue primarily comes from its inspection and measurement equipment segment, totaling ¥202.94 billion.

Insider Ownership: 11.1%

Lasertec Corporation's earnings are projected to grow at 14.9% annually, outpacing the Japanese market average. Despite recent share price volatility, it trades below its estimated fair value, suggesting potential for investment appeal. The company recently launched SICA108, an advanced SiC wafer inspection system that enhances defect detection and classification capabilities using proprietary technology. This innovation aligns with the growing demand for high-quality SiC wafers in various applications, supporting Lasertec's growth trajectory in a competitive industry landscape.

- Get an in-depth perspective on Lasertec's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Lasertec implies its share price may be too high.

Turning Ideas Into Actions

- Reveal the 1520 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300010

Doushen (Beijing) Education & Technology

Doushen (Beijing) Education & Technology INC.

Reasonable growth potential with adequate balance sheet.