As global markets continue to reach record highs, with major indices like the Dow Jones Industrial Average and S&P 500 Index setting new intraday records, investors are keenly observing the shifting economic landscape. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant area for potential investment. These stocks can offer growth opportunities at lower price points, particularly when they are backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$144.95M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.245 | £845.83M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.13 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$66.23M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

Click here to see the full list of 5,687 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Sun.King Technology Group (SEHK:580)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sun.King Technology Group Limited is an investment holding company that manufactures and trades power electronic components for power transmission, distribution, electrified transportation, and industrial sectors in China, with a market cap of approximately HK$19.30 billion.

Operations: The company generates revenue of CN¥1.25 billion from its operations in the manufacturing and trading of power electronic components.

Market Cap: HK$1.93B

Sun.King Technology Group's financial health appears robust with net profit margins improving from 2.6% to 5.7% and cash reserves exceeding total debt, indicating strong liquidity. The company's short-term assets significantly cover both its short- and long-term liabilities, enhancing financial stability. Despite a negative operating cash flow, earnings have surged by a notable 184.9% over the past year, outpacing industry growth rates. However, return on equity remains low at 3.1%. Recent strategic moves include a share buyback program and board changes with the resignation of Ms. Zhang Ling as non-executive director in October 2024.

- Click here and access our complete financial health analysis report to understand the dynamics of Sun.King Technology Group.

- Understand Sun.King Technology Group's track record by examining our performance history report.

Guosheng Shian Technology (SHSE:603778)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guosheng Shian Technology Co., Ltd. operates in garden engineering construction, garden landscape design, and seedling sales in China, with a market cap of CN¥2.45 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥2.45B

Guosheng Shian Technology faces financial challenges, with a reported net loss of CN¥152.37 million for the first nine months of 2024 despite revenue growth to CN¥1.07 billion from CN¥906.22 million the previous year. The company's short-term assets (CN¥1.1 billion) fall short of covering its short-term liabilities (CN¥2 billion), though long-term liabilities are adequately covered by these assets. While debt levels remain satisfactory with a net debt to equity ratio at 4%, profitability remains elusive as losses have increased over five years at an annual rate of 31.7%. The management team is experienced, but the board lacks tenure stability, averaging only 1.3 years in service.

- Get an in-depth perspective on Guosheng Shian Technology's performance by reading our balance sheet health report here.

- Gain insights into Guosheng Shian Technology's historical outcomes by reviewing our past performance report.

Shanghai Shunho New Materials TechnologyLtd (SZSE:002565)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Shunho New Materials Technology Co., Ltd. operates in the materials technology sector and has a market cap of CN¥3.82 billion.

Operations: Shanghai Shunho New Materials Technology Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥3.82B

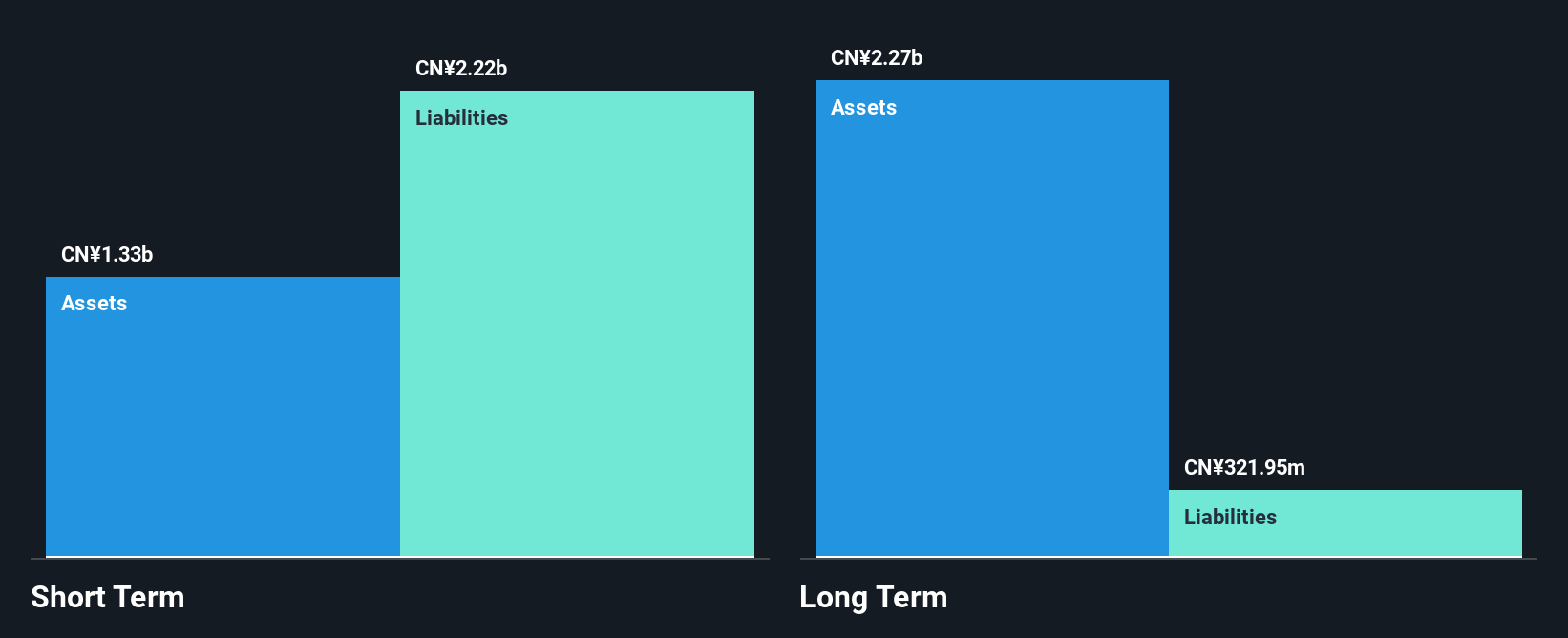

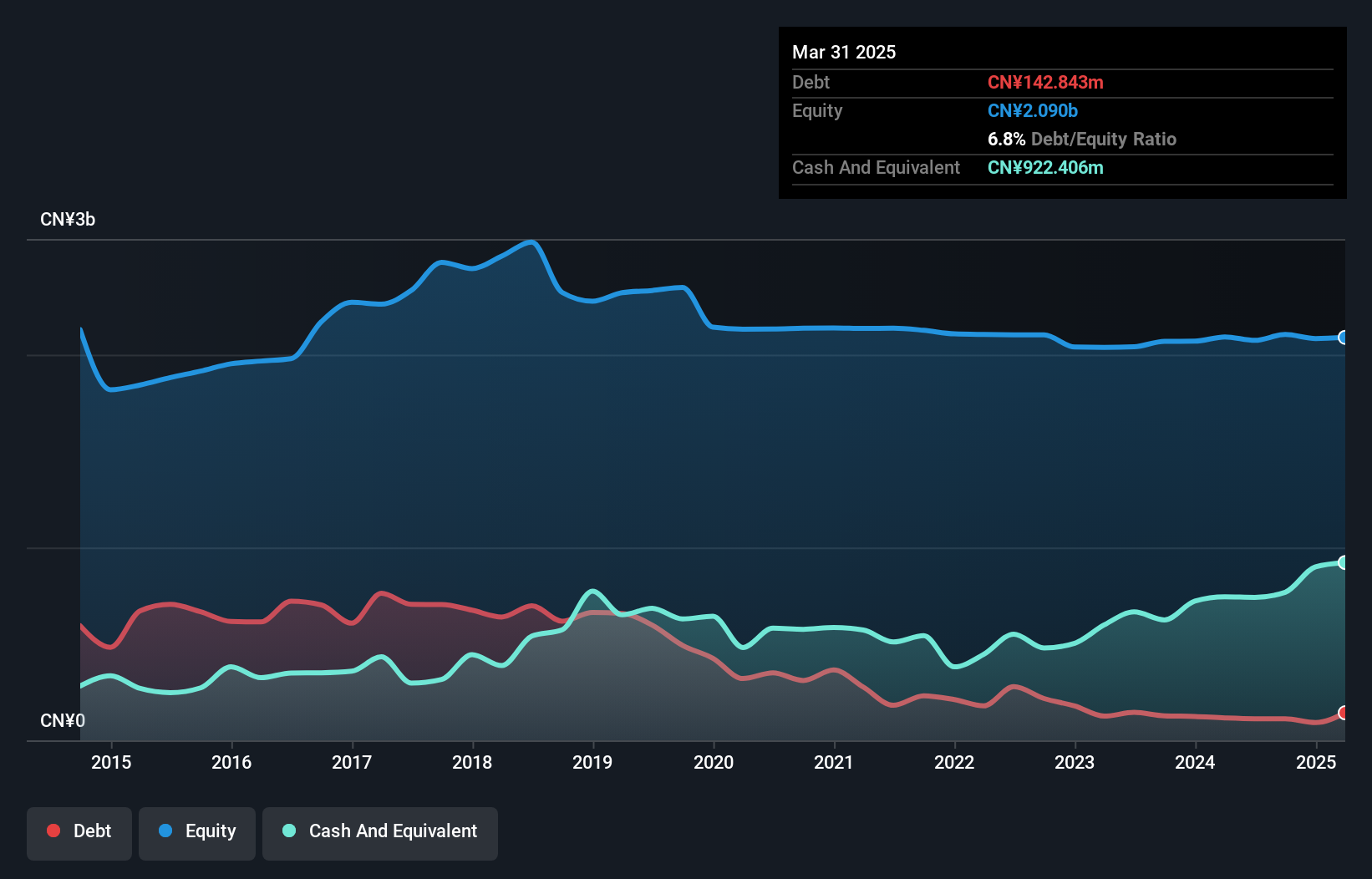

Shanghai Shunho New Materials Technology Co., Ltd. has demonstrated financial improvement, reporting a revenue increase to CN¥1.13 billion for the first nine months of 2024, up from CN¥976.15 million the previous year, and achieving profitability with a net income of CN¥55.96 million compared to last year's CN¥25.69 million loss. The company is trading significantly below its estimated fair value and maintains strong financial health with short-term assets exceeding both long-term liabilities and short-term obligations by substantial margins. Additionally, its debt level is well-managed with more cash than total debt, supported by robust operating cash flow coverage at 221%.

- Click here to discover the nuances of Shanghai Shunho New Materials TechnologyLtd with our detailed analytical financial health report.

- Evaluate Shanghai Shunho New Materials TechnologyLtd's historical performance by accessing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 5,687 Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002565

Shanghai Shunho New Materials TechnologyLtd

Shanghai Shunho New Materials Technology Co.,Ltd.

Flawless balance sheet with acceptable track record.