July 2025 Asian Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets experience varied performances, with U.S. indices hitting record highs and Asian markets showing mixed signals, investors are keenly observing growth opportunities in Asia's dynamic economic landscape. In this context, companies with high insider ownership often attract attention as they suggest strong alignment between management and shareholder interests, potentially indicating confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.5% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 25.7% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 94.4% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 41.8% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Here we highlight a subset of our preferred stocks from the screener.

Topsec Technologies Group (SZSE:002212)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topsec Technologies Group Inc., along with its subsidiaries, offers safety services and big data products in China, with a market cap of CN¥9.85 billion.

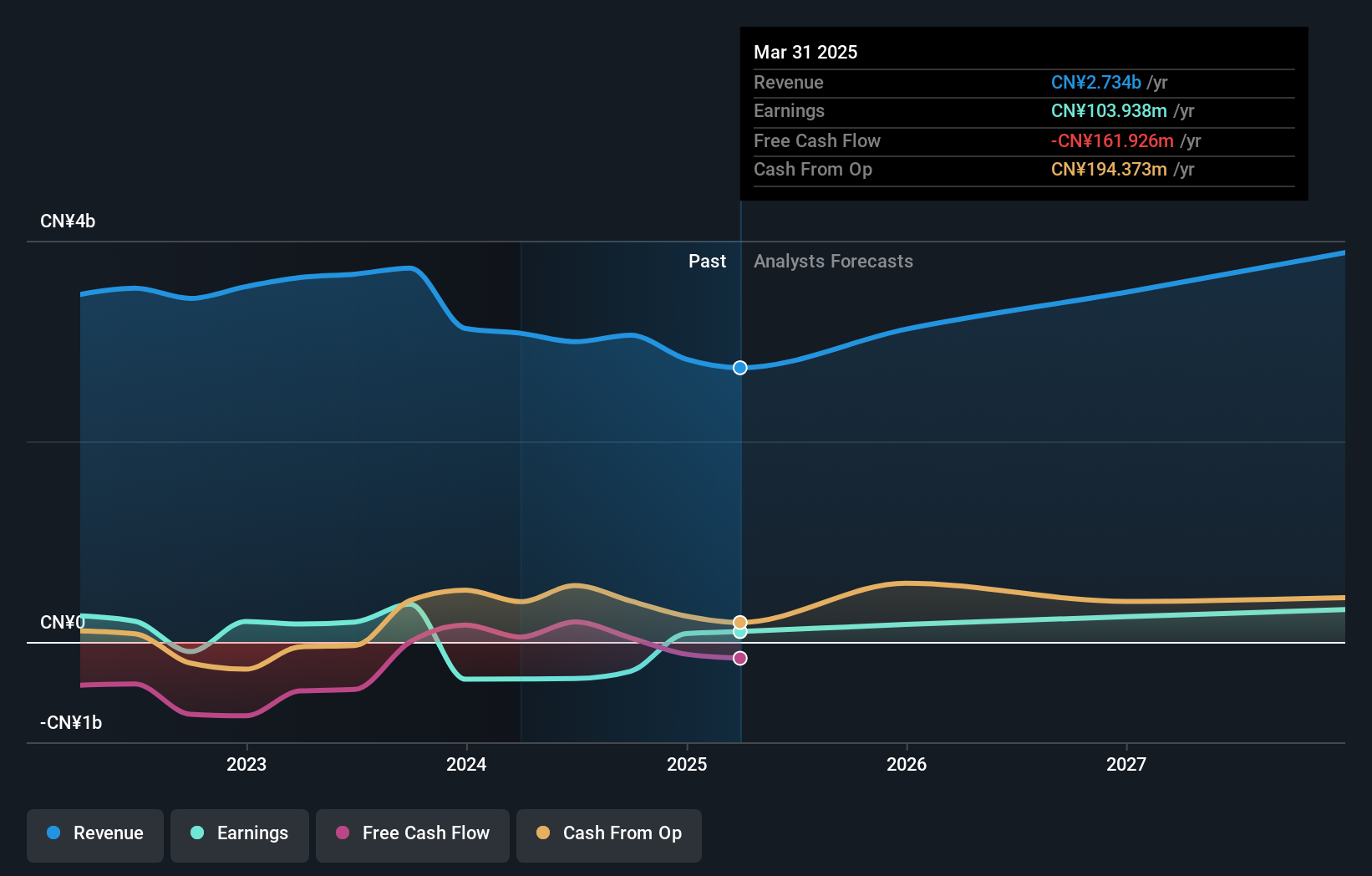

Operations: The company's revenue from cybersecurity services amounts to CN¥2.73 billion.

Insider Ownership: 10.9%

Earnings Growth Forecast: 37.1% p.a.

Topsec Technologies Group's earnings are forecast to grow significantly at 37.1% annually, outpacing the Chinese market average of 23.4%. Despite a recent net income turnaround to CNY 83.01 million in 2024 from a loss, revenue growth is expected at a modest pace of 12.4% per year, aligning with market rates. Recent shareholder meetings focused on employee stock ownership plans indicate strategic insider engagement, though no significant insider trading activity has been reported recently.

- Navigate through the intricacies of Topsec Technologies Group with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Topsec Technologies Group is trading beyond its estimated value.

Inner Mongolia Furui Medical Science (SZSE:300049)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inner Mongolia Furui Medical Science Co., Ltd. operates in the medical science sector, focusing on the development and production of healthcare products, with a market cap of CN¥9.86 billion.

Operations: Unfortunately, there is no specific revenue segment information provided for Inner Mongolia Furui Medical Science Co., Ltd. in the given text.

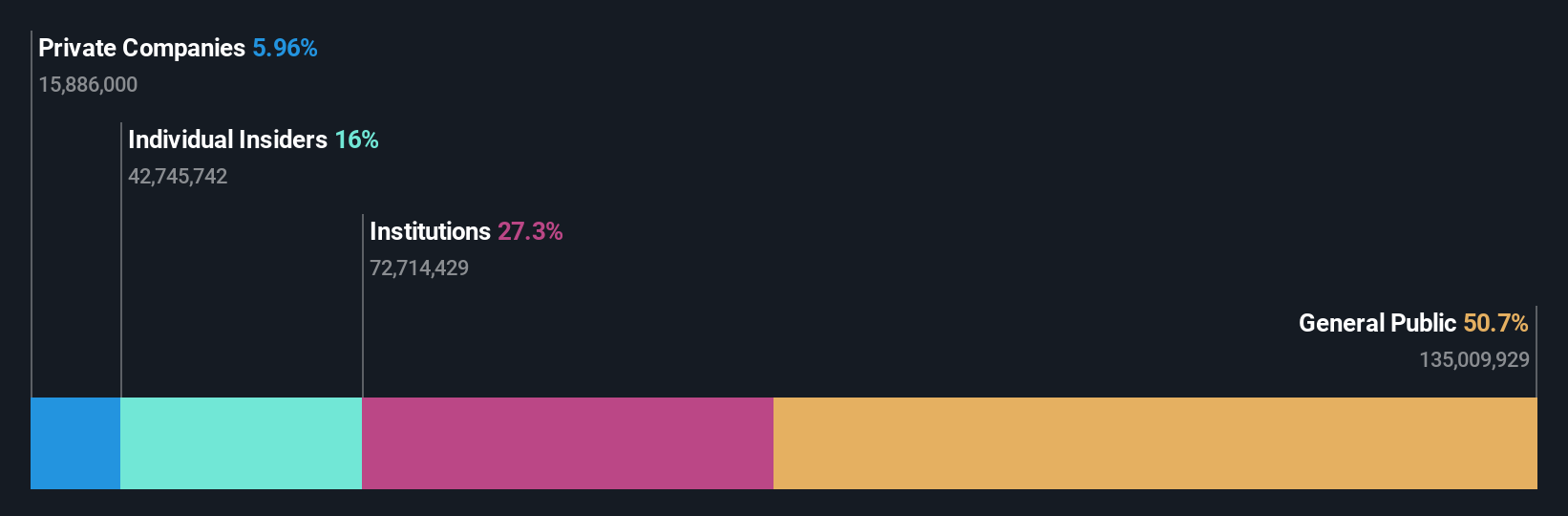

Insider Ownership: 16%

Earnings Growth Forecast: 40% p.a.

Inner Mongolia Furui Medical Science is experiencing robust growth with earnings projected to rise 40% annually, surpassing the Chinese market average. Revenue is expected to increase by 21.6% per year, also outpacing market growth. Despite a dip in profit margins from 10.6% to 7.3%, insider ownership remains significant, reflecting confidence in long-term prospects. Recent amendments to the company's articles of association indicate strategic adjustments aligning with its growth trajectory and evolving business needs.

- Get an in-depth perspective on Inner Mongolia Furui Medical Science's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Inner Mongolia Furui Medical Science is priced higher than what may be justified by its financials.

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wondershare Technology Group Co., Ltd. develops application software products both in China and internationally, with a market cap of approximately CN¥13 billion.

Operations: Wondershare Technology Group Co., Ltd. generates revenue through its development and sale of application software products across domestic and international markets.

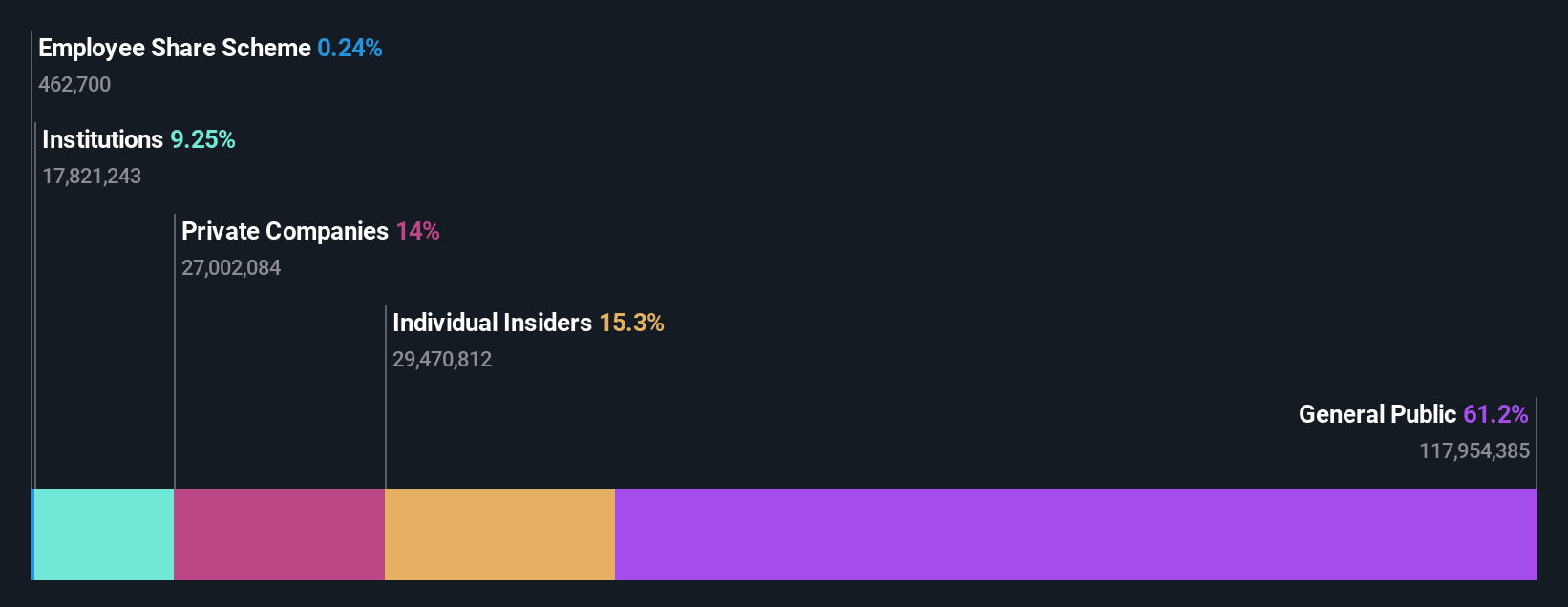

Insider Ownership: 15.3%

Earnings Growth Forecast: 115.0% p.a.

Wondershare Technology Group is poised for significant growth, with earnings projected to rise 114.96% annually, despite a recent net loss of CNY 32.81 million in Q1 2025. Revenue growth is forecasted at 17.2% per year, outpacing the Chinese market's average. High insider ownership suggests confidence in its strategic direction, underscored by innovative AI-driven product launches like EdrawMax V14.5 and Filmora enhancements showcased at major tech events across Europe and Asia.

- Dive into the specifics of Wondershare Technology Group here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Wondershare Technology Group's share price might be too optimistic.

Seize The Opportunity

- Gain an insight into the universe of 605 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Curious About Other Options? These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Topsec Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002212

Topsec Technologies Group

Provides safety services and big data products in China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives