- China

- /

- Entertainment

- /

- SZSE:300133

3 Global Growth Companies With High Insider Ownership And 52% Revenue Growth

Reviewed by Simply Wall St

As global markets reach new heights, driven by favorable economic data and speculation of potential interest rate cuts, investors are increasingly focusing on growth opportunities that align with these evolving conditions. In this environment, companies with high insider ownership and impressive revenue growth stand out as potentially strong contenders, offering a blend of confidence from within the company and robust financial performance.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Synspective (TSE:290A) | 12.8% | 48.9% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.7% | 96.8% |

| Laopu Gold (SEHK:6181) | 35.5% | 35.3% |

| KebNi (OM:KEBNI B) | 38.3% | 63.7% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 43.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 80.6% |

| CD Projekt (WSE:CDR) | 29.7% | 39.5% |

Let's review some notable picks from our screened stocks.

Suzhou Dongshan Precision Manufacturing (SZSE:002384)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou Dongshan Precision Manufacturing Co., Ltd. operates as a company specializing in the manufacturing of electronic components and precision parts, with a market cap of CN¥93.80 billion.

Operations: Suzhou Dongshan Precision Manufacturing Co., Ltd. generates its revenue from the manufacturing of electronic components and precision parts.

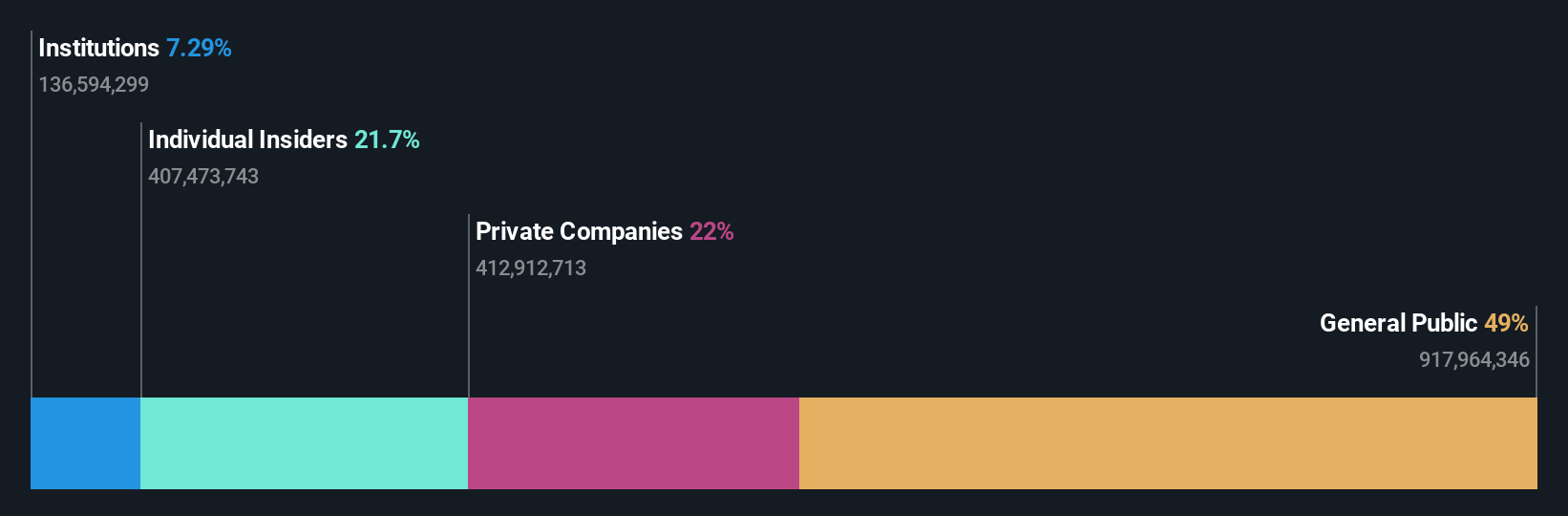

Insider Ownership: 26.6%

Revenue Growth Forecast: 14.8% p.a.

Suzhou Dongshan Precision Manufacturing is poised for significant earnings growth, with forecasts predicting a 37.4% annual increase, outpacing the broader Chinese market. However, its profit margins have declined from 5.1% to 3.3%. Recent developments include proposed changes to registered capital and articles of association at an upcoming shareholder meeting on August 21, 2025. Despite high growth potential, the company's share price has been volatile recently and insider trading activity appears minimal.

- Delve into the full analysis future growth report here for a deeper understanding of Suzhou Dongshan Precision Manufacturing.

- The analysis detailed in our Suzhou Dongshan Precision Manufacturing valuation report hints at an inflated share price compared to its estimated value.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Doushen (Beijing) Education & Technology operates in the education and technology sector, with a market cap of CN¥18.43 billion.

Operations: The company's revenue is primarily derived from its Information Technology Service segment, which generated CN¥755.62 million.

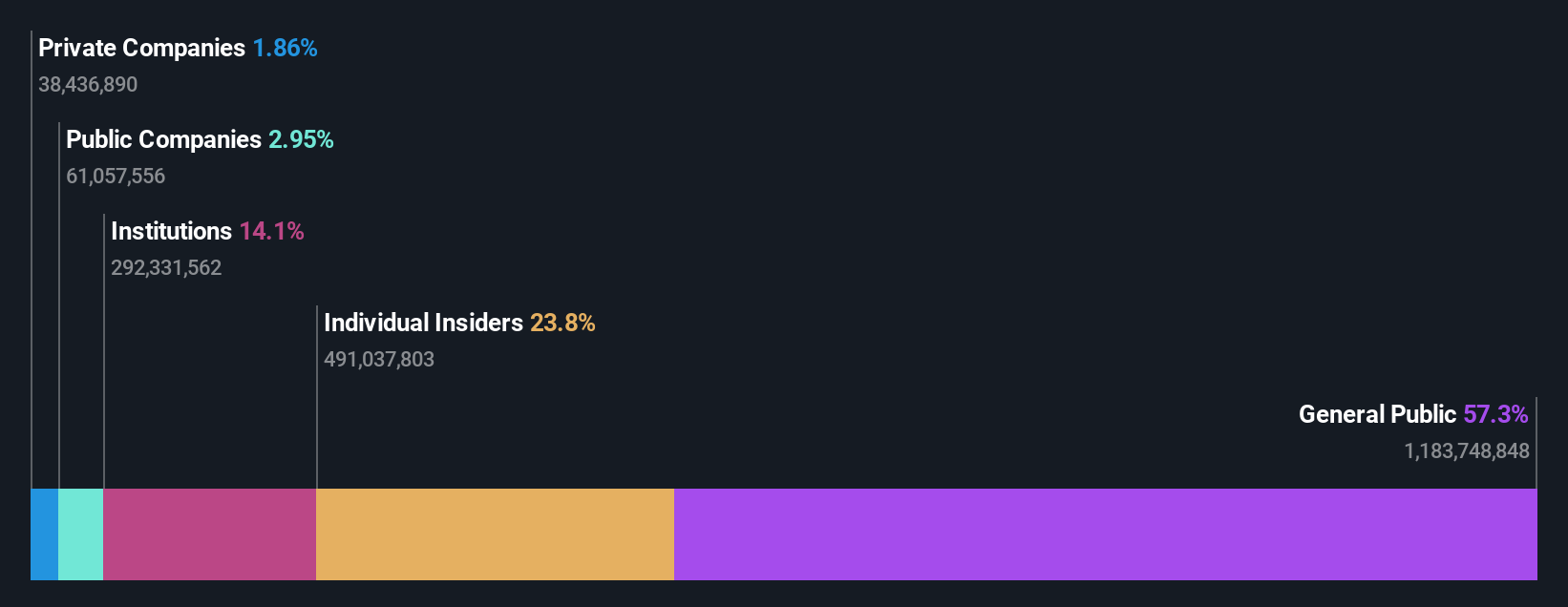

Insider Ownership: 24.1%

Revenue Growth Forecast: 52.9% p.a.

Doushen (Beijing) Education & Technology is set for substantial growth, with earnings forecasted to rise 42.89% annually, surpassing the Chinese market's average. Revenue is expected to grow at a robust 52.9% per year. Despite this potential, insider trading data over the past three months is unavailable. The upcoming Annual General Meeting on June 12 will address key issues including unrecovered losses exceeding one-third of paid-in capital and the election of an independent director.

- Click to explore a detailed breakdown of our findings in Doushen (Beijing) Education & Technology's earnings growth report.

- According our valuation report, there's an indication that Doushen (Beijing) Education & Technology's share price might be on the expensive side.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market cap of CN¥16.21 billion.

Operations: The company generates revenue from the production, distribution, and derivatives of film and television dramas across domestic and international markets.

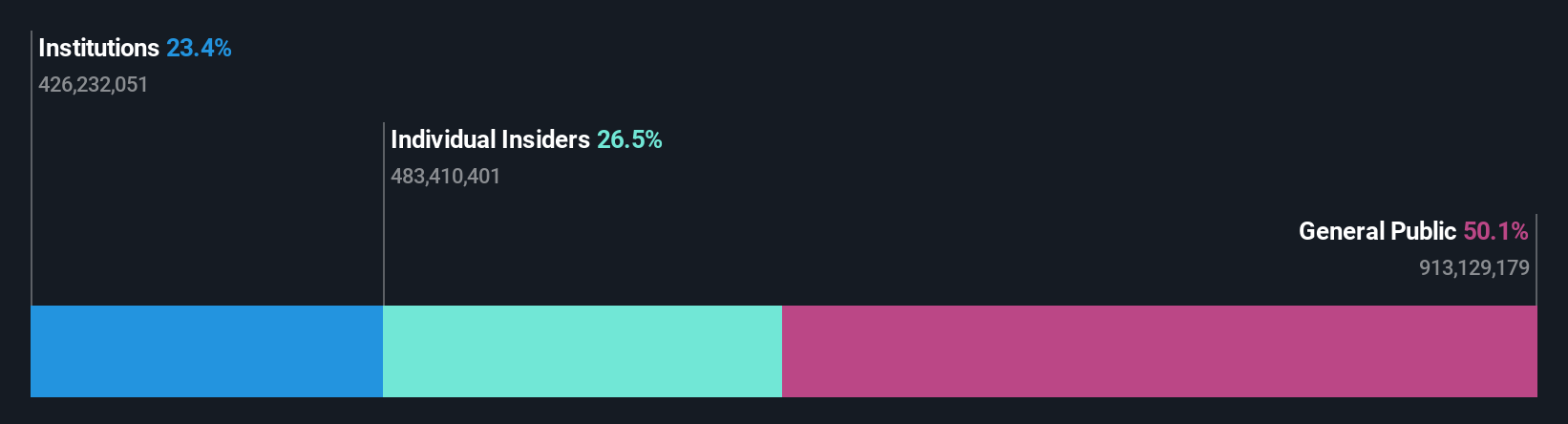

Insider Ownership: 20.7%

Revenue Growth Forecast: 14.1% p.a.

Zhejiang Huace Film & TV demonstrates promising growth potential with its earnings forecasted to increase significantly at 25.7% annually, outpacing the Chinese market average. Recent earnings results show a strong performance, with net income rising to CNY 117.52 million from CNY 71.2 million year-on-year. Despite high share price volatility and low expected return on equity, insider ownership remains stable without substantial buying or selling activity in recent months.

- Take a closer look at Zhejiang Huace Film & TV's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Zhejiang Huace Film & TV is priced higher than what may be justified by its financials.

Seize The Opportunity

- Click here to access our complete index of 817 Fast Growing Global Companies With High Insider Ownership.

- Searching for a Fresh Perspective? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huace Film & TV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300133

Zhejiang Huace Film & TV

Engages in the production, distribution, and derivative of film and television dramas in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives