As global markets navigate a period of volatility marked by AI competition concerns and fluctuating interest rates, the technology sector remains in sharp focus, with the Nasdaq Composite experiencing notable declines. Amidst these dynamics, identifying high growth tech stocks involves looking for companies that demonstrate innovative capabilities and resilience to market shifts, particularly those that can leverage advancements in AI while navigating economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1233 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

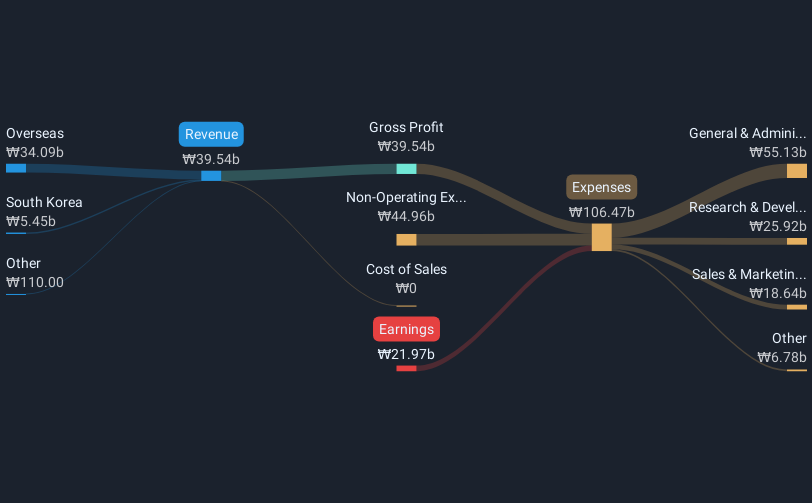

Overview: Lunit Inc. is a South Korean company specializing in AI-powered software and solutions for cancer diagnostics and therapeutics, with a market cap of ₩2.05 trillion.

Operations: Lunit focuses on AI-driven healthcare software, generating revenue of ₩39.54 billion from this segment.

Lunit's recent strategic moves underscore its commitment to reshaping cancer diagnostics through AI. On February 3, 2025, Lunit partnered with the Society for Immunotherapy of Cancer to launch a research program enhancing tumor microenvironment analysis via its AI model, Lunit SCOPE IO. This initiative will provide no-cost access to advanced histologic feature analyses for academic researchers, fostering innovation in immunotherapy research. Additionally, a study published on January 23 in the Journal of Clinical Oncology Precision Oncology highlighted how Lunit's AI tools significantly improved HER2 biomarker evaluation in colorectal cancer therapy, demonstrating enhanced prediction of treatment responses and outcomes—patients identified with high HER2 expression by the AI showed markedly better survival rates (16.5 months vs. 4.1 months). These developments not only advance clinical practices but also position Lunit at the forefront of precision oncology by integrating cutting-edge technology into routine diagnostic workflows.

- Dive into the specifics of Lunit here with our thorough health report.

Gain insights into Lunit's past trends and performance with our Past report.

Koal Software (SHSE:603232)

Simply Wall St Growth Rating: ★★★★☆☆

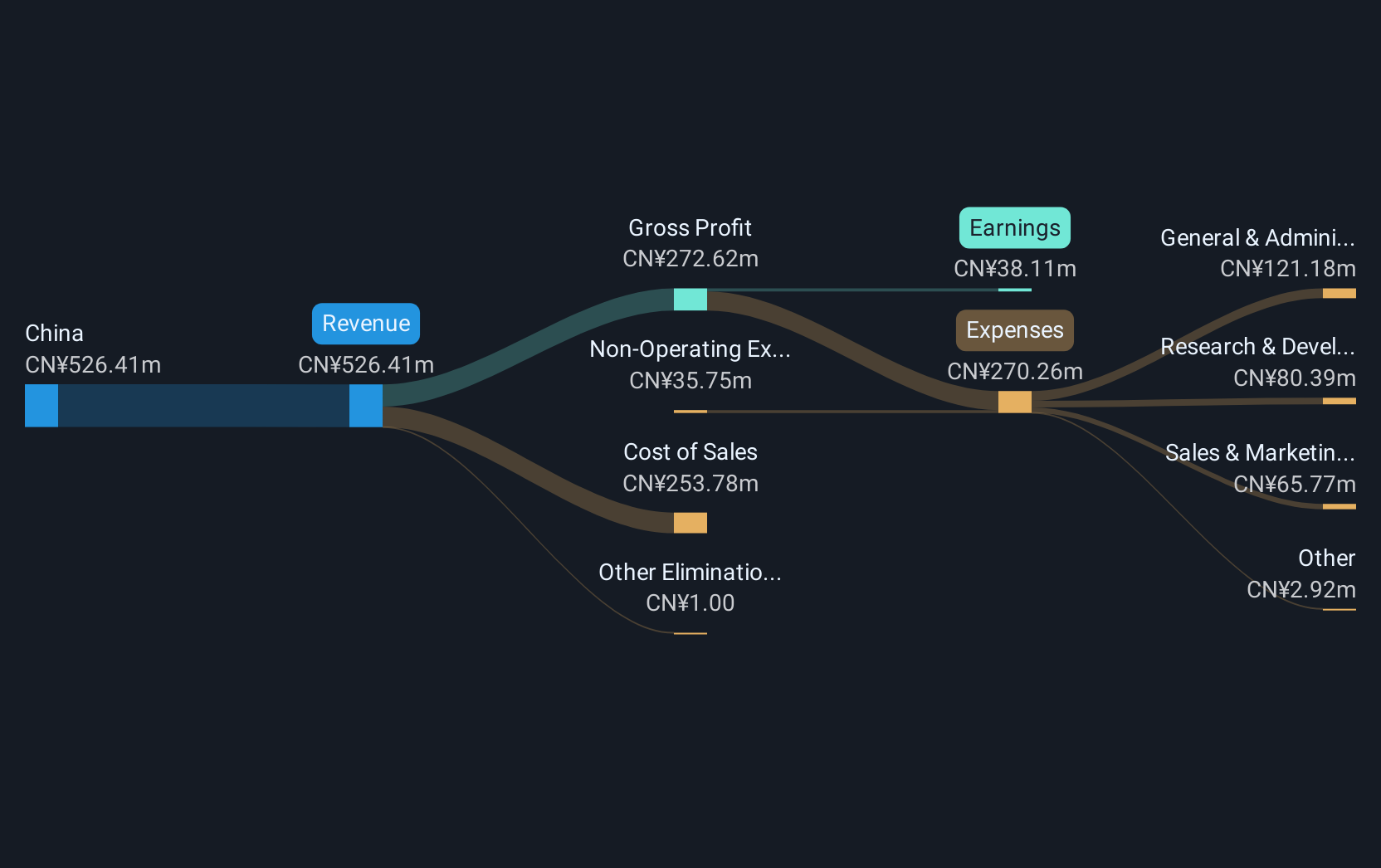

Overview: Koal Software Co., Ltd. specializes in developing public key infrastructure platforms in China and has a market capitalization of CN¥3.27 billion.

Operations: The company focuses on developing public key infrastructure platforms in China. It operates with a market capitalization of CN¥3.27 billion, indicating its scale within the industry.

Koal Software, amid a tumultuous tech landscape, has demonstrated remarkable financial agility with a 705.9% earnings growth over the past year and an anticipated annual earnings increase of 45.6%. This performance is bolstered by strategic R&D investments which have consistently accounted for approximately 15% of their revenue, signaling a robust commitment to innovation. Recent developments include their extraordinary shareholders meeting scheduled for December 30, 2024, which may discuss future strategies enhancing their market position in software development further. With revenue growth also outpacing the market at 19.5% annually, Koal's endeavors in expanding its technological capabilities and market reach suggest promising prospects despite industry volatility.

- Get an in-depth perspective on Koal Software's performance by reading our health report here.

Evaluate Koal Software's historical performance by accessing our past performance report.

Gstarsoft (SHSE:688657)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gstarsoft Co., Ltd. focuses on the research, development, design, and sale of industrial software both in China and internationally, with a market capitalization of CN¥2.66 billion.

Operations: Gstarsoft generates revenue primarily through the sale of industrial software, leveraging its expertise in research and development. The company's operations span both domestic and international markets, contributing to its market capitalization of CN¥2.66 billion.

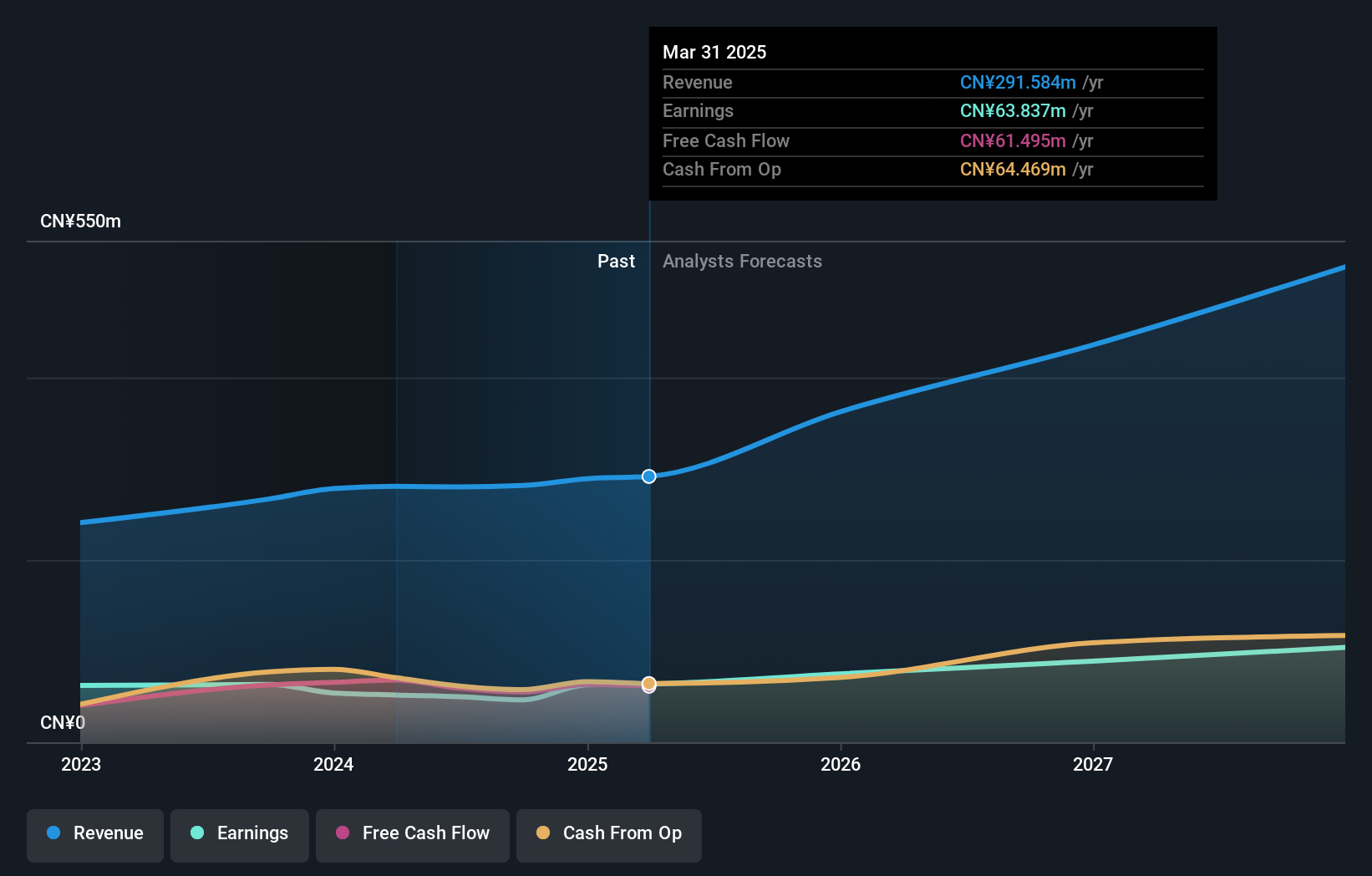

Gstarsoft, navigating through a competitive tech environment, has shown a robust revenue growth of 24% annually, outpacing the CN market's 13.5%. Despite a downturn in earnings last year with a 26.7% reduction, forecasts indicate an optimistic earnings growth of 24.2% per annum. The company's strategic focus on R&D is evident from its consistent allocation towards innovation; however, its Return on Equity is projected to be modest at 4.6% in three years' time. Recent activities include the completion of a share repurchase program where Gstarsoft bought back 235,154 shares for CNY 9.36 million, underscoring confidence in its financial health and future prospects despite current profitability challenges marked by a profit margin decrease to 16.5% from last year’s 23.8%.

Where To Now?

- Unlock our comprehensive list of 1233 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688657

Gstarsoft

Engages in the research, development, design, and sale of industrial software in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives