Beijing Shiji Information Technology Co., Ltd.'s (SZSE:002153) Shares May Have Run Too Fast Too Soon

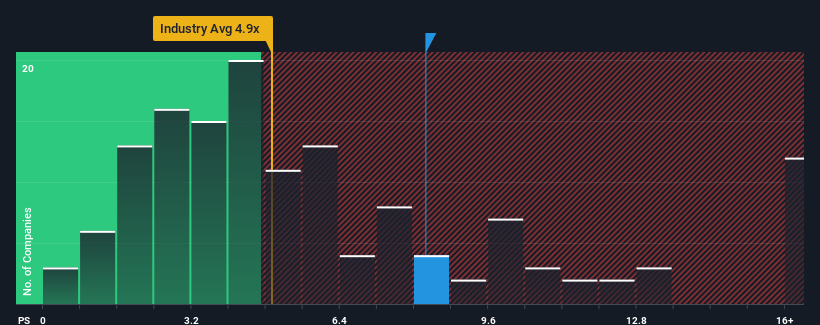

Beijing Shiji Information Technology Co., Ltd.'s (SZSE:002153) price-to-sales (or "P/S") ratio of 8.2x may look like a poor investment opportunity when you consider close to half the companies in the Software industry in China have P/S ratios below 4.9x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beijing Shiji Information Technology

How Beijing Shiji Information Technology Has Been Performing

Beijing Shiji Information Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Shiji Information Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Beijing Shiji Information Technology?

In order to justify its P/S ratio, Beijing Shiji Information Technology would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. The last three years don't look nice either as the company has shrunk revenue by 27% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 32% as estimated by the nine analysts watching the company. That's shaping up to be similar to the 33% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Beijing Shiji Information Technology's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Beijing Shiji Information Technology's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given Beijing Shiji Information Technology's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Beijing Shiji Information Technology with six simple checks.

If these risks are making you reconsider your opinion on Beijing Shiji Information Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Beijing Shiji Information Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Shiji Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002153

Beijing Shiji Information Technology

Beijing Shiji Information Technology Co., Ltd.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives