BeiJing Seeyon Internet Software Corp.'s (SHSE:688369) Share Price Boosted 26% But Its Business Prospects Need A Lift Too

BeiJing Seeyon Internet Software Corp. (SHSE:688369) shares have continued their recent momentum with a 26% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 37% over that time.

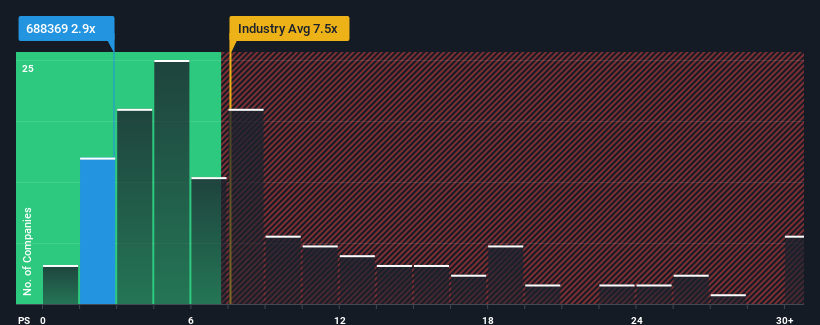

In spite of the firm bounce in price, BeiJing Seeyon Internet Software's price-to-sales (or "P/S") ratio of 2.9x might still make it look like a strong buy right now compared to the wider Software industry in China, where around half of the companies have P/S ratios above 7.5x and even P/S above 13x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for BeiJing Seeyon Internet Software

What Does BeiJing Seeyon Internet Software's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, BeiJing Seeyon Internet Software's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BeiJing Seeyon Internet Software.Is There Any Revenue Growth Forecasted For BeiJing Seeyon Internet Software?

The only time you'd be truly comfortable seeing a P/S as depressed as BeiJing Seeyon Internet Software's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 25% over the next year. With the industry predicted to deliver 32% growth, the company is positioned for a weaker revenue result.

With this information, we can see why BeiJing Seeyon Internet Software is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does BeiJing Seeyon Internet Software's P/S Mean For Investors?

BeiJing Seeyon Internet Software's recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that BeiJing Seeyon Internet Software maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for BeiJing Seeyon Internet Software you should be aware of.

If these risks are making you reconsider your opinion on BeiJing Seeyon Internet Software, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if BeiJing Seeyon Internet Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688369

BeiJing Seeyon Internet Software

Provides collaborative management software, solutions, platforms, and cloud services for organizational customers in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success