Undiscovered Gems Three Small Caps with Strong Financial Foundations

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and fluctuating economic indicators, small-cap indexes like the S&P MidCap 400 and Russell 2000 experienced notable declines, highlighting the volatility that currently characterizes global markets. Amid such uncertainty, identifying stocks with strong financial foundations becomes crucial for investors seeking stability; this article explores three small-cap companies that stand out as potential undiscovered gems in today's challenging environment.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Donpon Precision | 45.58% | 2.76% | 46.41% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Te Chang Construction | 16.62% | 15.59% | 18.35% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Actions Technology (SHSE:688049)

Simply Wall St Value Rating: ★★★★★☆

Overview: Actions Technology Co., Ltd. is a fabless semiconductor company focused on the research, production, and sale of audio SoC and integrated chips in China with a market cap of CN¥7.37 billion.

Operations: The primary revenue stream for Actions Technology comes from its semiconductor segment, generating CN¥725.36 million.

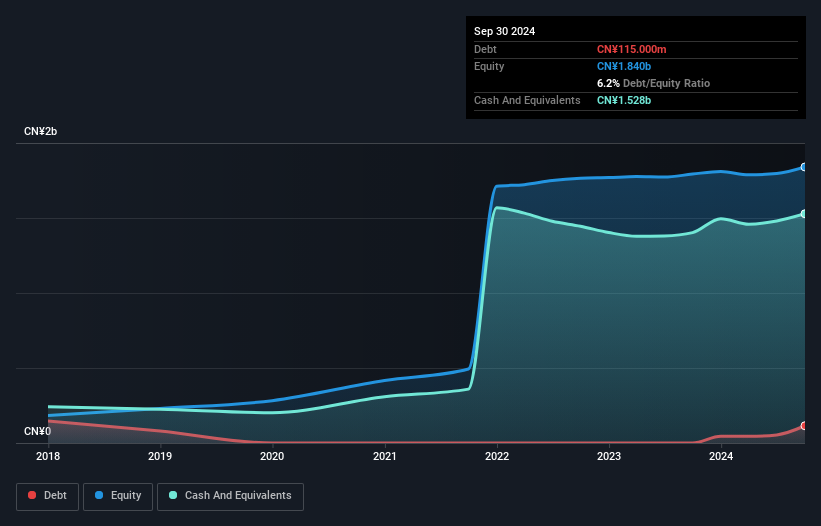

Actions Technology stands out with its robust earnings growth of 112.7% over the past year, significantly surpassing the Semiconductor industry's 8%. The company's debt to equity ratio has risen from 0% to a manageable 3.3% in five years, while it maintains more cash than total debt, indicating sound financial health. Despite a volatile share price recently, Actions Technology's net income soared to CNY 41.45 million for Q1 2025 from CNY 8.53 million last year, with basic earnings per share climbing from CNY 0.06 to CNY 0.29, showcasing its potential as an emerging player in the market.

Shanxi Blue Flame Holding (SZSE:000968)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanxi Blue Flame Holding Company Limited focuses on the exploration, development, and utilization of coal mine gas with a market capitalization of CN¥6.99 billion.

Operations: Shanxi Blue Flame Holding generates revenue primarily from its coal mine gas operations. The company has a market capitalization of CN¥6.99 billion.

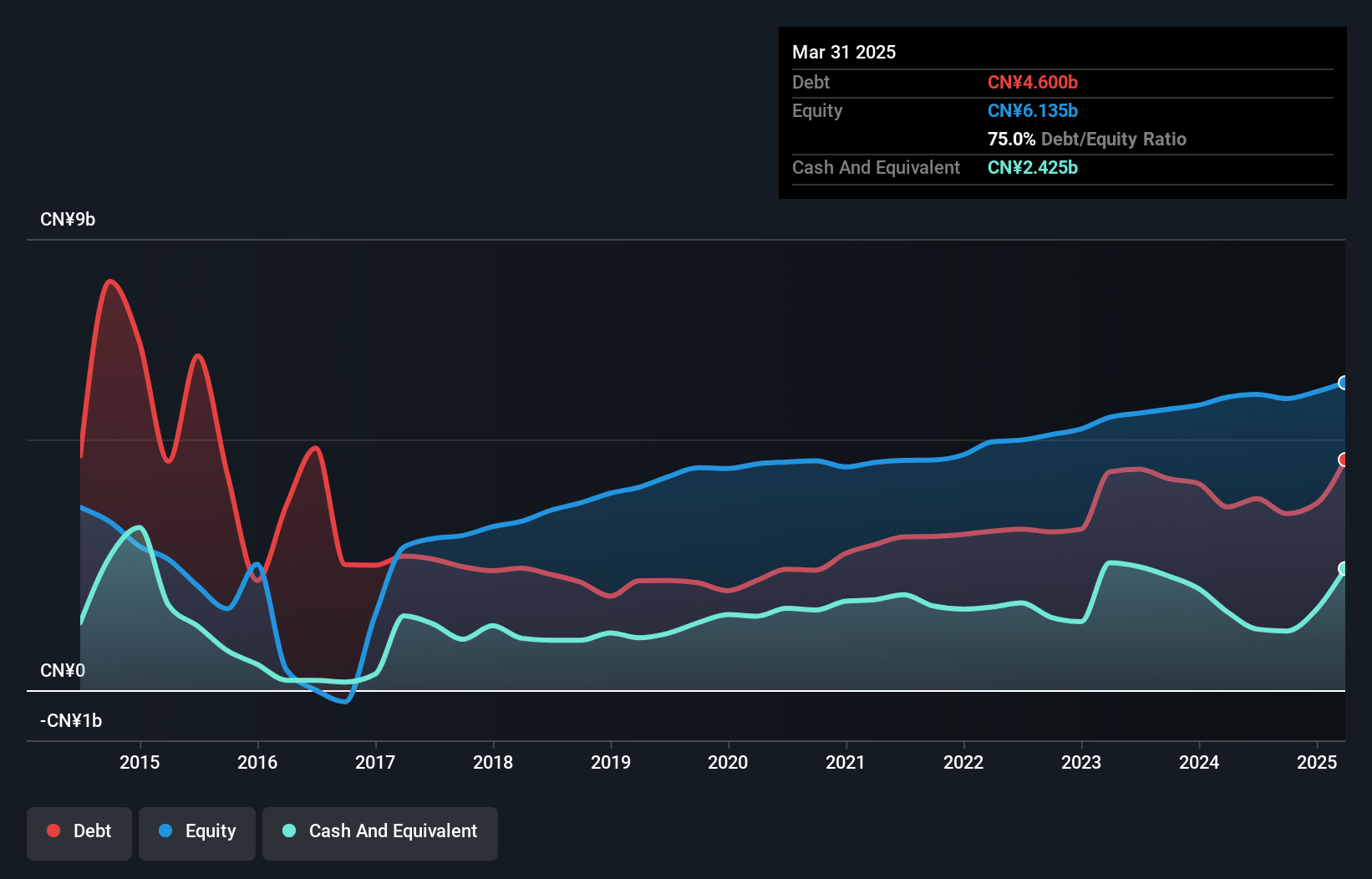

Shanxi Blue Flame Holding, a smaller player in the energy sector, has been navigating its financial landscape with some notable figures. The company's debt to equity ratio has climbed from 48.5% to 75% over five years, indicating increased leverage. Despite this, the interest payments are comfortably covered by EBIT at a multiple of 6.9x. Recent earnings showed improvement with net income reaching CNY 184 million in Q1 2025 compared to CNY 160 million last year, reflecting high-quality earnings and positive cash flow trends. However, dividends have decreased to CNY 0.30 per ten shares for the year ending in December 2024.

- Unlock comprehensive insights into our analysis of Shanxi Blue Flame Holding stock in this health report.

Learn about Shanxi Blue Flame Holding's historical performance.

CETC Cyberspace Security Technology (SZSE:002268)

Simply Wall St Value Rating: ★★★★★★

Overview: CETC Cyberspace Security Technology Co., Ltd. focuses on providing cybersecurity solutions and services, with a market cap of CN¥13.71 billion.

Operations: The company generated CN¥2.49 billion from its information security segment.

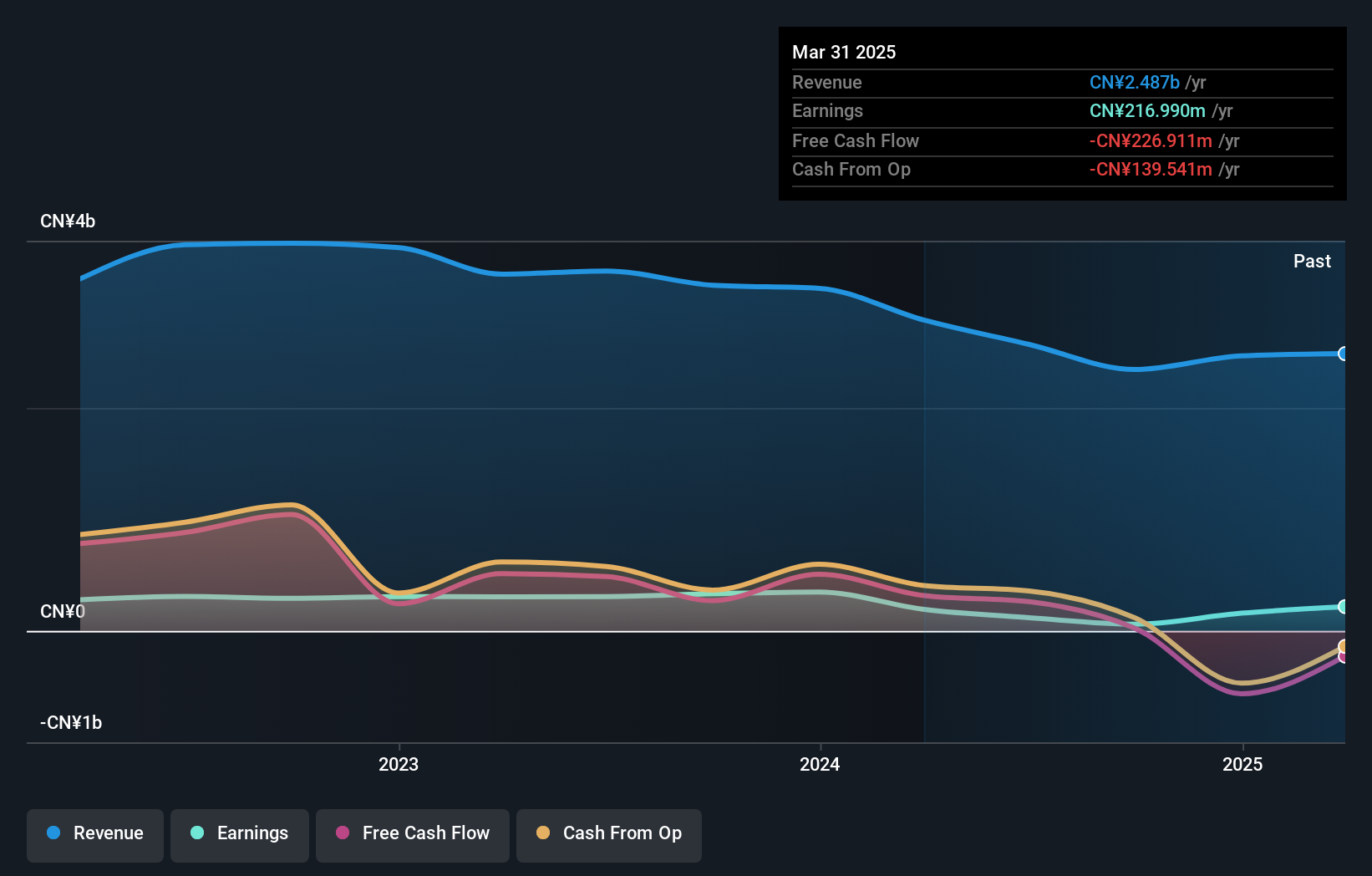

CETC Cyberspace Security Technology, a smaller player in the software industry, has shown promising signs with a 12.9% earnings growth over the past year, outpacing the industry's -2%. The company is debt-free, eliminating concerns about interest coverage. Despite not being free cash flow positive recently, CETC's price-to-earnings ratio of 69.5x remains below the industry average of 83.6x, suggesting potential undervaluation. Recent changes include amendments to their articles and approval of a dividend plan offering CNY 0.60 per ten shares for 2024 profits. Net loss narrowed to CNY 134.68 million in Q1 from CNY 193.52 million last year.

- Dive into the specifics of CETC Cyberspace Security Technology here with our thorough health report.

Next Steps

- Navigate through the entire inventory of 3181 Global Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002268

CETC Cyberspace Security Technology

CETC Cyberspace Security Technology Co., Ltd.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion