Hangzhou Raycloud Technology Co.,Ltd's (SHSE:688365) 37% Share Price Surge Not Quite Adding Up

Hangzhou Raycloud Technology Co.,Ltd (SHSE:688365) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 44% in the last twelve months.

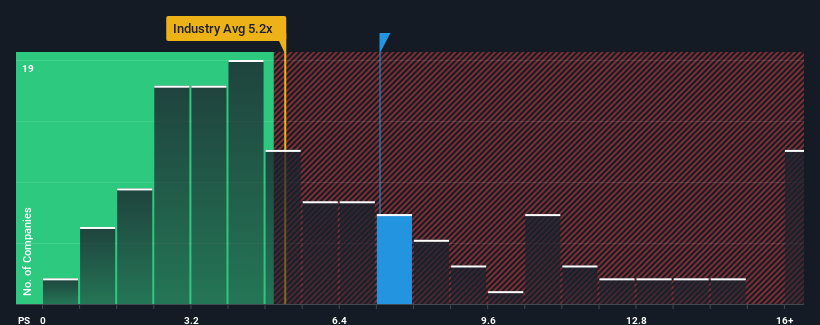

Since its price has surged higher, you could be forgiven for thinking Hangzhou Raycloud TechnologyLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 7.3x, considering almost half the companies in China's Software industry have P/S ratios below 5.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Hangzhou Raycloud TechnologyLtd

How Has Hangzhou Raycloud TechnologyLtd Performed Recently?

While the industry has experienced revenue growth lately, Hangzhou Raycloud TechnologyLtd's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Hangzhou Raycloud TechnologyLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hangzhou Raycloud TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.2% decrease to the company's top line. As a result, revenue from three years ago have also fallen 6.4% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 34% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 33%, which is not materially different.

With this information, we find it interesting that Hangzhou Raycloud TechnologyLtd is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Hangzhou Raycloud TechnologyLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Hangzhou Raycloud TechnologyLtd's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Having said that, be aware Hangzhou Raycloud TechnologyLtd is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Raycloud TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688365

Hangzhou Raycloud TechnologyLtd

Operates as an e-commerce software and service technology company in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives