Investors Still Aren't Entirely Convinced By Nanjing Sciyon Wisdom Technology Group Co., Ltd.'s (SZSE:002380) Revenues Despite 25% Price Jump

Nanjing Sciyon Wisdom Technology Group Co., Ltd. (SZSE:002380) shares have continued their recent momentum with a 25% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 12% is also fairly reasonable.

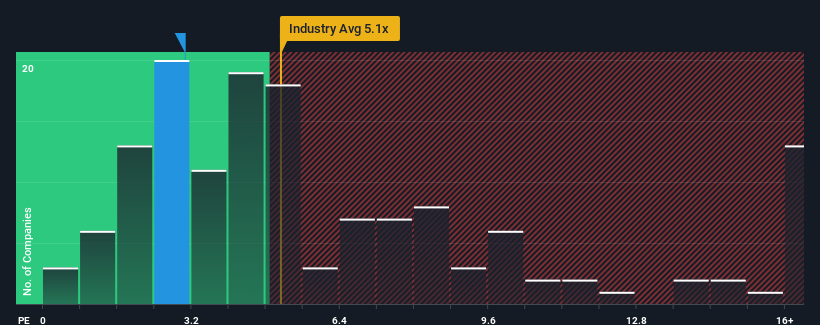

Even after such a large jump in price, Nanjing Sciyon Wisdom Technology Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.1x, since almost half of all companies in the Software industry in China have P/S ratios greater than 5.1x and even P/S higher than 9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Nanjing Sciyon Wisdom Technology Group

How Has Nanjing Sciyon Wisdom Technology Group Performed Recently?

With revenue growth that's superior to most other companies of late, Nanjing Sciyon Wisdom Technology Group has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nanjing Sciyon Wisdom Technology Group.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Nanjing Sciyon Wisdom Technology Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. The strong recent performance means it was also able to grow revenue by 64% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 60% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 35%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Nanjing Sciyon Wisdom Technology Group's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Nanjing Sciyon Wisdom Technology Group's P/S?

The latest share price surge wasn't enough to lift Nanjing Sciyon Wisdom Technology Group's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Nanjing Sciyon Wisdom Technology Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Nanjing Sciyon Wisdom Technology Group, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Sciyon Wisdom Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002380

Nanjing Sciyon Wisdom Technology Group

Nanjing Sciyon Wisdom Technology Group Co., Ltd.

Undervalued with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.