- Taiwan

- /

- Tech Hardware

- /

- TWSE:3515

Exploring High Growth Tech Stocks for November 2024

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, small-cap stocks have shown resilience, holding up better than their large-cap counterparts amidst cautious sentiment. In this climate, identifying high-growth tech stocks requires a focus on companies with strong fundamentals and innovative potential that can withstand market volatility and capitalize on emerging opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

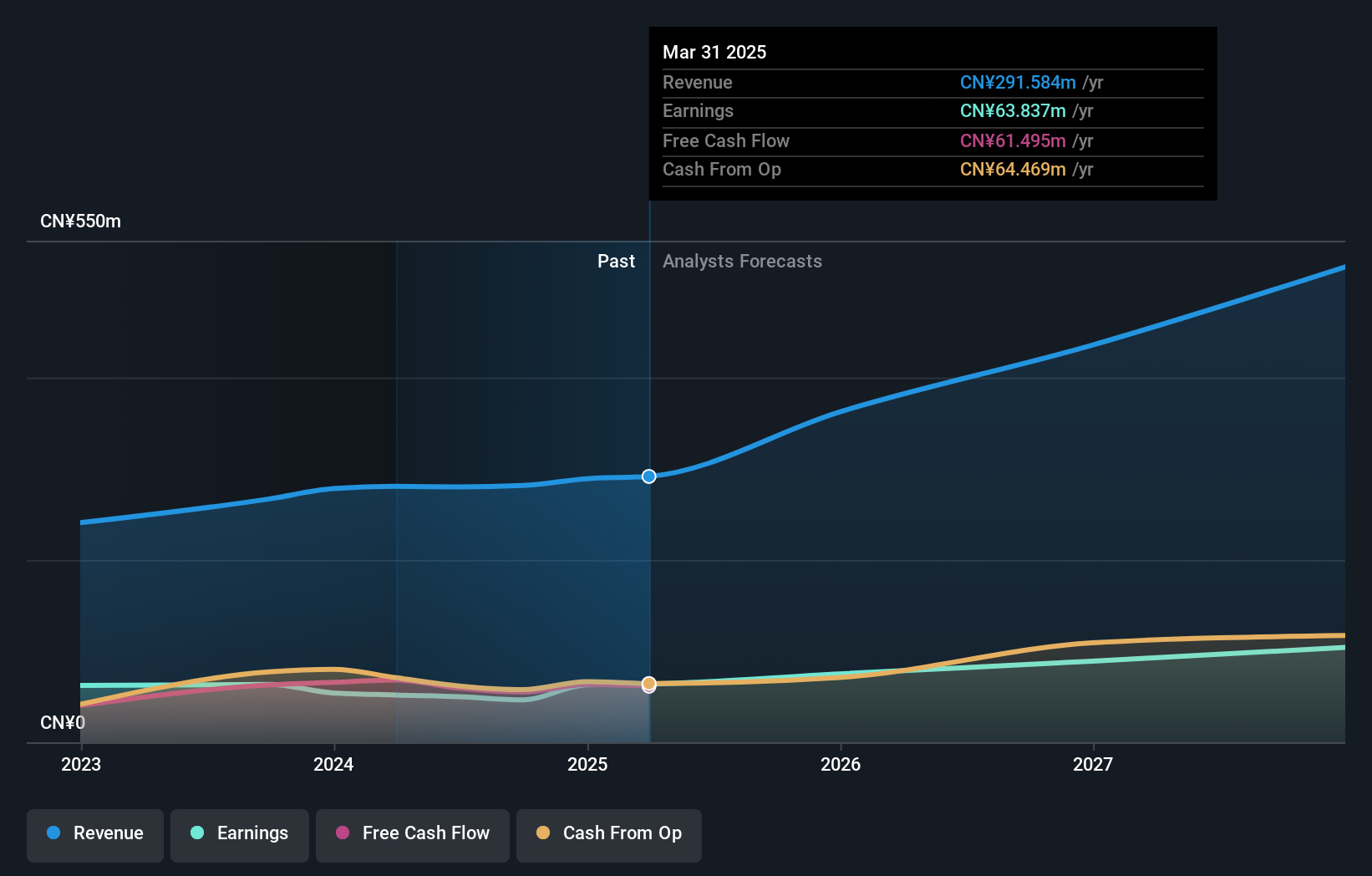

Gstarsoft (SHSE:688657)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gstarsoft Co., Ltd. specializes in the research, development, design, and sale of 2D/3D computer-aided design (CAD) software and cloud solutions globally, with a market capitalization of CN¥2.64 billion.

Operations: Gstarsoft generates revenue primarily from the sale of 2D/3D CAD software and cloud solutions. The company focuses on leveraging its expertise in design technology to cater to a global market, contributing significantly to its financial performance.

Gstarsoft, navigating through a challenging tech landscape, reported a slight increase in revenue to CNY 197.77 million for the nine months ending September 2024, up from CNY 194.34 million the previous year. Despite this growth, net income dipped to CNY 34.69 million from CNY 42.28 million, reflecting a tightened profit margin which now stands at 16.5%, down from last year's 23.8%. The company's commitment to innovation is evident in its R&D investments and strategic share repurchase plan aimed at fueling an employee stock ownership scheme, signaling confidence in its future trajectory amidst forecasts of revenue growing at an impressive rate of 24% annually—outpacing the broader Chinese market projections of 14%.

- Navigate through the intricacies of Gstarsoft with our comprehensive health report here.

Review our historical performance report to gain insights into Gstarsoft's's past performance.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. is a company focused on agricultural technology solutions with a market capitalization of CN¥6.65 billion.

Operations: Zhejiang Top Cloud-agri Technology Co., Ltd. specializes in providing advanced agricultural technology solutions. The company generates revenue primarily through its innovative products and services designed to enhance agricultural productivity and efficiency.

Zhejiang Top Cloud-agri Technology Co., Ltd. has demonstrated robust financial growth with a 30.6% annual increase in revenue, outpacing the broader Chinese market's growth rate of 14%. This performance is supported by a significant rise in net income from CNY 66.7 million to CNY 76.6 million over the past year, alongside an earnings per share increase from CNY 1.04 to CNY 1.2. The company's strategic focus on R&D is evident as it continues to invest heavily in innovation, aligning with its recent inclusion in major indices and successful IPO that raised CNY 309.14 million, earmarked for further technological advancements and market expansion.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang Top Cloud-agri TechnologyLtd.

Learn about Zhejiang Top Cloud-agri TechnologyLtd's historical performance.

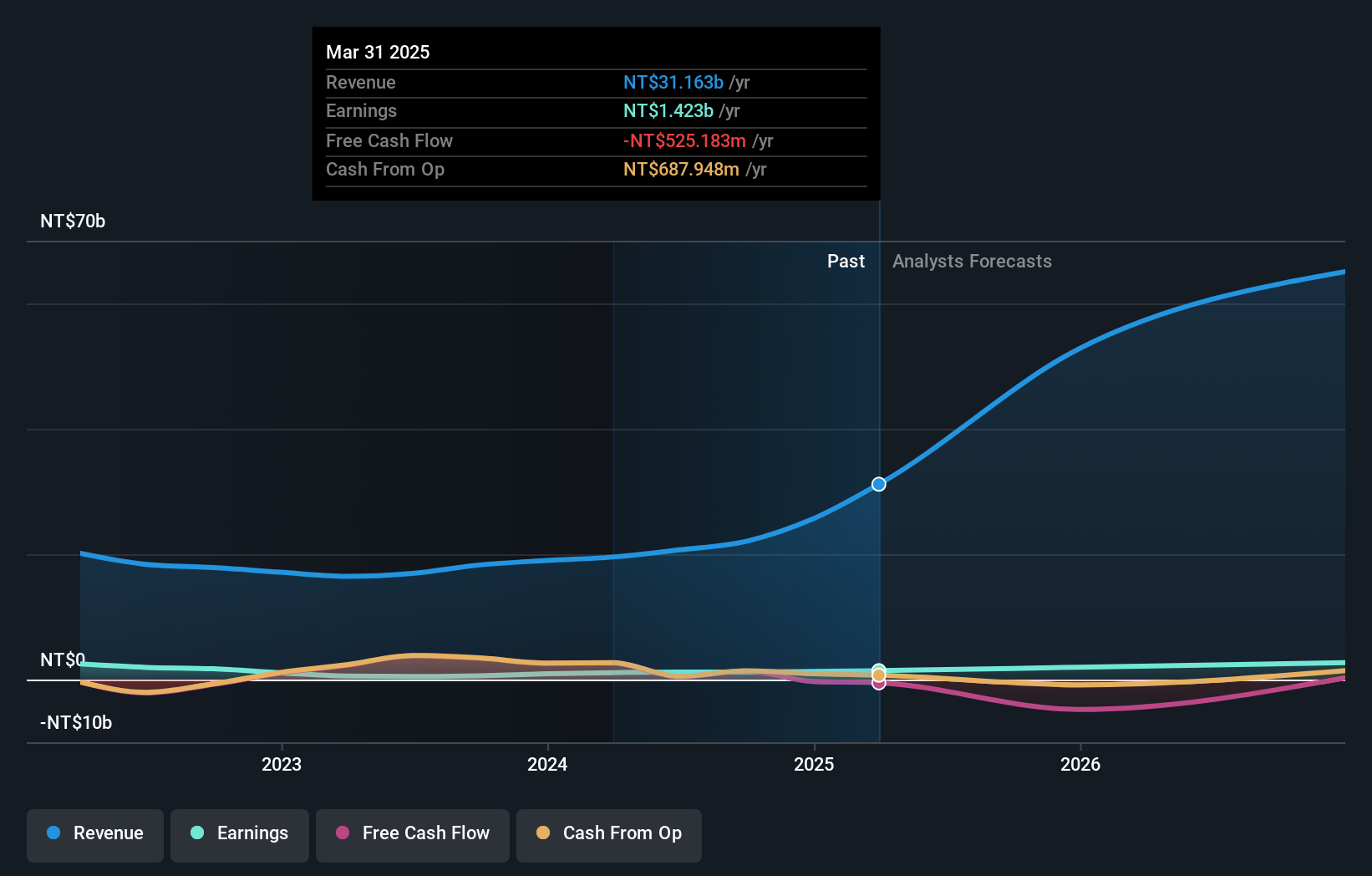

ASROCK Incorporation (TWSE:3515)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ASROCK Incorporation designs, develops, and sells motherboards in Taiwan with a market cap of NT$26.21 billion.

Operations: ASROCK Incorporation generates revenue primarily through the sale of motherboards, focusing its operations within Taiwan. The company's market cap stands at NT$26.21 billion, reflecting its position in the technology sector.

ASROCK Incorporation has shown a notable increase in sales, reaching TWD 16.44 billion over nine months, up from TWD 13.38 billion the previous year, reflecting a robust growth trajectory in a competitive tech landscape. This surge aligns with an impressive 95.8% earnings growth over the past year, outstripping the tech industry's average of 11.3%. The company's commitment to innovation is underscored by its R&D efforts which are expected to fuel future earnings projected to grow at an annual rate of 20.4%, surpassing the broader Taiwanese market forecast of 18.9%. These strategic investments in technology development not only enhance ASROCK's product offerings but also position it well for sustained long-term growth amidst evolving industry demands.

- Click here and access our complete health analysis report to understand the dynamics of ASROCK Incorporation.

Evaluate ASROCK Incorporation's historical performance by accessing our past performance report.

Taking Advantage

- Navigate through the entire inventory of 1288 High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3515

ASROCK Incorporation

Designs, develops, and sells motherboards in Taiwan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives