As global markets continue to react positively to political developments and technological advancements, with U.S. stocks reaching record highs amid optimism for softer tariffs and AI enthusiasm, investors are increasingly focused on growth opportunities. In such an environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the business best and align management interests closely with shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 22.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| CD Projekt (WSE:CDR) | 29.7% | 34.6% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

We'll examine a selection from our screener results.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pexip Holding ASA is a video technology company that offers a comprehensive video conferencing platform and digital infrastructure globally, with a market capitalization of NOK4.51 billion.

Operations: The company's revenue primarily comes from the Sale of Collaboration Services, amounting to NOK1.07 billion.

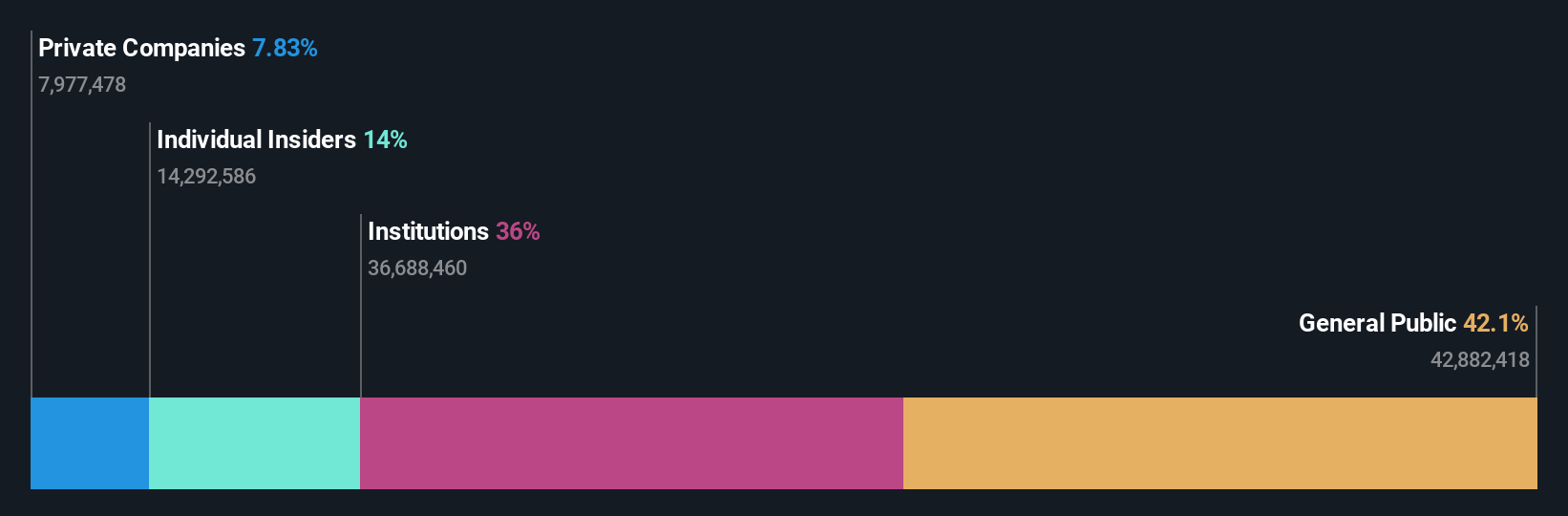

Insider Ownership: 19.1%

Pexip Holding has seen a notable turnaround, reporting a net income of NOK 5.8 million in Q3 2024 compared to a loss the previous year. While insider selling was significant recently, insiders have bought more shares than they sold over the past three months. The company trades significantly below fair value estimates and is expected to achieve profitability within three years, with revenue growth projected at 13.7% annually, outpacing the Norwegian market average.

- Delve into the full analysis future growth report here for a deeper understanding of Pexip Holding.

- Our comprehensive valuation report raises the possibility that Pexip Holding is priced lower than what may be justified by its financials.

Suzhou Delphi Laser (SHSE:688170)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou Delphi Laser Co., Ltd. specializes in the R&D, manufacturing, and sale of precision laser processing equipment and lasers both in China and internationally, with a market cap of CN¥2.28 billion.

Operations: The company's revenue segments include the design and production of precision laser processing equipment and lasers for both domestic and international markets.

Insider Ownership: 28.2%

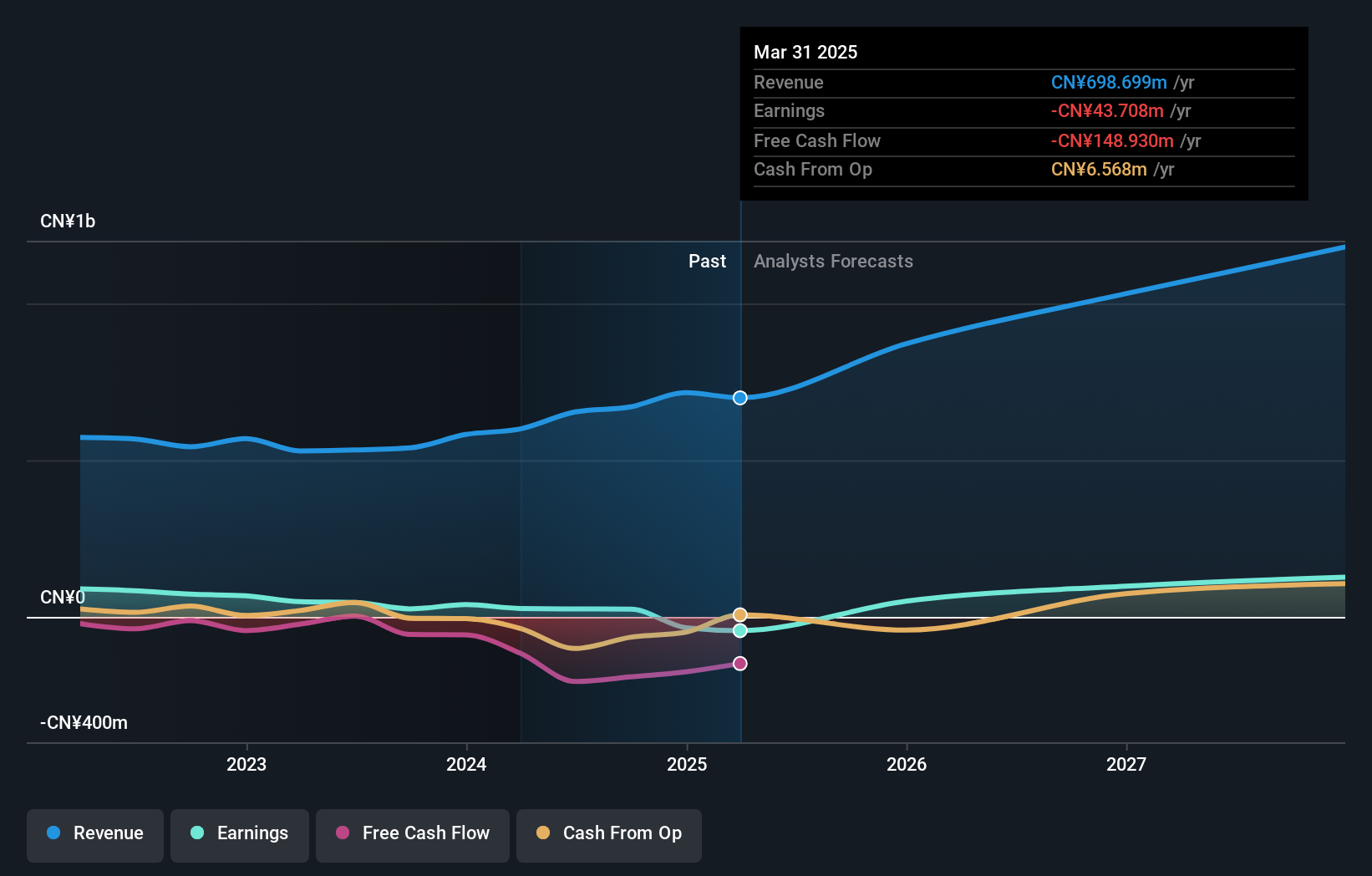

Suzhou Delphi Laser is poised for substantial earnings growth, with forecasts indicating a 46% annual increase, outpacing the Chinese market's average. However, its revenue growth at 18.5% per year lags behind the desired 20%, though it still surpasses the market average of 13.4%. Despite high non-cash earnings quality, recent financials reveal a net loss of CNY 21.35 million for nine months ending September 2024, highlighting profitability challenges amidst promising growth prospects.

- Dive into the specifics of Suzhou Delphi Laser here with our thorough growth forecast report.

- The analysis detailed in our Suzhou Delphi Laser valuation report hints at an inflated share price compared to its estimated value.

Gstarsoft (SHSE:688657)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gstarsoft Co., Ltd. is involved in the research, development, design, and sale of industrial software both in China and internationally, with a market cap of CN¥2.58 billion.

Operations: Revenue Segments (in millions of CN¥):null

Insider Ownership: 34.4%

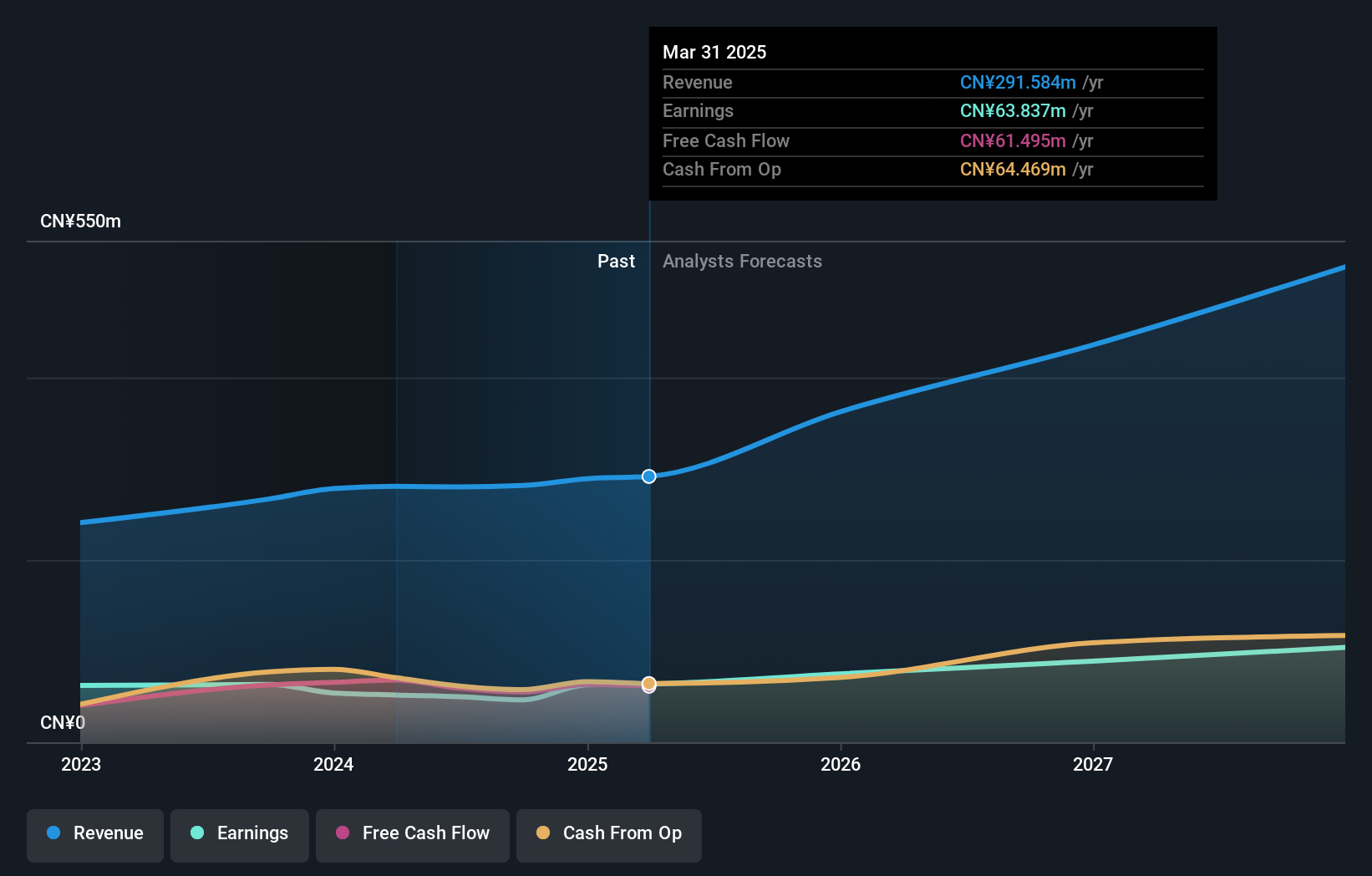

Gstarsoft's earnings are projected to grow significantly at 24.21% annually, although this is slightly below the Chinese market average of 25.1%. The company's revenue growth forecast of 24% per year outpaces the market's 13.4%. Despite a low future Return on Equity forecast of 4.6%, its Price-To-Earnings ratio of 55.4x remains attractive compared to the industry average. Recent buybacks totaling CNY 9.36 million indicate management confidence but profit margins have decreased from last year’s figures.

- Take a closer look at Gstarsoft's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Gstarsoft's current price could be inflated.

Summing It All Up

- Click through to start exploring the rest of the 1465 Fast Growing Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688657

Gstarsoft

Engages in the research, development, design, and sale of industrial software in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives