Topsec Technologies Group Inc. (SZSE:002212) Soars 32% But It's A Story Of Risk Vs Reward

Topsec Technologies Group Inc. (SZSE:002212) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

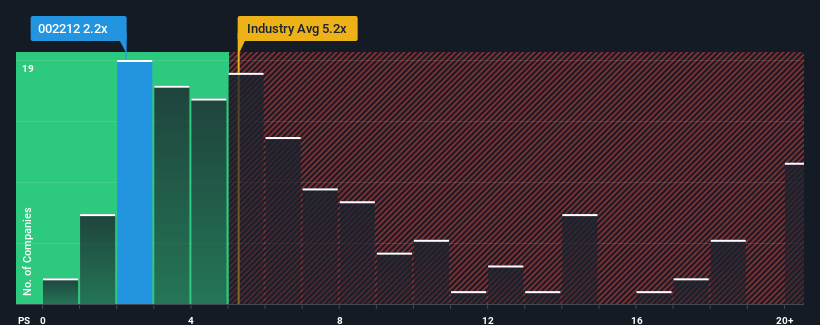

Even after such a large jump in price, Topsec Technologies Group may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.2x, since almost half of all companies in the Software industry in China have P/S ratios greater than 5.2x and even P/S higher than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Topsec Technologies Group

What Does Topsec Technologies Group's Recent Performance Look Like?

Topsec Technologies Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Topsec Technologies Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Topsec Technologies Group's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 26% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 24% as estimated by the three analysts watching the company. With the industry predicted to deliver 26% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that Topsec Technologies Group is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Topsec Technologies Group's P/S Mean For Investors?

Even after such a strong price move, Topsec Technologies Group's P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Topsec Technologies Group's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Topsec Technologies Group with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Topsec Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002212

Topsec Technologies Group

Provides network security and intelligent cloud solutions for basic networks, industrial internet, internet of vehicles, and internet of things in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives