We Ran A Stock Scan For Earnings Growth And Beijing ZZNode Technologies (SZSE:003007) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Beijing ZZNode Technologies (SZSE:003007). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Beijing ZZNode Technologies Growing Its Earnings Per Share?

Over the last three years, Beijing ZZNode Technologies has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, Beijing ZZNode Technologies' EPS grew from CN¥0.45 to CN¥0.83, over the previous 12 months. It's a rarity to see 86% year-on-year growth like that.

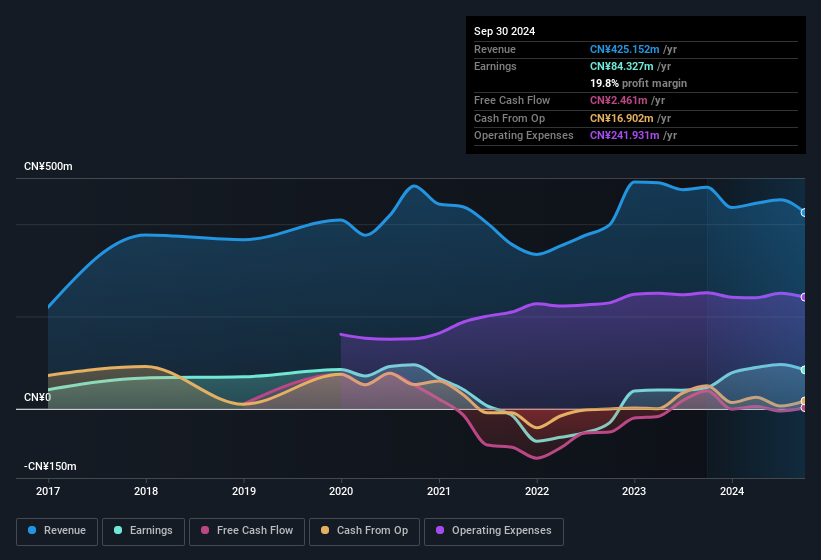

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, Beijing ZZNode Technologies' revenue dropped 11% last year, but the silver lining is that EBIT margins improved from 6.4% to 9.6%. That's not a good look.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

See our latest analysis for Beijing ZZNode Technologies

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Beijing ZZNode Technologies' balance sheet strength, before getting too excited.

Are Beijing ZZNode Technologies Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Beijing ZZNode Technologies will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Indeed, with a collective holding of 65%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. CN¥2.6b That means they have plenty of their own capital riding on the performance of the business!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between CN¥1.4b and CN¥5.8b, like Beijing ZZNode Technologies, the median CEO pay is around CN¥822k.

Beijing ZZNode Technologies' CEO took home a total compensation package worth CN¥558k in the year leading up to December 2023. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Beijing ZZNode Technologies Deserve A Spot On Your Watchlist?

Beijing ZZNode Technologies' earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Beijing ZZNode Technologies certainly ticks a few boxes, so we think it's probably well worth further consideration. We don't want to rain on the parade too much, but we did also find 2 warning signs for Beijing ZZNode Technologies that you need to be mindful of.

Although Beijing ZZNode Technologies certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Beijing ZZNode Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003007

Beijing ZZNode Technologies

Provides operation support system software and solutions for the information networks and IT infrastructure to telecom operators and large enterprise in China.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success