As global markets navigate a choppy start to the year, with U.S. small-cap stocks underperforming and inflation concerns persisting, investors are closely watching how these factors influence the broader economic landscape. In such an environment, identifying high growth tech stocks involves evaluating companies that demonstrate resilience and adaptability amid fluctuating market conditions and evolving economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Shenzhen Fortune Trend Technology (SHSE:688318)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Fortune Trend Technology Co., Ltd. operates within the technology sector and has a market capitalization of CN¥27.76 billion.

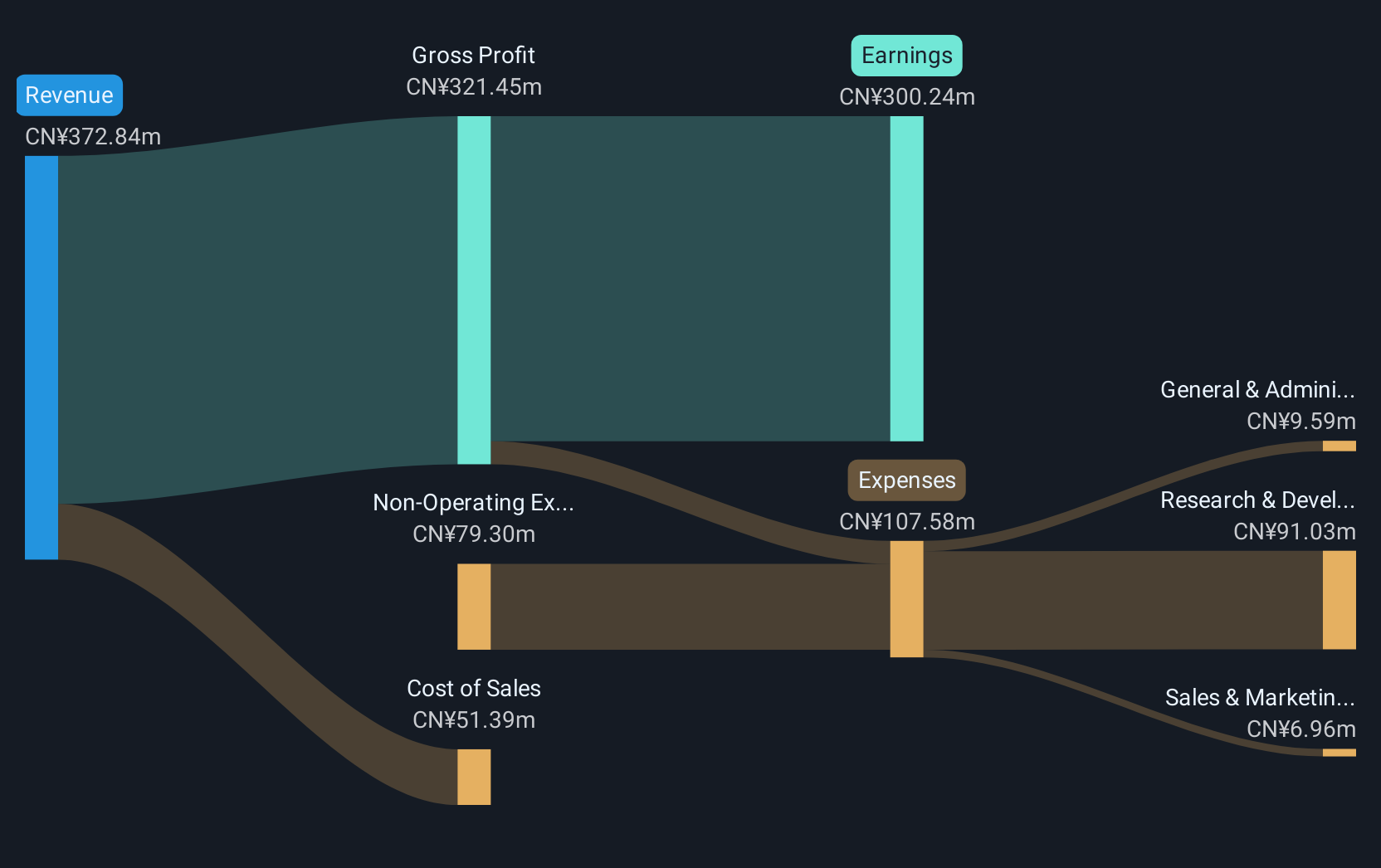

Operations: Shenzhen Fortune Trend Technology Co., Ltd. is engaged in the technology sector, focusing on providing software solutions and services. The company's revenue streams are primarily derived from its software development and related technological services.

Shenzhen Fortune Trend Technology, amid a challenging fiscal period, reported a revenue drop to CNY 210.28 million from CNY 248.64 million year-over-year as of September 2024, with net income also declining to CNY 144.01 million from CNY 198.18 million. Despite these setbacks, the company's projected annual revenue growth rate stands impressively at 34.9%, surpassing the Chinese market's average of 13.3%. Furthermore, anticipated earnings are expected to surge by an annual rate of 39.2%, outpacing the broader market forecast of 24.8%. This robust growth trajectory underscores Shenzhen Fortune Trend's resilience and potential in navigating through economic fluctuations while maintaining a competitive edge in high-growth tech sectors.

ALSO Holding (SWX:ALSN)

Simply Wall St Growth Rating: ★★★★☆☆

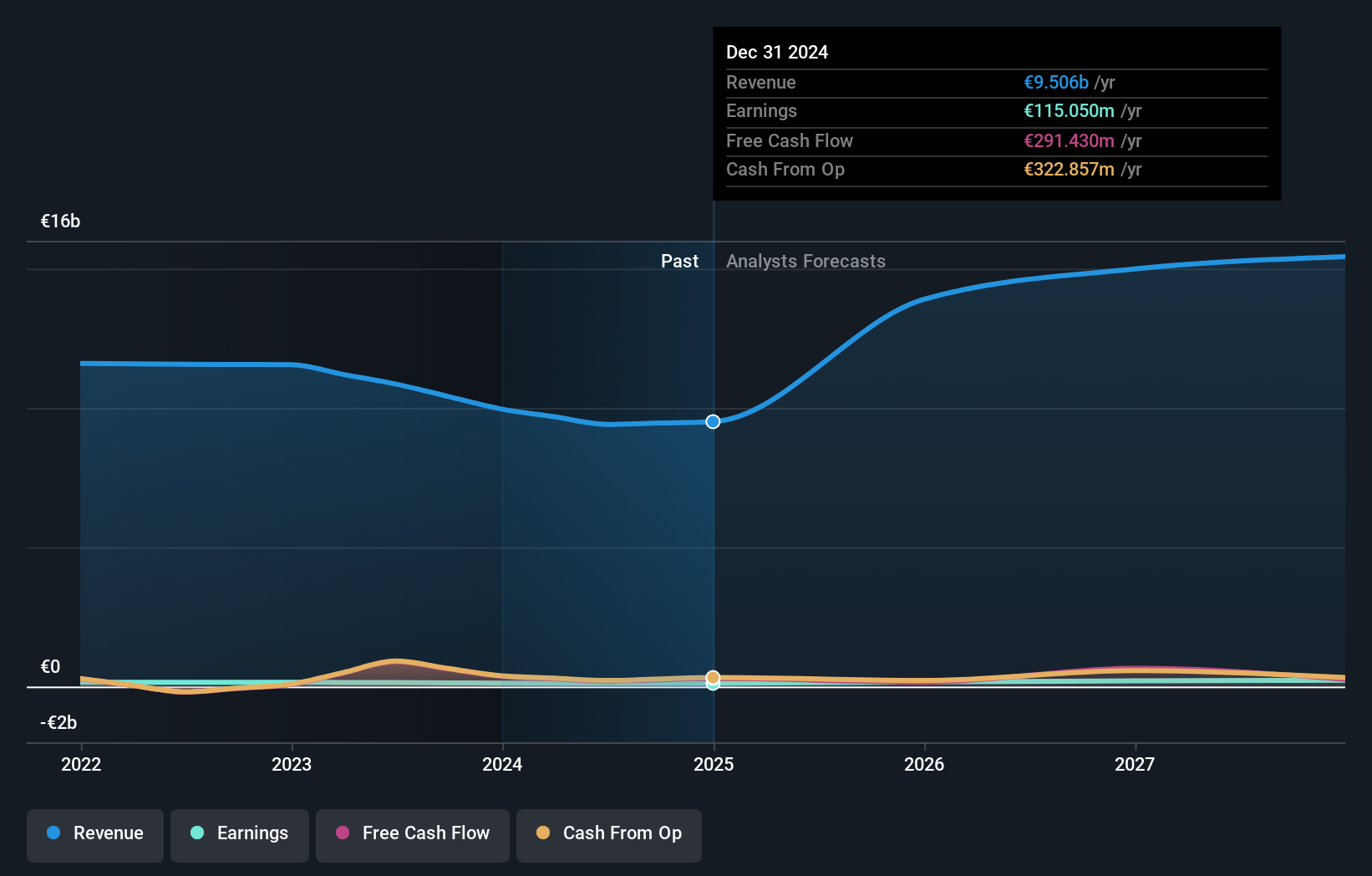

Overview: ALSO Holding AG is a technology services provider for the ICT industry operating in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF2.73 billion.

Operations: The company generates revenue primarily from its operations in Central Europe (€4.62 billion) and Northern/Eastern Europe (€5.24 billion). It operates within the ICT industry, providing technology services across multiple regions.

ALSO Holding demonstrates a robust growth trajectory within the tech sector, with its revenue and earnings outpacing the Swiss market average. The company's annual revenue growth rate stands at 10.5%, significantly higher than the local market's 4.2%. Additionally, ALSO's earnings are projected to surge by an impressive 27.6% annually, dwarfing the Swiss market forecast of 11.2%. This financial vigor is supported by strategic R&D investments which have been pivotal in maintaining its competitive edge and fostering innovation in a rapidly evolving industry landscape.

- Get an in-depth perspective on ALSO Holding's performance by reading our health report here.

Evaluate ALSO Holding's historical performance by accessing our past performance report.

Bitfarms (TSX:BITF)

Simply Wall St Growth Rating: ★★★★★☆

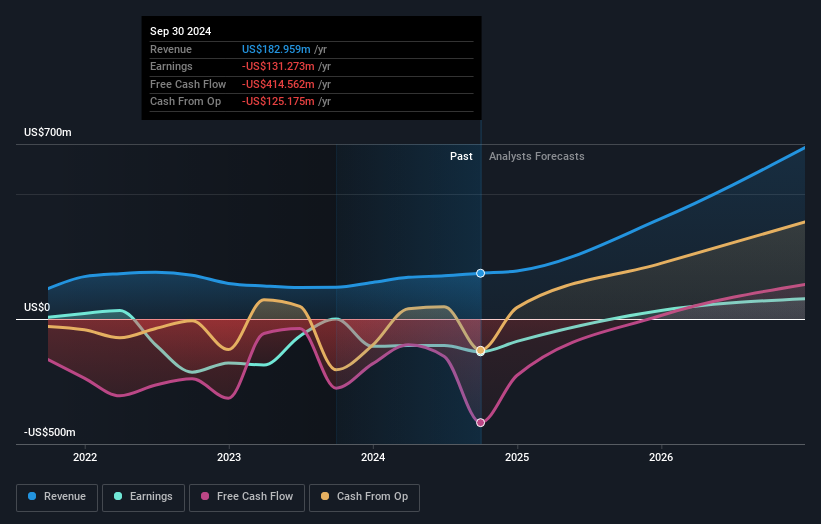

Overview: Bitfarms Ltd. is involved in cryptocurrency mining operations across Canada, the United States, Paraguay, and Argentina with a market capitalization of CA$1.10 billion.

Operations: The company focuses on cryptocurrency mining, generating revenue primarily from this activity, with reported earnings of $182.96 million.

Amidst a challenging backdrop, Bitfarms showcases resilience with its strategic adaptations and robust revenue growth of 57.3% annually, outpacing the broader Canadian market's expansion of just 7.1%. The company's recent pivot to enhance its treasury management by selling a significant portion of its Bitcoin holdings underscores a nimble approach in navigating volatile markets. Furthermore, Bitfarms' commitment to innovation is evident as it ramps up operations through new hosting agreements, like the one with Stronghold Digital Mining, ensuring sustained operational efficiency and potential profitability within three years. This strategic foresight combined with an aggressive revenue growth strategy positions Bitfarms uniquely within the tech landscape despite current unprofitability and market volatility challenges.

- Delve into the full analysis health report here for a deeper understanding of Bitfarms.

Understand Bitfarms' track record by examining our Past report.

Turning Ideas Into Actions

- Reveal the 1202 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shenzhen Fortune Trend Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688318

Shenzhen Fortune Trend Technology

Shenzhen Fortune Trend Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives